-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

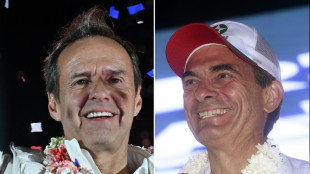

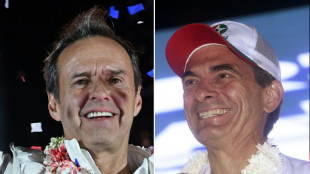

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Regency Silver Corp. Announces Upsize of Brokered Private Placement To $2.5m Led by Centurion One Capital

-

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

-

Genflow Biosciences PLC Announces Company Update on Dog Trials

-

How to develop perfect battery systems for complex mobile solutions

How to develop perfect battery systems for complex mobile solutions

-

'Skibidi' and 'tradwife': social media words added to Cambridge dictionary

-

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

-

LIV's DeChambeau joins Henley and English as US Ryder Cup qualifiers

-

No.1 Scheffler outlasts MacIntyre to win BMW Championship

No.1 Scheffler outlasts MacIntyre to win BMW Championship

-

Swiatek swamps Rybakina, to face Paolini in Cincinnati final

-

Atletico beaten by Espanyol in La Liga opener

Atletico beaten by Espanyol in La Liga opener

-

PSG get Ligue 1 title defence off to winning start

-

Rahm edges Niemann for LIV season title as Munoz wins at Indy

Rahm edges Niemann for LIV season title as Munoz wins at Indy

-

Seven killed in latest Ecuador pool hall shooting

-

Mass rally in Tel Aviv calls for end to Gaza war, hostage deal

Mass rally in Tel Aviv calls for end to Gaza war, hostage deal

-

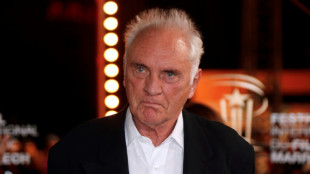

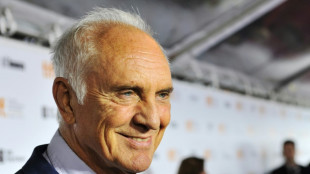

Terence Stamp: from arthouse icon to blockbuster villain

-

World No. 3 Swiatek powers past Rybakina into Cincinnati WTA final

World No. 3 Swiatek powers past Rybakina into Cincinnati WTA final

-

Tens of thousands of Israelis protest for end to Gaza war

-

Terence Stamp, 60s icon and Superman villain, dies

Terence Stamp, 60s icon and Superman villain, dies

-

Air Canada suspends plan to resume flights as union vows to continue strike

-

Arsenal battle to beat Man Utd, world champions Chelsea held by Palace

Arsenal battle to beat Man Utd, world champions Chelsea held by Palace

-

Arsenal capitalise on Bayindir error to beat Man Utd

-

'Weapons' tops North American box office for 2nd week

'Weapons' tops North American box office for 2nd week

-

Newcastle sign Ramsey from Aston Villa

-

Terence Stamp in five films

Terence Stamp in five films

-

Terence Stamp, Superman villain and 'swinging sixties' icon, dies aged 87: UK media

-

Chelsea draw blank in Palace stalemate

Chelsea draw blank in Palace stalemate

-

European leaders to join Zelensky in Trump meeting

Stocks rally as Iran-Israel ceasefire holds, oil claws back some losses

Most equities extended a global rally Wednesday after Iran and Israel agreed to a ceasefire that ended more than a week of hostilities, while the dollar struggled to recover from a sharp drop stoked by bets on a US interest rate cut.

However, wariness over the agreement by the Middle East foes helped oil prices climb, though they are still well down from their highs on Monday.

Investors around the world breathed a sigh of relief after Donald Trump announced the ceasefire days after US forces bombed Iran's nuclear sites, which he said were "completely destroyed".

The Israeli government said it had agreed to the US deal after achieving all of its objectives in the war with Iran, with Prime Minister Benjamin Netanyahu hailing a "historic victory" after 12 days of bombing.

Stocks surged and oil tanked on the news, and the optimism rolled into Wednesday, with Hong Kong, Shanghai, Sydney and Singapore leading the gains across Asia. Tokyo edged down.

Oil prices later rose, with both main contracts up more than one percent.

However, they are still down around 16 percent from the highs hit Monday in the first reaction to the US bombing of Iran and before the ceasefire announcement.

The mood was also helped by Fed boss Jerome Powell choosing not to pour cold water on the prospects of a rate cut.

In closely watched testimony to Congress, he said that "if it turns out that inflation pressures do remain contained, then we will get to a place where we cut rates sooner rather than later".

While he said "I don’t think we need to be in any rush because the economy is still strong", the comments indicated a flexible tone.

They also came after Fed governors Christopher Waller and Michelle Bowman suggested officials could reduce borrowing costs next month.

The dollar tumbled against its peers and remained under pressure against the yen, pound and euro in early Asian trade.

"The market staged a full-throttle risk-on revival, launching global equities into the stratosphere as oil prices cratered and rate-cut bets gained momentum," said SPI Asset Management's Stephen Innes.

"With the Middle East truce -- however duct-taped and temperamental -- holding long enough to calm headlines, traders pulled the ripcord on the fear trade and dove headfirst into equities.

"Trump's... scolding of Israel and Iran added ice water to the fire -- or at least enough jawbone to muzzle the Middle East combatants for now."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.1 percent at 38,750.47 (break)

Hong Kong - Hang Seng Index: UP 0.8 percent at 24,373.72

Shanghai - Composite: UP 0.1 percent at 3,422.31

West Texas Intermediate: UP 1.3 percent at $65.23 per barrel

Brent North Sea Crude: UP 1.3 percent at $68.00 per barrel

Euro/dollar: UP at $1.1629 from $1.1625 on Tuesday

Pound/dollar: UP at $1.3628 from $1.3616

Dollar/yen: DOWN at 144.69 yen from 144.89 yen

Euro/pound: UP at 85.33 pence from 85.24 pence

New York - Dow: UP 1.2 percent at 43,089.02 (close)

London - FTSE 100: FLAT at 8,758.99 (close)

M.Thompson--AMWN