-

China says trade jumped in July, beating forecasts

China says trade jumped in July, beating forecasts

-

Struggling Test opener Konstas sent on Australia A tour of India

-

Mo'unga to return to New Zealand in time for World Cup build-up

Mo'unga to return to New Zealand in time for World Cup build-up

-

Higher US tariffs take effect on dozens of economies

-

Sony hikes profit forecasts after strong quarter for games

Sony hikes profit forecasts after strong quarter for games

-

Osaka books WTA Montreal title clash with Canadian teen Mboko

-

Pacific microstate sells first passports to fund climate action

Pacific microstate sells first passports to fund climate action

-

Kinky knots: Japanese bondage becomes art

-

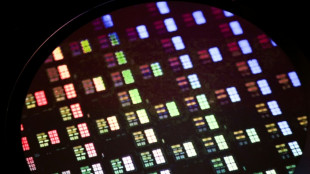

Markets rise as Trump chip exemptions boost tech giants

Markets rise as Trump chip exemptions boost tech giants

-

Japanese population sees record drop in 2024

-

United Airlines flights grounded in the US

United Airlines flights grounded in the US

-

Khachanov topples Zverev to reach ATP Toronto final

-

Mexican authorities accuse Adidas of cultural appropriation

Mexican authorities accuse Adidas of cultural appropriation

-

World Cup host Morocco under pressure to save stray dogs

-

Trump's 'dividend' promise for Americans leaves open questions

Trump's 'dividend' promise for Americans leaves open questions

-

Dangerous dreams: Inside internet's 'sleepmaxxing' craze

-

For Argentine farmers, Milei's free-market reforms fall short

For Argentine farmers, Milei's free-market reforms fall short

-

Bank of England set to cut rate as UK economy weakens

-

Canadian teen Mboko beats Rybakina to reach WTA Montreal final

Canadian teen Mboko beats Rybakina to reach WTA Montreal final

-

Ohtani homers for 1,000th MLB hit in Dodgers defeat

-

Trump hikes India levy over Russian oil as tariff deadline looms

Trump hikes India levy over Russian oil as tariff deadline looms

-

Smiling through: Alcaraz won't let Wimbledon defeat get him down

-

Apple to invest additional $100 bn in US

Apple to invest additional $100 bn in US

-

Trump says likely to meet Putin 'very soon'

-

Major climate-GDP study under review after facing challenge

Major climate-GDP study under review after facing challenge

-

Lebanon's Hezbollah rejects cabinet decision to disarm it

-

Rare 'Hobbit' first edition auctioned for £43,000

Rare 'Hobbit' first edition auctioned for £43,000

-

Sinner lukewarm on expanded Cincinnati format

-

Rested Scheffler ready to tackle US PGA Tour playoffs

Rested Scheffler ready to tackle US PGA Tour playoffs

-

Sudan says army destroys Emirati aircraft, killing 40 mercenaries

-

White House says Trump open to meeting Putin and Zelensky

White House says Trump open to meeting Putin and Zelensky

-

Grok, is that Gaza? AI image checks mislocate news photographs

-

'Global icon' Son Heung-min joins LAFC from Tottenham

'Global icon' Son Heung-min joins LAFC from Tottenham

-

In Cuba, Castro's 'influencer' grandson causes a stir

-

Mexican president backs threatened female football referee

Mexican president backs threatened female football referee

-

France wildfire kills one as Spanish resort blaze 'stabilised'

-

German great Mueller signs with MLS Whitecaps

German great Mueller signs with MLS Whitecaps

-

US government gets a year of ChatGPT Enterprise for $1

-

Trump calls Putin-Witkoff talks 'highly productive' but sanctions still due

Trump calls Putin-Witkoff talks 'highly productive' but sanctions still due

-

Egypt sets opening of $1 bn Pyramids museum for Nov 1

-

Prince Harry, African charity row rumbles on as watchdog blames 'all parties'

Prince Harry, African charity row rumbles on as watchdog blames 'all parties'

