-

Stocks diverge ahead of Trump-Zelensky talks

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

-

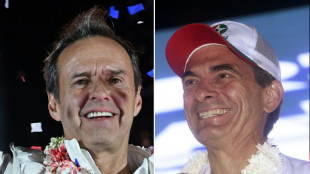

Two right-wing candidates headed to Bolivia presidential run-off

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

-

Arrive AI Secures Ninth U.S. Patent, Solidifying Leadership in Autonomous Delivery Innovation

-

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

-

Eagle Plains Highlights Intrusion Related Gold Potential at Dragon Lake Project, YT

-

AmeriTrust Further Enhances its Management Team

AmeriTrust Further Enhances its Management Team

-

Monster Plowing Company Wins 2025 Consumer Choice Award for Snow Removal in the GTA

-

Avino Drills 1,638 g/t Silver Over 7.90 Metres Including 15,352 g/t Silver Over 0.37 Metres at La Preciosa

Avino Drills 1,638 g/t Silver Over 7.90 Metres Including 15,352 g/t Silver Over 0.37 Metres at La Preciosa

-

Clear Smiles, Clear Recognition: Leaside Orthodontic Centre Honoured with 2025 Consumer Choice Award in Toronto Central

-

NESR to Release Second Quarter 2025 Financial Results on August 20th

NESR to Release Second Quarter 2025 Financial Results on August 20th

-

City College of Business, Hospitality & Technology Honoured with 2025 Consumer Choice Award for Career & Business Education in York Region

-

Announcing the 2025 Lévis Consumer Choice Award Winners

Announcing the 2025 Lévis Consumer Choice Award Winners

-

Regency Silver Corp. Announces Upsize of Brokered Private Placement To $2.5m Led by Centurion One Capital

-

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

-

Genflow Biosciences PLC Announces Company Update on Dog Trials

-

How to develop perfect battery systems for complex mobile solutions

How to develop perfect battery systems for complex mobile solutions

-

'Skibidi' and 'tradwife': social media words added to Cambridge dictionary

-

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

-

LIV's DeChambeau joins Henley and English as US Ryder Cup qualifiers

-

No.1 Scheffler outlasts MacIntyre to win BMW Championship

No.1 Scheffler outlasts MacIntyre to win BMW Championship

-

Swiatek swamps Rybakina, to face Paolini in Cincinnati final

-

Atletico beaten by Espanyol in La Liga opener

Atletico beaten by Espanyol in La Liga opener

-

PSG get Ligue 1 title defence off to winning start

-

Rahm edges Niemann for LIV season title as Munoz wins at Indy

Rahm edges Niemann for LIV season title as Munoz wins at Indy

-

Seven killed in latest Ecuador pool hall shooting

Oil slides, stocks rise as Iran-Israel ceasefire holds

Oil prices sank and stock markets rose Tuesday as a ceasefire between Iran and Israel appeared to be taking hold after US President Donald Trump berated both countries for violating the truce.

Crude futures slumped in volatile trading after Trump announced a ceasefire.

"This morning's ceasefire further reduced the perceived threat to Middle Eastern oil supply routes," said David Morrison, analyst at Trade Nation.

The main international and US oil contracts briefly bounced off their lows as Israel and Iran accused each other of breaking the ceasefire, but then fell around five percent after Trump berated the two countries in an expletive-laced outburst.

Iran's President Masoud Pezeshkian said later his country will respect a ceasefire if Israel also upholds its side of the terms, while Israel said it refrained from further strikes after a phone call between Trump and Prime Minister Benjamin Netanyahu.

Prices were also brought down by Trump saying that China could continue to buy oil from Iran, in what appeared to be relief from sanctions Washington had previously imposed.

Oil prices had already fallen by more than seven percent on Monday after Iran's response to US strikes on its nuclear facilities was limited to choreographed missile launches on a US military base in Qatar.

There was also relief that Iran has refrained from closing the strategic Strait of Hormuz, a chokepoint for about one-fifth of the world's oil supply.

Wall Street's three main indices were up around one percent in late morning trading.

Paris and Frankfurt ended the day with solid gains, but London closed flat as shares in oil majors Shell and BP fell along with crude prices.

Asian markets closed higher.

The dollar accelerated losses on Tuesday after remarks by US Federal Reserve chair Jerome Powell failed to dampen market expectations for interest rate cuts.

The European single currency reached its highest level against the dollar since October 2021 at $1.1642, while the greenback also dropped to its lowest level against the British pound since January 2022.

"Powell was a little more neutral to slightly more dovish than markets had anticipated, no doubt helped by the collapse in oil prices," said Fawad Razaqzada, analyst at City Index and Forex.com.

"The US dollar could be heading further lower unless a fresh flare up in the Middle East conflict sends oil prices spiking again," he added.

Escalating tensions in the Middle East has removed some focus from Trump's tariffs war, which threatens to dampen global economic growth.

"With the immediate geopolitical tensions dialled down, investors are free to focus on President Trump's trade war and the first tariff deadline coming up in a couple of weeks," Morrison said.

"As far as investors are concerned, they've just stared down the prospect of World War Three, so they're not going to be fussed by a few percentage points on US imports," he added.

Several countries face steep tariffs if they fail to reach deals with the United States by July 9, with duties of 50 percent looming large over the European Union.

- Key figures at around 1530 GMT -

Brent North Sea Crude: DOWN 4.9 percent at $67.04 per barrel

West Texas Intermediate: DOWN 4.8 percent at $65.22 per barrel

New York - Dow: UP 1.0 percent at 42,987.03 points

New York - S&P 500: UP 0.9 percent at 6,080.79

New York - Nasdaq Composite: UP 1.3 percent at 19,890.87

London - FTSE 100: FLAT at 8,758.99

Paris - CAC 40: UP 1.0 percent at 7,615.99

Frankfurt - DAX: UP 1.6 percent at 23,641.58

Tokyo - Nikkei 225: UP 1.1 percent at 38,790.56 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 24,177.07 (close)

Shanghai - Composite: UP 1.2 percent at 3,420.57 (close)

Euro/dollar: UP at $1.1628 from $1.1581 on Monday

Pound/dollar: UP at $1.3626 from $1.3526

Dollar/yen: DOWN at 144.77 yen from 146.12 yen

Euro/pound: DOWN at 85.34 pence from 85.60 pence

burs-rl/gv

J.Oliveira--AMWN