-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

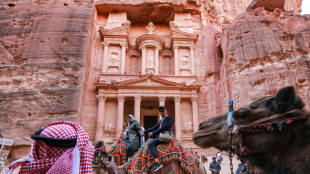

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

-

Bangladesh ex-PM palace becomes revolution museum

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

-

Trump confirms US envoy Witkoff to travel to Russia 'next week'

Trump confirms US envoy Witkoff to travel to Russia 'next week'

-

Australia name experienced squad for Women's Rugby World Cup

-

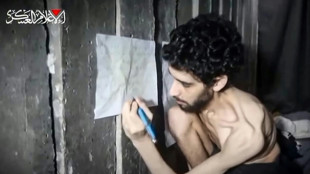

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

-

Dire water shortages compound hunger and displacement in Gaza

-

Philippine, Indian navies begin first joint South China Sea patrols

Philippine, Indian navies begin first joint South China Sea patrols

-

AI search pushing an already weakened media ecosystem to the brink

-

New Zealand former top cop charged over child porn, bestiality material

New Zealand former top cop charged over child porn, bestiality material

-

Messi out indefinitely with 'minor muscle injury': club

-

Robertson names one uncapped player in All Blacks squad

Robertson names one uncapped player in All Blacks squad

-

Swiatek crashes out of WTA Canadian Open, Osaka races through

-

Lyles says best to come after testy trials win

Lyles says best to come after testy trials win

-

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

-

MGAM Files First Provisional Patent for PUHZL

MGAM Files First Provisional Patent for PUHZL

-

Altigen Technologies and Krista.ai Announce Strategic Partnership to Deliver AI-Powered Automation for the Enterprise

| RYCEF | 0.14% | 14.2 | $ | |

| BCE | 0.06% | 23.595 | $ | |

| NGG | 3.14% | 72.67 | $ | |

| RBGPF | 0.08% | 75 | $ | |

| SCS | 34.7% | 15.59 | $ | |

| SCU | 0% | 12.72 | $ | |

| CMSC | 0% | 22.87 | $ | |

| BCC | -0.16% | 83.1 | $ | |

| RIO | 0.6% | 60.01 | $ | |

| GSK | -1.21% | 37.11 | $ | |

| VOD | 0.5% | 11.015 | $ | |

| BTI | 2.1% | 55.51 | $ | |

| AZN | -0.63% | 73.485 | $ | |

| RELX | 0.33% | 51.76 | $ | |

| CMSD | 0% | 23.35 | $ | |

| JRI | 0.61% | 13.18 | $ | |

| BP | 1.37% | 32.205 | $ |

Stocks mostly rise as traders boost US rate cut bets

Most stock markets bounced on Monday as hopes for US interest rate cuts rose following a sharp slowdown in jobs growth that raised concerns about the world's top economy.

The broad gains followed a sell-off on Wall Street Friday in reaction to the weak jobs data and news that dozens of countries would be hit with US tariffs ranging from 10 to 41 percent.

European indices mostly started the week on the front foot, with Paris gaining 0.8 percent and Frankfurt rising over one percent.

"Investors seem to be taking an optimistic view... betting on an increased likelihood of further monetary easing by the Fed after Friday's employment figures," said John Plassard, head of investment strategy at Cite Gestion Private Bank.

He noted, however, that "uncertainty reigns" as US President Donald Trump's tariffs are set to take effect on Thursday.

Switzerland's stock market dropped around two percent at Monday's open, its first session as it returned from a holiday after a tough 39-percent US tariff rate was announced.

The index pared some of its losses in early afternoon trading, with hopes the Swiss government can negotiate a reduction in the levy, which is steeper than that imposed on the European Union and Britain.

London advanced, lifted by banking stocks after the sector was granted reprieve from the worst of feared compensation claims over controversial car loans dating back to 2007.

Lloyds Banking Group rose nearly eight percent, while Close Brothers, listed on the FTSE 250, soared more than 20 percent.

Asian investors started the week mixed, with Hong Kong and Shanghai advancing while Tokyo fell.

Stocks had struggled Friday as US jobs growth missed expectation in July, with revised data showing the weakest hiring since the Covid-19 pandemic -- fuelling concerns that Trump's tariffs are starting to bite.

The president responded to the data by firing the commissioner of labour statistics, accusing her of manipulating employment data for political reasons.

Markets reacted more favourably on Monday, as the slowdown boosted hopes of Fed rate cuts to support the economy.

"Analysts are betting that rate-setters will prioritise recession avoidance over price controls," said Derren Nathan, head of equity research at Hargreaves Lansdown.

"This is likely the main driver of a rebound in US stock futures in anticipation of a positive market open later today," he added.

Observers also noted that news of Federal Reserve governor Adriana Kugler stepping down six months early gives Trump a chance to increase his influence on the Fed as he pushes for lower rates.

Oil prices fell after a sharp output increase by eight OPEC+ countries, with markets anticipating abundant supply.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.3 percent at 9,093.20 points

Paris - CAC 40: UP 0.8 percent at 7,606.20

Frankfurt - DAX: UP 1.3 percent at 23,720.70

Tokyo - Nikkei 225: DOWN 1.3 percent at 40,290.70 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 24,733.45 (close)

Shanghai - Composite: UP 0.9 percent at 3,583.31 (close)

New York - Dow: DOWN 1.2 percent at 43,588.58 (close)

Dollar/yen: UP at 147.57 yen from 147.43 yen on Friday

Euro/dollar: DOWN at $1.1574 from $1.1586

Pound/dollar: UP at $1.3293 from $1.3276

Euro/pound: DOWN at 87.10 pence from 87.25 pence

West Texas Intermediate: DOWN 1.6 percent at $66.25 per barrel

Brent North Sea Crude: DOWN 1.5 percent at $68.64 per barrel

M.Thompson--AMWN