-

Stocks diverge ahead of Trump-Zelensky talks

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

-

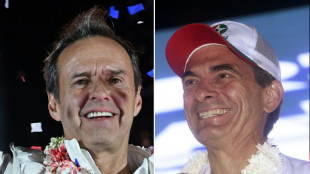

Two right-wing candidates headed to Bolivia presidential run-off

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

-

Arrive AI Secures Ninth U.S. Patent, Solidifying Leadership in Autonomous Delivery Innovation

-

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

-

Eagle Plains Highlights Intrusion Related Gold Potential at Dragon Lake Project, YT

-

AmeriTrust Further Enhances its Management Team

AmeriTrust Further Enhances its Management Team

-

Monster Plowing Company Wins 2025 Consumer Choice Award for Snow Removal in the GTA

-

Avino Drills 1,638 g/t Silver Over 7.90 Metres Including 15,352 g/t Silver Over 0.37 Metres at La Preciosa

Avino Drills 1,638 g/t Silver Over 7.90 Metres Including 15,352 g/t Silver Over 0.37 Metres at La Preciosa

-

Clear Smiles, Clear Recognition: Leaside Orthodontic Centre Honoured with 2025 Consumer Choice Award in Toronto Central

-

NESR to Release Second Quarter 2025 Financial Results on August 20th

NESR to Release Second Quarter 2025 Financial Results on August 20th

-

City College of Business, Hospitality & Technology Honoured with 2025 Consumer Choice Award for Career & Business Education in York Region

-

Announcing the 2025 Lévis Consumer Choice Award Winners

Announcing the 2025 Lévis Consumer Choice Award Winners

-

Regency Silver Corp. Announces Upsize of Brokered Private Placement To $2.5m Led by Centurion One Capital

-

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

-

Genflow Biosciences PLC Announces Company Update on Dog Trials

-

How to develop perfect battery systems for complex mobile solutions

How to develop perfect battery systems for complex mobile solutions

-

'Skibidi' and 'tradwife': social media words added to Cambridge dictionary

-

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

-

LIV's DeChambeau joins Henley and English as US Ryder Cup qualifiers

-

No.1 Scheffler outlasts MacIntyre to win BMW Championship

No.1 Scheffler outlasts MacIntyre to win BMW Championship

-

Swiatek swamps Rybakina, to face Paolini in Cincinnati final

-

Atletico beaten by Espanyol in La Liga opener

Atletico beaten by Espanyol in La Liga opener

-

PSG get Ligue 1 title defence off to winning start

-

Rahm edges Niemann for LIV season title as Munoz wins at Indy

Rahm edges Niemann for LIV season title as Munoz wins at Indy

-

Seven killed in latest Ecuador pool hall shooting

Asian stocks up as Trump announces Iran-Israel ceasefire

Asian shares gained and oil prices were down Tuesday, as fears of an energy market shock eased following US President Donald Trump's announcement of a ceasefire between Iran and Israel.

Investors were relieved that Iran did not retaliate to a US attack on its nuclear facilities by throttling oil transport through the strategic Strait of Hormuz.

On Monday, Iran said it had launched missiles at a major US base in Qatar, which described the situation as stable, while analysts said oilfield assets were unaffected.

"Tehran played it cool. Their 'retaliation' hit a US base in Qatar -- loud enough for headlines, quiet enough not to shake the oil market's foundations," said Stephen Innes at SPI Asset Management.

"And once that became clear, the war premium came crashing out of crude," with Brent and the main US crude contract WTI sliding more than seven percent overnight.

Both oil contracts were down over two percent on Tuesday.

In Asia, the mood was largely upbeat, with Tokyo and Hong Kong up 1.4 percent, Shanghai gaining 0.8 percent and Seoul jumping 2.7 percent.

Singapore gained 0.7 percent, Sydney was up 1.1 percent and Taipei put on 1.8 percent, but Jakarta was down 1.7 percent.

Trump said Iran and Israel had agreed to a staggered ceasefire that would bring about an "official end" to their conflict, as strikes continued to hammer Tehran.

Iran's foreign minister said Tuesday that Tehran did not intend to continue its strikes if Israel stopped its attacks.

"Details of the ceasefire agreement are still sparse at the time of writing and as such the detente and de-escalation is not a done deal," wrote Michael Wan at MUFG.

"Nonetheless, latest news reports suggest Iran has agreed to the ceasefire and if this is right, the left tail risk of more extreme scenarios resulting in significant oil supply disruptions have meaningfully diminished."

In forex markets, the dollar gave up gains after Federal Reserve Governor Michelle Bowman said she would support cutting interest rates at July's meeting if inflation holds steady.

The market currently expects the Fed to resume cutting interest rates in September.

Bowman indicated that "ongoing progress in tariff negotiations providing a less risky economic environment to adjust policy"," prompting the dollar to weaken, Wan said.

- Key figures at around 0200 GMT -

Tokyo - Nikkei 225: UP 1.4 percent at 38,873.07

Hong Kong - Hang Seng Index: UP 1.4 percent at 24,025.13

Shanghai - Composite: UP 0.8 percent at 3,886.66

Euro/dollar: UP at $1.1590 from $1.1581 on Monday

Pound/dollar: UP at $1.3539 from $1.3526

Dollar/yen: DOWN at 145.66 yen from 146.12 yen

Euro/pound: FLAT at 85.60 pence

West Texas Intermediate: DOWN 2.3 percent at $66.19 per barrel

Brent North Sea Crude: DOWN 2.2 percent at $69.24 per barrel

New York - Dow: UP 0.9 percent at 42,581.78 (close)

London - FTSE 100: DOWN 0.2 percent at 8,758.04 (close)

M.Fischer--AMWN