-

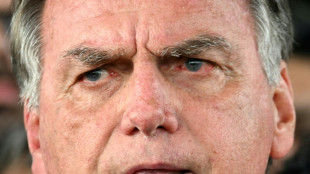

Brazil judge places ex-president Bolsonaro under house arrest

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

Lions hooker Sheehan banned over Lynagh incident

-

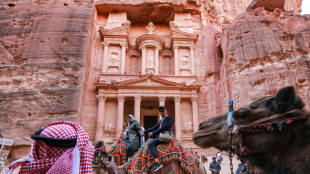

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

China's Baidu to deploy robotaxis on rideshare app Lyft

-

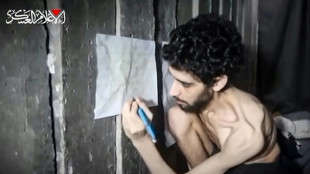

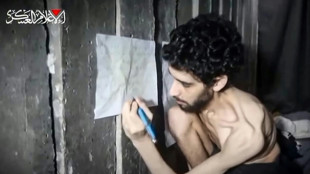

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

| RBGPF | 0.08% | 75 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| RYCEF | 2.07% | 14.5 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| RIO | 0.58% | 60 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| SCU | 0% | 12.72 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| BP | 2.28% | 32.49 | $ |

Gladstone Land Announces Preferred Stock Repurchase Authorization

MCLEAN, VA / ACCESS Newswire / July 11, 2025 / Gladstone Land Corporation (Nasdaq:LAND) ("Gladstone Land" or the "Company") announced that its board of directors has authorized a share repurchase program for up to $20,000,000 of the Company's 6.00% Series B Cumulative Redeemable Preferred Stock (Nasdaq: LANDO) and up to $35,000,000 of the Company's 6.00% Series C Cumulative Redeemable Preferred Stock (Nasdaq: LANDP) (together, the "Preferred Stock Repurchase Program"). The repurchases are intended to be implemented through open market transactions on U.S. exchanges or in privately negotiated transactions, in accordance with applicable securities laws, and any market purchases will be made during applicable trading window periods or pursuant to any applicable Rule 10b5-1 trading plans. The timing, prices, and sizes of repurchases will depend upon prevailing market prices, general economic and market conditions and other considerations. The board's authorization of the Preferred Stock Repurchase Program expires July 10, 2026, and the Preferred Stock Repurchase Program may be suspended or discontinued at any time and does not obligate the Company to acquire any particular amount of preferred stock.

"After a thorough analysis and in consultation with our board of directors, we are announcing another share repurchase authorization as part of a capital allocation strategy that we believe is in the best interest of our shareholders and our business. We believe that the current market conditions provide an attractive buying opportunity for our preferred stock and that using capital to repurchase our preferred shares at appropriate prices represents a favorable strategic use of capital," said David Gladstone, President of the Company.

About Gladstone Land Corporation:

Founded in 1997, Gladstone Land is a publicly traded real estate investment trust that acquires and owns farmland and farm-related properties located in major agricultural markets in the U.S. The Company currently owns 150 farms, comprised of approximately 103,000 acres in 15 different states and over 55,000 acre-feet of water assets in California. Gladstone Land's farms are predominantly located in regions where its tenants are able to grow fresh produce annual row crops, such as berries and vegetables, which are generally planted and harvested annually. The Company also owns farms growing permanent crops, such as almonds, blueberries, figs, olives, pistachios, and wine grapes, which are generally planted every 20-plus years and harvested annually. Over 30% of the Company's fresh produce acreage is either organic or in transition to become organic, and nearly 20% of its permanent crop acreage falls into this category. The Company may also acquire property related to farming, such as cooling facilities, processing buildings, packaging facilities, and distribution centers. Gladstone Land pays monthly distributions to its stockholders and has paid 149 consecutive monthly cash distributions on its common stock since its initial public offering in January 2013. The current per-share distribution on its common stock is $0.0467 per month, or $0.5604 per year. Additional information, including detailed information about each of the Company's farms, can be found at www.GladstoneLand.com.

Owners or brokers who have farmland for sale in the U.S. should contact:

Western U.S. - Bill Reiman at (805) 263-4778 or [email protected];

Mid-Atlantic and Midwest U.S. - Joey Van Wingerden at (703) 287-5914 or [email protected]; or

Southeastern U.S.- Brett Smith at (703) 287-5837 or [email protected].

Lenders who are interested in providing Gladstone Land with long-term financing on farmland should contact Jay Beckhorn at (703) 587-5823 or [email protected].

For stockholder information on Gladstone Land, call (703) 287-5893. For Investor Relations inquiries related to any of the monthly dividend-paying Gladstone funds, please visit www.GladstoneCompanies.com.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS:

Certain statements in this press release are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on the Company's current plans that are believed to be reasonable as of the date of this press release. Factors that may cause actual results to differ materially from these forward-looking statements include, but are not limited to, the Company's ability to procure financing for investments, downturns in the current economic environment, the performance of its tenants, the impact of competition on its efforts to renew existing leases or re-lease real property, and significant changes in interest rates. Additional factors that could cause actual results to differ materially from those stated or implied by its forward-looking statements are disclosed under the caption "Risk Factors" within the Company's Form 10-K for the fiscal year ended December 31, 2024, as filed with the SEC on February 19, 2025, and certain other documents filed with the SEC from time to time. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

For further information: Gladstone Land, (703) 287-5893

SOURCE: Gladstone Land Corporation

View the original press release on ACCESS Newswire

P.Santos--AMWN