-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

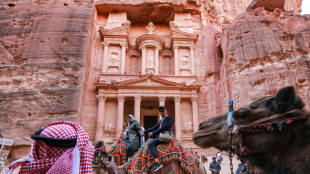

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

-

Bangladesh ex-PM palace becomes revolution museum

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

-

Trump confirms US envoy Witkoff to travel to Russia 'next week'

Trump confirms US envoy Witkoff to travel to Russia 'next week'

-

Australia name experienced squad for Women's Rugby World Cup

-

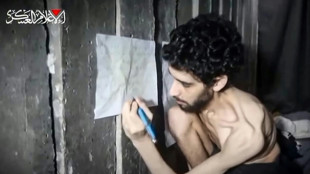

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

-

Dire water shortages compound hunger and displacement in Gaza

-

Philippine, Indian navies begin first joint South China Sea patrols

Philippine, Indian navies begin first joint South China Sea patrols

-

AI search pushing an already weakened media ecosystem to the brink

-

New Zealand former top cop charged over child porn, bestiality material

New Zealand former top cop charged over child porn, bestiality material

-

Messi out indefinitely with 'minor muscle injury': club

-

Robertson names one uncapped player in All Blacks squad

Robertson names one uncapped player in All Blacks squad

-

Swiatek crashes out of WTA Canadian Open, Osaka races through

-

Lyles says best to come after testy trials win

Lyles says best to come after testy trials win

-

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

-

MGAM Files First Provisional Patent for PUHZL

MGAM Files First Provisional Patent for PUHZL

-

Altigen Technologies and Krista.ai Announce Strategic Partnership to Deliver AI-Powered Automation for the Enterprise

| RYCEF | 0.14% | 14.2 | $ | |

| BCE | 0.06% | 23.595 | $ | |

| NGG | 3.14% | 72.67 | $ | |

| RBGPF | 0.08% | 75 | $ | |

| SCS | 34.7% | 15.59 | $ | |

| SCU | 0% | 12.72 | $ | |

| CMSC | 0% | 22.87 | $ | |

| BCC | -0.16% | 83.1 | $ | |

| RIO | 0.6% | 60.01 | $ | |

| GSK | -1.21% | 37.11 | $ | |

| VOD | 0.5% | 11.015 | $ | |

| BTI | 2.1% | 55.51 | $ | |

| AZN | -0.63% | 73.485 | $ | |

| RELX | 0.33% | 51.76 | $ | |

| CMSD | 0% | 23.35 | $ | |

| JRI | 0.61% | 13.18 | $ | |

| BP | 1.37% | 32.205 | $ |

What the IRS Really Knows About Your Income in 2025 - Clear Start Tax Reveals How to Stay Ahead of Surprise Tax Bill

IRS tech tools are smarter than ever - Clear Start Tax explains how income mismatches trigger audits, and what taxpayers can do to stay compliant.

IRVINE, CA / ACCESS Newswire / July 16, 2025 / With the IRS expanding its data-matching capabilities through advanced systems like the Information Returns Processing (IRP) platform, taxpayers are finding themselves blindsided by CP2000 notices, audits, or unexpected tax bills, sometimes months after filing. According to Clear Start Tax, understanding how the IRS cross-checks income data in 2025 is essential to staying ahead of costly surprises.

"The IRS doesn't need to guess - they already have your 1099s, W-2s, and even crypto reports before you file," said the Head of Client Solutions at Clear Start Tax. "Most IRS notices come from mismatches, not criminal intent. But if you ignore them, they can escalate fast."

How the IRS Sees Your Income - Before You Even File

Contrary to popular belief, the IRS doesn't wait for an audit to catch mistakes - most income mismatches are flagged automatically. The IRS's Information Returns Processing (IRP) system aggregates data from countless sources, comparing it against your tax return behind the scenes. This means the IRS often knows about your income, even if you forget to report it.

The IRP system pulls in data from:

W-2s from employers

1099 forms from banks, brokerages, and gig platforms

SSA and unemployment records

Cryptocurrency exchange reports (via Form 1099-DA, coming soon)

Mortgage and insurance statements

Foreign bank account data (via FATCA agreements)

These records are automatically compared against your tax return. If a mismatch appears, a CP2000 notice - or worse, an audit flag - can be triggered without warning.

CP2000 Notices Are the First Warning Sign

A CP2000 notice is often the first time a taxpayer learns the IRS found a mismatch in their income reporting. It's not an audit - yet - but it carries serious consequences if ignored. The IRS uses these notices to propose changes to your return, often with added taxes, interest, and potential penalties.

According to Clear Start Tax, the most common triggers for CP2000 notices in 2025 include:

Missing or incorrect 1099-NEC or 1099-K gig income

Reporting investment income incorrectly (e.g., selling crypto without basis data)

Overlooking unemployment or early retirement withdrawals

Filing with outdated employer information

Omitting foreign income or failing to disclose foreign accounts

"In 2024, the IRS issued over 11 million CP2000 notices," added the Head of Client Solutions. "It's one of their most common enforcement tools - and most people don't even know what it is until they get one."

Avoid Surprises by Matching Records Before the IRS Does

Once the IRS has flagged your return, it becomes much harder to negotiate or correct errors. That's why Clear Start Tax encourages taxpayers to stay one step ahead by verifying all income sources and tax documents before they file. This proactive approach can prevent costly notices and reduce the risk of enforcement actions.

Steps Clear Start Tax recommends include:

Reconciling all 1099, W-2, and third-party data before filing

Requesting wage and income transcripts from the IRS

Amending prior-year returns with missing income

Responding promptly and professionally to CP2000 or Letter 6173 notices

Exploring relief options if penalties or balances are already accruing

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

Fresh Start Program Offers Relief - Even After a Notice

For those who have already received a CP2000 notice or now owe tax due to underreported income, you still have options. The IRS Fresh Start Program helps taxpayers reduce, settle, or restructure their debt. Clear Start Tax helps clients determine eligibility and guides them through each step of the resolution process.

Depending on a taxpayer's financial situation, the program may offer:

Payment plans based on current ability to pay

Reduction or removal of penalties and interest

Settlement for less than the full amount owed through an Offer in Compromise

"Even if you've made a mistake, there's a path forward," said the Head of Client Solutions. "What matters is responding early - and getting the facts straight before the IRS takes further action."

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

O.Johnson--AMWN