-

Australia lashes Netanyahu over 'weak' leader outburst

Australia lashes Netanyahu over 'weak' leader outburst

-

Polar bear waltz: Fake Trump-Putin AI images shroud Ukraine peace effort

-

Sounds serious: NYC noise pollution takes a toll

Sounds serious: NYC noise pollution takes a toll

-

Trump slams US museums for focus on 'how bad slavery was'

-

US agrees to talks with Brazilian WTO delegates on tariffs

US agrees to talks with Brazilian WTO delegates on tariffs

-

Israel-France row flares over Macron's move to recognise Palestinian state

-

White House starts TikTok account as platform in US legal limbo

White House starts TikTok account as platform in US legal limbo

-

Syrian, Israeli diplomats met in Paris to discuss 'de-escalation': report

-

Wanyonyi, the former cattle herder ready to eclipse Rudisha

Wanyonyi, the former cattle herder ready to eclipse Rudisha

-

Swiatek, Ruud romp into US Open mixed doubles semis, Alcaraz, Djokovic out

-

Mbappe lifts Real Madrid past Osasuna in La Liga opener

Mbappe lifts Real Madrid past Osasuna in La Liga opener

-

Venezuela says 66 children 'kidnapped' by the United States

-

Brazil nixes red World Cup jersey amid political outcry

Brazil nixes red World Cup jersey amid political outcry

-

Real Madrid scrape past Osasuna in La Liga opener

-

McIlroy backs 'clean slate' season finale format change

McIlroy backs 'clean slate' season finale format change

-

'Call of Duty', 'Black Myth' wow Gamescom trade show

-

Isak says 'change' best for everyone after Newcastle trust broken

Isak says 'change' best for everyone after Newcastle trust broken

-

Salah makes history with third PFA player of the year award

-

Rabiot, Rowe put up for sale by Marseille after bust-up

Rabiot, Rowe put up for sale by Marseille after bust-up

-

Weary Swiatek wins US Open mixed doubles opener

-

Miami fearing Messi blow ahead of Leagues Cup quarter-finals

Miami fearing Messi blow ahead of Leagues Cup quarter-finals

-

Trump rules out US troops but eyes air power in Ukraine deal

-

Trump course back on PGA schedule for 2026 season: tour

Trump course back on PGA schedule for 2026 season: tour

-

Mexican boxer Chavez Jr. deported from US over alleged cartel ties

-

Former Mali PM Choguel Kokalla Maiga charged with embezzlement, imprisoned

Former Mali PM Choguel Kokalla Maiga charged with embezzlement, imprisoned

-

Sinner withdraws from US Open mixed doubles draw

-

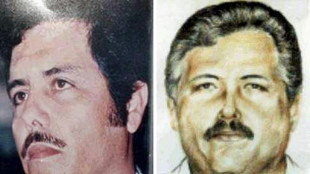

Mexican drug lord Zambada to plead guilty in US court

Mexican drug lord Zambada to plead guilty in US court

-

Russians welcome idea of Putin and Zelensky meeting

-

Spanish PM says 'difficult hours' left in wildfire fight

Spanish PM says 'difficult hours' left in wildfire fight

-

Ex-owner of world's largest rhino farm arrested for trafficking

-

South Africa ring changes after Australia defeat in Rugby Championship

South Africa ring changes after Australia defeat in Rugby Championship

-

Sinner withdrawn from US Open mixed doubles draw

-

Serbia protesters accuse police of abuse and warn of 'spiral of violence'

Serbia protesters accuse police of abuse and warn of 'spiral of violence'

