-

Rybakina advances to WTA Canadian Open semis

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

Lions hooker Sheehan banned over Lynagh incident

-

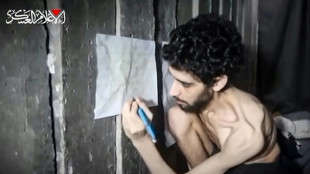

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

China's Baidu to deploy robotaxis on rideshare app Lyft

-

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

| RBGPF | 0.08% | 75 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| RIO | 0.58% | 60 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| RYCEF | 2.07% | 14.5 | $ | |

| BP | 2.28% | 32.49 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| SCU | 0% | 12.72 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BCE | -1.12% | 23.31 | $ |

What is the Typical Loan Term for a Boat?

NEW YORK CITY, NY / ACCESS Newswire / July 10, 2025 / Buying a boat is a big step for most people, but you typically don't pay for it all at once - that's where boat loans come in.

A boat loan can help you enjoy life on the water without paying the full cost upfront. Before signing any papers, though, you should know how long a boat loan usually lasts and how to choose the right one for you.

The typical loan term for a boat can range anywhere from two to about 20 years. Smaller boats or less expensive ones may require less time to pay off, while larger, more expensive boats - like yachts - may require more time.

What is a boat loan and how does it work?

Typically, a boat loan consists of money you borrow from a bank, credit union or online lender, and agree to pay back over time, with interest. Interest is the cost of borrowing money.

When you take out a boat loan, you'll make monthly payments. These monthly payments include a portion of the loan amount (called the principal) plus the interest. Boat loans are often secured, which means they are backed by collateral. Collateral is something valuable you own - in this case, the boat. So, if you stop making payments, the lender could take back the boat to cover their losses.

Lenders may also offer unsecured loans that don't require collateral, but they're harder to qualify for and generally have higher interest rates than secured loans.

What should you consider when choosing loan terms?

There's no one-size-fits-all answer for how to choose the best loan because what works for someone else might not work for you. That said, there are a few key questions to think about before you sign a loan agreement.

How old is the boat?

The age of a boat could affect your loan options. If you're buying a brand-new boat, you may be able to get a longer loan term and a better interest rate. That's because newer boats are more valuable and are seen to come with fewer risks for the lender.

On the other hand, if you're buying a used boat, lenders might not offer as long a loan term, because older boats lose value faster, and they may need more repairs.

What type of boat is it?

Not all boats are treated the same when it comes to loans. A small fishing boat or a personal watercraft like a jet ski might qualify for a shorter-term loan, but if you're buying a large sailboat or yacht, you might be offered a decades-long loan term.

Think about how often you'll use the boat and what kind of boating you'll do. If it's just for weekend fun, you might not want to be paying off a loan for decades. But if it's a big investment that you'll use for extended voyages over the years to come, a longer loan term might make sense.

What is the loan amount?

The amount you borrow plays a role in the terms of your loan, meaning larger loans may come with longer terms. But you don't want to end up owing more than the boat is worth.

Boats lose value over time, just like cars. If you take out a big loan with a long term, you could find yourself in a situation where you still owe a lot - even after the boat has lost value or if you no longer have it at all. The last thing you want is to keep making payments on a boat you no longer use or own.

What is your financial situation?

Your income, expenses and overall budget all play a part in choosing the right boat loan. If you have a steady income and manageable monthly bills, you may be able to afford a shorter loan term with higher payments. A shorter loan term could help you save money on interest in the long run.

Your credit score also matters. A stronger credit score could help you qualify for a lower interest rate, which means a more affordable loan overall. If you have less favorable credit, lenders may still approve your application, but you could end up with a higher interest rate and higher monthly payments.

It's also important to think about your savings and any other debts you already have. A boat loan should ideally fit comfortably into your financial life without causing added stress in the years ahead.

Charting your course with the right boat loan term

Choosing the right loan term is about figuring out how you can enjoy your boat to the fullest without putting too much stress on your wallet. Whether it's a shorter three-year term or a 20-year plan, take the time to do your research, understand how different loan terms work for different types of boats and consider the financial responsibilities that come with taking out any kind of loan.

SPONSORED CONTENT

CONTACT:

Sonakshi Murze

Manager

[email protected]

SOURCE: OneMain Financial

View the original press release on ACCESS Newswire

D.Moore--AMWN