-

Brazil seeks WTO relief against Trump tariffs

-

Isak told to train alone by Newcastle - reports

Isak told to train alone by Newcastle - reports

-

McDonald's sees US rebound but says low-income diners remain stressed

-

Trump hikes India levy over Russian oil as tariff deadline approaches

Trump hikes India levy over Russian oil as tariff deadline approaches

-

Swiss president hopes Washington talks avert surprise tariff

-

France wildfire kills one as Spanish resort evacuated

France wildfire kills one as Spanish resort evacuated

-

Stocks higher with eyes on earnings, US tariff deadline

-

Vonn appoints Svindal as coach ahead of 2026 Olympics

Vonn appoints Svindal as coach ahead of 2026 Olympics

-

Backlash after 'interview' with AI avatar of US school shooting victim

| SCU | 0% | 12.72 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| CMSC | -0.52% | 22.95 | $ | |

| BCC | -4.64% | 82.92 | $ | |

| GSK | -1.55% | 36.75 | $ | |

| RYCEF | 1.17% | 14.5 | $ | |

| NGG | 0.03% | 72.3 | $ | |

| CMSD | 0.13% | 23.54 | $ | |

| SCS | 0.19% | 15.99 | $ | |

| RIO | 0.65% | 60.09 | $ | |

| VOD | 1.77% | 11.3 | $ | |

| JRI | 0.6% | 13.34 | $ | |

| RELX | -3.65% | 48.81 | $ | |

| BCE | -1.33% | 23.25 | $ | |

| AZN | -1.2% | 73.6 | $ | |

| BTI | 0.99% | 56.4 | $ | |

| BP | 0.83% | 33.88 | $ |

Bank of England set to cut rate as UK economy weakens

The Bank of England is widely expected to cut its key interest rate Thursday, with policymakers mindful of US tariffs and their potential risks to an already-struggling UK economy.

With the BoE likely to trim borrowing costs by a quarter point to 4.0 percent, focus will be on potential changes to the central bank's economic growth and inflation outlooks.

"There are clear signs of (UK) economic deterioration, particularly stemming from the labour market," Victoria Scholar, head of investment at Interactive Investor, noted ahead of the latest rate call.

"Yet policymakers must weigh this up against the risk of inflationary pressures particularly with rising food prices and international uncertainty around (US President Donald) Trump's tariffs and volatility in energy markets."

Against this backdrop, analysts expect splits within the Bank's Monetary Policy Committee.

Some argue that while the majority of the nine policymakers, including governor Andrew Bailey, will vote for a quarter-point cut, some are likely to demand an even larger reduction and others no change.

A quarter-point cut Thursday would be the BoE's fifth such reduction since starting a trimming cycle in August 2024, emphasising its "gradual" approach to reducing rates.

The BoE's main task is to keep Britain's annual inflation rate at 2.0 percent but the latest official data showed it had jumped unexpectedly to an 18-month high in June.

The Consumer Prices Index increased to 3.6 percent as motor fuel and food prices stayed high.

- Weak economy -

Latest official figures also show that Britain's economy unexpectedly contracted for a second month running in May and UK unemployment is at a near four-year high of 4.7 percent.

This is largely down to Prime Minister Keir Starmer's Labour government increasing a UK business tax from April, the same month that the country became subject to Trump's 10-percent baseline tariff on most goods.

London and Washington reached an agreement in May to cut levies of more than 10 percent imposed by Trump on certain UK-made items imported by the United States, notably vehicles.

Last month, the BoE warned in a report that tariff unpredictability and Middle East conflicts pose risks to UK financial stability.

The US Federal Reserve last week kept interest rates unchanged, defying strong political pressure from Trump to slash borrowing costs in a bid to boost the world's biggest economy.

Asked about US tariffs following the decision, Fed Chair Jerome Powell told a press conference: "We're still a ways away from seeing where things settle down."

The European Central Bank is meanwhile widely expected to keep rates unchanged at its next meeting, with eurozone inflation around the ECB's two-percent target.

But that could change, according to some economists, based on how Trump's tariffs affect the single-currency bloc.

Ch.Havering--AMWN