-

Ronaldo gets Hong Kong hero's welcome, avoids Messi pitfall

-

Israel demands release of all hostages after Hamas backs new truce offer

Israel demands release of all hostages after Hamas backs new truce offer

-

Death toll from northern Pakistan monsoon floods hits almost 400

-

Trump says US air support possible for Ukraine security guarantee

Trump says US air support possible for Ukraine security guarantee

-

Nigerian judge delays trial over 2022 church massacre

-

Lionesses hero Agyemang returns to Brighton on loan

Lionesses hero Agyemang returns to Brighton on loan

-

Stock markets cautious with eyes on Ukraine talks, US rates

-

Record number of aid workers killed in 2024, UN says

Record number of aid workers killed in 2024, UN says

-

Klopp 'decisive' in move to Leipzig, says Bakayoko

-

UK drops demand for access to Apple user data

UK drops demand for access to Apple user data

-

'Historic' final a record sell-out, says Rugby women's World Cup chief

-

Verma snubbed as India name Women's World Cup squad

Verma snubbed as India name Women's World Cup squad

-

Markram, Maharaj lead South Africa to crushing win in ODI series-opener

-

Russia says peace deal must ensure its 'security' amid Ukraine talks

Russia says peace deal must ensure its 'security' amid Ukraine talks

-

Death toll from northern Pakistan monsoon floods rises to almost 400

-

Pollution hotspots at England's most famous lake need 'urgent' action

Pollution hotspots at England's most famous lake need 'urgent' action

-

Air Canada flight attendants end strike after reaching 'tentative' deal

Aflac: 5 Reasons to Get Universal Life Insurance in 2025

NEW YORK, NY / ACCESS Newswire / June 16, 2025 / People in the market for lifelong life insurance coverage have many options. One popular option is universal life insurance.This policy type offers the same coverage length and cash value as whole life insurance but expands on certain features and adds flexibility. As a result, many policyholders may find universal life insurance to be the best choice.This article explores five reasons people should consider getting universal life insurance in 2025.

1. Lifelong coverage

Universal life insurance offers coverage for one's entire life as long as the policyholder keeps up on premiums and avoids causing the policy to lapse in other ways. This can give policyholders significant peace of mind, knowing their loved ones will have a large death benefit to maintain financial stability no matter what the future holds.

2. Cash value

Universal life insurance has a cash value growth component, which can serve as a wealth-building vehicle.The insurer adds a portion of each premium payment to the cash value, which grows tax-deferred at fixed interest.Once the cash value grows enough, policyholders can use it to their advantage in several ways, including:

Loans: Policy loans don't require credit checks. They have low rates and no fixed repayment dates. Interest accumulates on the loan amount. The policy stays in force as long as the cash value is larger than the loan.

Withdrawals: Policyholders can withdraw funds from the cash value. Depending on the withdrawal size, this may have tax consequences and could shrink the death benefit.

Premium payments: Policyholders can pay some or all their premiums with cash value, reducing the cost of their coverage.

3. Flexible premiums and death benefits

Unlike whole life insurance, universal life insurance lets one adjust their premiums and death benefits within policy-specified limits.For example, imagine a policyholder gets a raise and needs to cover a larger income. In exchange for higher premiums, they could expand their coverage to ensure they continue to cover their income adequately.

On the other hand, perhaps a policyholder's living expenses decrease when they retire and no longer need as large a death benefit. They can save more money by reducing their premiums in exchange for a lower death benefit.Regardless, this added flexibility makes it easier for policyholders to fit lifelong coverage into their budgets.

4. Lower premiums than whole life insurance

Universal life insurance offers similar benefits to whole life insurance. However, on average, it has lower premiums since some slight policy lapse risks are involved in adjusting one's premiums and death benefit.1However, these risks are not great as long as one keeps up with premium payments and has sufficient cash value.

5. Many riders are available

Riders are specific policy add-ons that let one customize their coverage to fit specific needs or contingencies. These are crucial to explore when looking for universal life insurance quotes.For example, a critical illness rider lets one access a portion of their death benefit while living if diagnosed with a qualifying illness. Given the lifelong coverage, this can come in handy for those with a family history of critical or terminal illness.

Another useful rider is a child life insurance rider. This pays out a portion of the death benefit if the policyholder's child passes away, which can help ease financial strain while grieving one's loss.Universal life insurance allows for a wide variety of riders, helping one customize their coverage to their needs.

