-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

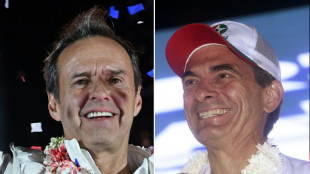

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Regency Silver Corp. Announces Upsize of Brokered Private Placement To $2.5m Led by Centurion One Capital

-

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

Empire Metals Limited Announces Drilling Outlines Large, High-Grade Zone

-

Genflow Biosciences PLC Announces Company Update on Dog Trials

-

How to develop perfect battery systems for complex mobile solutions

How to develop perfect battery systems for complex mobile solutions

-

'Skibidi' and 'tradwife': social media words added to Cambridge dictionary

-

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

Akie Iwai joins twin sister Chisato as LPGA winner with Portland Classic triumph

-

LIV's DeChambeau joins Henley and English as US Ryder Cup qualifiers

-

No.1 Scheffler outlasts MacIntyre to win BMW Championship

No.1 Scheffler outlasts MacIntyre to win BMW Championship

-

Swiatek swamps Rybakina, to face Paolini in Cincinnati final

-

Atletico beaten by Espanyol in La Liga opener

Atletico beaten by Espanyol in La Liga opener

-

PSG get Ligue 1 title defence off to winning start

-

Rahm edges Niemann for LIV season title as Munoz wins at Indy

Rahm edges Niemann for LIV season title as Munoz wins at Indy

-

Seven killed in latest Ecuador pool hall shooting

-

Mass rally in Tel Aviv calls for end to Gaza war, hostage deal

Mass rally in Tel Aviv calls for end to Gaza war, hostage deal

-

Terence Stamp: from arthouse icon to blockbuster villain

-

World No. 3 Swiatek powers past Rybakina into Cincinnati WTA final

World No. 3 Swiatek powers past Rybakina into Cincinnati WTA final

-

Tens of thousands of Israelis protest for end to Gaza war

-

Terence Stamp, 60s icon and Superman villain, dies

Terence Stamp, 60s icon and Superman villain, dies

-

Air Canada suspends plan to resume flights as union vows to continue strike

-

Arsenal battle to beat Man Utd, world champions Chelsea held by Palace

Arsenal battle to beat Man Utd, world champions Chelsea held by Palace

-

Arsenal capitalise on Bayindir error to beat Man Utd

-

'Weapons' tops North American box office for 2nd week

'Weapons' tops North American box office for 2nd week

-

Newcastle sign Ramsey from Aston Villa

-

Terence Stamp in five films

Terence Stamp in five films

-

Terence Stamp, Superman villain and 'swinging sixties' icon, dies aged 87: UK media

-

Chelsea draw blank in Palace stalemate

Chelsea draw blank in Palace stalemate

-

European leaders to join Zelensky in Trump meeting

Clear Start Tax Issues Consumer Alert: IRS Identity Theft Cases Continue After Filing Deadline

Tax Identity Theft on the Rise in 2025 - Clear Start Tax Urges Victims to Act Quickly to Limit IRS Damage

IRVINE, CA / ACCESS Newswire / June 25, 2025 / Even after the April 15 deadline, tax identity theft continues to spike in 2025. Clear Start Tax is warning taxpayers to stay alert for one of the most damaging forms of IRS fraud: discovering that someone else has already filed a return in your name. Left unaddressed, this growing issue can delay refunds, trigger audits, and cause years of financial headaches.

The IRS has already flagged a surge in suspicious early-season filings, often from criminals using stolen personal information to claim refunds fraudulently. Unfortunately, many victims don't realize what has happened until they attempt to file and receive a rejection stating that their return has "already been filed."

"It's one of the most stressful tax situations a person can face," said the Head of Client Solutions at Clear Start Tax. "You're locked out of your own account, refunds are frozen, and the IRS clock doesn't stop. But with the right steps, you can regain control."

Signs Someone Else Filed Using Your Information

If someone uses your Social Security Number to file a tax return, the IRS may process the fraudulent return before you even realize it. Clear Start Tax says to watch for the following red flags:

Your e-filed return is rejected because a return was already submitted using your SSN.

The IRS says a refund was issued, but you haven't filed, and didn't receive the funds.

The IRS sends a notice about a suspicious return, new account activity, or a balance due from an unfamiliar filing.

Your IRS account shows filings or income you don't recognize.

Tax identity theft can leave you responsible for balances or penalties you didn't cause. To protect yourself and explore your options under the IRS Fresh Start Program, answer a few quick questions and take the first step toward resolution.

What To Do If You Suspect Tax Identity Theft

The IRS has a formal process for victims of identity theft, but fast action is critical. Clear Start Tax outlines the steps you should take right away if you think someone has filed a return using your Social Security number:

File IRS Form 14039 (Identity Theft Affidavit) immediately to alert the IRS of suspected fraud.

Respond to any IRS notices - do not ignore them, even if they reference a return you didn't file.

Request a copy of the fraudulent return by submitting Form 4506-F for further investigation.

File your real return by paper (not e-file) and include all required identity verification documents.

Clear Start Tax adds that many victims fail to respond quickly enough, which can delay the resolution process or lead to enforced balances for tax debt they don't actually owe.

How Clear Start Tax Helps Identity Theft Victims

Tax identity theft cases can be difficult to navigate without expert help, especially when IRS systems continue to flag your account. Clear Start Tax supports affected clients by handling the entire response process:

Managing all IRS correspondence

Filing Forms 14039 and 4506-F

Correcting account records and securing account transcripts

Rebuilding compliance and applying for appropriate taxpayer protections

"We've helped clients who were wrongly pursued for years because of identity theft," said the Head of Client Solutions at Clear Start Tax. "The key is fast documentation, clean records, and expert follow-through - especially when the IRS system flags your account."

Don't Wait for the IRS to Sort It Out

Identity theft cases can take months or even years to fully resolve, especially when there's overlap with back taxes, unfiled returns, or penalties. Victims who act quickly, keep clear documentation, and work with experienced professionals are more likely to avoid long-term damage.

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

Y.Aukaiv--AMWN