-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

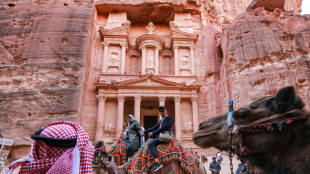

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

-

Bangladesh ex-PM palace becomes revolution museum

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

-

Trump confirms US envoy Witkoff to travel to Russia 'next week'

Trump confirms US envoy Witkoff to travel to Russia 'next week'

-

Australia name experienced squad for Women's Rugby World Cup

-

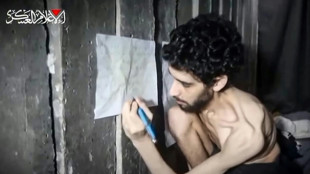

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

-

Dire water shortages compound hunger and displacement in Gaza

-

Philippine, Indian navies begin first joint South China Sea patrols

Philippine, Indian navies begin first joint South China Sea patrols

-

AI search pushing an already weakened media ecosystem to the brink

-

New Zealand former top cop charged over child porn, bestiality material

New Zealand former top cop charged over child porn, bestiality material

-

Messi out indefinitely with 'minor muscle injury': club

-

Robertson names one uncapped player in All Blacks squad

Robertson names one uncapped player in All Blacks squad

-

Swiatek crashes out of WTA Canadian Open, Osaka races through

-

Lyles says best to come after testy trials win

Lyles says best to come after testy trials win

-

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

-

MGAM Files First Provisional Patent for PUHZL

MGAM Files First Provisional Patent for PUHZL

-

Altigen Technologies and Krista.ai Announce Strategic Partnership to Deliver AI-Powered Automation for the Enterprise

| RBGPF | 0% | 74.94 | $ | |

| RYCEF | 0.07% | 14.19 | $ | |

| CMSC | 0.09% | 22.87 | $ | |

| SCS | -1.47% | 10.18 | $ | |

| GSK | 1.09% | 37.56 | $ | |

| NGG | 1.99% | 71.82 | $ | |

| AZN | 1.16% | 73.95 | $ | |

| CMSD | 0.34% | 23.35 | $ | |

| RELX | -0.58% | 51.59 | $ | |

| SCU | 0% | 12.72 | $ | |

| VOD | 1.37% | 10.96 | $ | |

| BTI | 1.23% | 54.35 | $ | |

| RIO | -0.2% | 59.65 | $ | |

| JRI | -0.23% | 13.1 | $ | |

| BCC | -0.55% | 83.35 | $ | |

| BCE | 1.02% | 23.57 | $ | |

| BP | -1.26% | 31.75 | $ |

D. Boral Capital Acted as Sole Bookrunner to Vendome Acquisition Corporation I (Nasdaq: VNMEU) in Connection with its $200.0 Million SPAC Initial Public Offering

NEW YORK CITY, NEW YORK / ACCESS Newswire / July 16, 2025 / On July 3, 2025, Vendome Acquisition Corporation I (the "Company") announced the closing of its initial public offering of 20,000,000 units at a price of $10.00 per unit, for total gross proceeds of $200 million. The units began trading on The Nasdaq Global Market under the ticker symbol "VNMEU" on July 2, 2025. Each unit consists of one of the Company's Class A ordinary shares and one-half of one redeemable public warrant. Each whole warrant entitles the holder thereof to purchase one Class A ordinary share at a price of $11.50 per share. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. Class A ordinary shares and warrants are listed on The Nasdaq Global Market under the symbols "VNME" and "VNMEW," respectively.

D. Boral Capital LLC acted as sole bookrunner for the offering.

Paul Hastings LLP acted as legal counsel to the Company and DLA Piper LLP acted as legal counsel to D. Boral Capital LLC.

The Offering of the securities described above was offered by the Company pursuant to an effective registration statement on Form S-1 (File No. 333-286534), as amended, filed with the Securities and Exchange Commission (the "SEC") and declared effective by the SEC on June 25, 2025. The Offering was made only by means of a prospectus. A final prospectus describing the terms of the Offering was filed with the SEC and forms a part of the effective registration statement. Copies of the final prospectus relating to this Offering may be obtained on the SEC's website at http://www.sec.gov or by contacting D. Boral Capital LLC at 590 Madison Avenue, 39th Floor, New York, NY 10022, by email at [email protected], or by telephone at (212) 970-5150.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Vendome Acquisition Corporation I

Vendome Acquisition Corporation I (Nasdaq:VNMEU) was formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. While the Company may pursue an initial business combination target in any industry, sector or geographic region, the Company intends to focus its search on target business in the consumer sector operating in North America, Southeast Asia, and Europe.

About D. Boral Capital

D. Boral Capital LLC is a premier, relationship-driven global investment bank headquartered in New York. The firm is dedicated to delivering exceptional strategic advisory and tailored financial solutions to middle-market and emerging growth companies. With a proven track record, D. Boral Capital provides expert guidance to clients across diverse sectors worldwide, leveraging access to capital from key markets, including the United States, Asia, Europe, the Middle East, and Latin America.

A recognized leader on Wall Street, D. Boral Capital has successfully aggregated approximately $30 billion in capital since its inception in 2020, executing ~350 transactions across a broad range of investment banking products.

Forward-Looking Statement

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the prospectus and the Company's other filings with the SEC. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

For more information, please contact:

D. Boral Capital LLC

Email: [email protected]

Telephone: +1(212)-970-5150

SOURCE: D. Boral Capital

View the original press release on ACCESS Newswire

F.Bennett--AMWN