The bottom line

Universal life insurance offers lifelong coverage, cash value, and riders, just like whole life insurance. However, premiums are lower, and one can use their cash value to pay premiums alongside the other options.Furthermore, universal life insurance lets one adjust their premiums and death benefits.

Overall, universal life insurance can cost less and be a more flexible alternative to whole life insurance. That said, policyholders should consider their coverage needs and shop around to find the best policy and rates.

Sources:

1 Investopedia - What Is Universal Life (UL) Insurance? Updated February 29, 2024. https://www.investopedia.com/terms/u/universallife.asp. Accessed August 7, 2024.

Aflac recommends speaking to a tax advisor to point you toward your goals.

Content within this article is provided for general informational purposes and is not provided as tax, legal, health, or financial advice for any person or for any specific situation. Employers, employees, and other individuals should contact their own advisers about their situations. For complete details, including availability and costs of Aflac insurance, please contact your local Aflac agent.

Aflac coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, Aflac coverage is underwritten by American Family Life Assurance Company of New York.

Aflac life plans - A68000 series: Term Life Policies: In Arkansas, Idaho, Oklahoma, Oregon, Texas, Pennsylvania & Virginia, Policies: ICC1368200, ICC1368300, ICC1368400. In Delaware, Policies A68200, A68300 & A68400. In New York, Policies NY68200, NY68300 and NY68400. Whole Life Policies: In Arkansas, Idaho, Oklahoma, Oregon, Texas, Pennsylvania & Virginia, Policies: ICC1368100. In Delaware, Policy A68100. In New York, Policy NYR68100. B60000 series: In Arkansas, Idaho, Oklahoma & Virginia, Policies: ICC18B60C10, ICC18B60100, ICC18B60200, ICC18B60300, & ICC18B60400. Not available in Delaware. Q60000 series/Whole: In Arkansas & Delaware, Policy Q60100M. In Idaho, Policy Q60100MID. In Oklahoma, Policy Q60100MOK. Not available in Virginia. Q60000 series/Term: In Delaware, Policies Q60200CM. In Arkansas, Idaho, Oklahoma, Policies ICC18Q60200C, ICC18Q60300C, ICC18Q60400C. Not available in Virginia.

Receipt of accelerated death benefits may affect eligibility for public assistance programs. Benefits may also be taxable, and are not expected to receive the same favorable tax treatment as other types of accelerated death benefits that may be available.

Aflac Final Expense insurance coverage is underwritten by Tier One Insurance Company, a subsidiary of Aflac Incorporated and is administered by Aetna Life Insurance Company. Tier One Insurance Company is part of the Aflac family of insurers. In California, Tier One Insurance Company does business as Tier One Life Insurance Company (NAIC 92908).

In AR, DE, ID, OK and VA: Policies ICC21-AFLLBL21 and ICC21-AFLRPL21; and Riders ICC21-AFLABR22, ICC21-AFLADB22, and ICC21-AFLCDR22. Aflac Final Expense policies are not available in New York.

Aflac does not offer Universal or Variable Universal life insurance.

Coverage may not be available in all states, including but not limited to DE, ID, NJ, NM, NY, VA or VT. Benefits/premium rates may vary based on state and plan levels. Optional riders may be available at an additional cost. Policies and riders may also contain a waiting period. Refer to the exact policy and rider forms for benefit details, definitions, limitations, and exclusions.

Aflac WWHQ | Tier One | 1932 Wynnton Road | Columbus, GA 31999

Aflac New York | 22 Corporate Woods Boulevard, Suite 2 | Albany, NY 12211

Continental American Insurance Company | Columbia, SC

Z2500181 Exp. 4/26

CONTACT:

Senior PR & Corporate Communications

Contact: Angie Blackmar, 706-392-2097 or [email protected]

SOURCE: Aflac

View the original press release on ACCESS Newswire

P.Silva--AMWN