-

Stocks diverge ahead of Trump-Zelensky talks

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

-

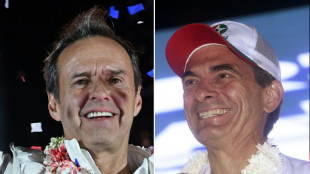

Two right-wing candidates headed to Bolivia presidential run-off

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

-

Arrive AI Secures Ninth U.S. Patent, Solidifying Leadership in Autonomous Delivery Innovation

-

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

-

Eagle Plains Highlights Intrusion Related Gold Potential at Dragon Lake Project, YT

-

AmeriTrust Further Enhances its Management Team

AmeriTrust Further Enhances its Management Team

-

Monster Plowing Company Wins 2025 Consumer Choice Award for Snow Removal in the GTA

-

Avino Drills 1,638 g/t Silver Over 7.90 Metres Including 15,352 g/t Silver Over 0.37 Metres at La Preciosa

Avino Drills 1,638 g/t Silver Over 7.90 Metres Including 15,352 g/t Silver Over 0.37 Metres at La Preciosa

-

Clear Smiles, Clear Recognition: Leaside Orthodontic Centre Honoured with 2025 Consumer Choice Award in Toronto Central

-

NESR to Release Second Quarter 2025 Financial Results on August 20th

NESR to Release Second Quarter 2025 Financial Results on August 20th

-

City College of Business, Hospitality & Technology Honoured with 2025 Consumer Choice Award for Career & Business Education in York Region

-

Announcing the 2025 Lévis Consumer Choice Award Winners

Announcing the 2025 Lévis Consumer Choice Award Winners

-

Regency Silver Corp. Announces Upsize of Brokered Private Placement To $2.5m Led by Centurion One Capital

-

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

-

Genflow Biosciences PLC Announces Company Update on Dog Trials

-

How to develop perfect battery systems for complex mobile solutions

How to develop perfect battery systems for complex mobile solutions

-

'Skibidi' and 'tradwife': social media words added to Cambridge dictionary

-

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

-

LIV's DeChambeau joins Henley and English as US Ryder Cup qualifiers

-

No.1 Scheffler outlasts MacIntyre to win BMW Championship

No.1 Scheffler outlasts MacIntyre to win BMW Championship

-

Swiatek swamps Rybakina, to face Paolini in Cincinnati final

-

Atletico beaten by Espanyol in La Liga opener

Atletico beaten by Espanyol in La Liga opener

-

PSG get Ligue 1 title defence off to winning start

-

Rahm edges Niemann for LIV season title as Munoz wins at Indy

Rahm edges Niemann for LIV season title as Munoz wins at Indy

-

Seven killed in latest Ecuador pool hall shooting

U.S. Bank: Common Pitfalls When Opening a New Bank Account

NEW YORK, NY / ACCESS Newswire / June 24, 2025 / A bank account is a smart step toward safeguarding money and building a financial history. However, it's important to understand how a bank account works before opening a new one. Below are some common mistakes to avoid when starting the process:

Choosing the wrong account type

Different types of bank accounts are better suited to different financial goals. For example, someone who wants to set up an emergency fund may pick a high-interest savings or money market account to maximize savings while keeping funds accessible. Someone who needs help paying bills on time may need a bank account that supports automatic bill payment. It's important to compare similar account types from several banks. Interest rates, monthly fees, and other features can all vary widely.

Overlooking convenience

Easy access to a bank account can save time and reduce stress, so convenience plays a key role in maintaining healthy money habits. But what constitutes convenience? For some, it might mean being able to open a bank account online, while others place a higher value on having a branch near their work or school.

These questions can help guide the decision-making process:

Does the bank have a physical location, or is it solely online?

Are the branches conveniently located?

Does the bank have a broad ATM network to easily access cash?

Are there online and mobile tools for managing finances on the go?

Not understanding the fee structure

Most bank accounts have fees that can add up quickly if they're not properly managed. Some standard bank fees include charges for:

Using an out-of-network ATM.

Overdrawing the account.

Dropping below the required minimum balance.

Transferring money between accounts.

Understanding these charges in advance allows consumers to choose options that fit their financial habits and avoid unnecessary costs.

Ignoring minimum balance requirements

Many banks require a minimum daily or monthly balance on checking and savings accounts. If the balance falls below this requirement, the bank may charge a fee or deny interest payments. Asking about these thresholds upfront and finding out if automatic transfers or direct deposit prevent fees can minimize issues later.

Forgetting to set up overdraft protection

An overdrawn account (one that doesn't have enough money to cover a transaction) usually triggers hefty fees. Luckily, many banks offer overdraft protection that prevents those fees while ensuring the transaction goes through. Activating overdraft protection is typically a matter of linking the account to another eligible account.

Not updating direct deposits or bill payments

People often forget to transfer recurring payments or direct deposits when switching banks. The result? Delays, missed payments, and late fees. One way to avoid this is to briefly maintain both accounts to monitor regular transactions and ensure nothing falls through the cracks before closing the older account.

Assuming all banks are FDIC insured

Choosing a financial institution insured by the FDIC is crucial when opening a bank account. FDIC insurance protects certain deposit accounts for up to $250,000, including savings accounts, checking accounts, certificates of deposit, and money market accounts.

The foundation for achieving financial goals

Opening a bank account can offer convenience, flexibility, and greater control over personal finances. However, overlooking the finer details may lead to unexpected challenges. By taking the time to research options, compare features, and plan ahead, individuals can choose an account that best supports their financial goals and sets the foundation for long-term success.

Resources

https://www.fdic.gov/resources/deposit-insurance

CONTACT:

Sonakshi Murze

Manager

[email protected]

SOURCE: iQuanti

View the original press release on ACCESS Newswire

H.E.Young--AMWN