-

Man killed in Spain wildfire as European heatwave intensifies

Man killed in Spain wildfire as European heatwave intensifies

-

US, China extend tariff truce for 90 days

-

Families mourn 40 years since deadly Japan Airlines crash

Families mourn 40 years since deadly Japan Airlines crash

-

Thai soldier wounded in Cambodia border landmine blast

-

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

-

PSG sign Ukrainian defender Illia Zabarnyi

-

Five Premier League talking points

Five Premier League talking points

-

Five talking points as Spain's La Liga begins

-

Markets boosted by China-US truce extension, inflation in focus

Markets boosted by China-US truce extension, inflation in focus

-

Japan boxing to adopt stricter safety rules after deaths of two fighters

-

France adopts law upholding ban on controversial insecticide

France adopts law upholding ban on controversial insecticide

-

Most markets rise as China-US truce extended, inflation in focus

-

Toll of India Himalayan flood likely to be at least 70

Toll of India Himalayan flood likely to be at least 70

-

Taylor Swift announces 12th album for 'pre pre-order'

-

Italian athlete dies at World Games in China

Italian athlete dies at World Games in China

-

AI porn victims see Hong Kong unprepared for threat

-

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Steely Sinner advances amid Cincinnati power-failure chaos

-

Families forever scarred 4 years on from Kabul plane deaths

Families forever scarred 4 years on from Kabul plane deaths

-

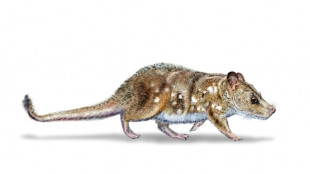

Scientists find 74-million-year-old mammal fossil in Chile

-

Trump signs order to extend China tariff truce by 90 days

Trump signs order to extend China tariff truce by 90 days

-

Spanish police bust 'spiritual retreat' offering hallucinogenic drugs

-

Jellyfish force French nuclear plant shutdown

Jellyfish force French nuclear plant shutdown

-

Murchison Minerals Closes Fully Subscribed Private Placement and Welcomes HCC Group as Strategic Investor

-

Zomedica's Fourth Friday at Four Webinar Returns: Spotlight on the VETIGEL(R) Hemostatic Product - The Future of Rapid Bleeding Control in Veterinary Medicine

Zomedica's Fourth Friday at Four Webinar Returns: Spotlight on the VETIGEL(R) Hemostatic Product - The Future of Rapid Bleeding Control in Veterinary Medicine

-

Amphastar Pharmaceuticals Bolsters Proprietary Pipeline Through Exclusive Licensing Agreement with Nanjing Anji Biotechnology Co., Ltd.

-

The Crypto Company Partners with Anchorage Digital Bank to Execute Secure and Strategic Crypto Treasury Initiative

The Crypto Company Partners with Anchorage Digital Bank to Execute Secure and Strategic Crypto Treasury Initiative

-

Three Pillars of SMX's Material Efficiency Technology: Trace It, Prove It, Trust It (NASDAQ: SMX)

-

Apex Critical Metals Updates 2025 Drill Program at Cap Project in Central British Columbia

Apex Critical Metals Updates 2025 Drill Program at Cap Project in Central British Columbia

-

Star Copper Confirms Southwest Expansion of Mineralization at Star Main Target

-

One dead, 10 hospitalized in Pennsylvania steel plant explosions

One dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Trump meets with Intel CEO after demanding he resign

-

Stocks cautious before US inflation report

Stocks cautious before US inflation report

-

Sabalenka survives massive Cincinnati struggle with Raducanu

-

Trump says plans to test out Putin as Europe engages Ukraine

Trump says plans to test out Putin as Europe engages Ukraine

-

Straka skips BMW but will play PGA Tour Championship

-

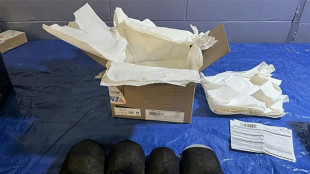

Chinese man pleads guilty in US to smuggling protected turtles

Chinese man pleads guilty in US to smuggling protected turtles

-

Trump sends troops to US capital, mulls wider crackdown

-

One dead, dozens injured in Pennsylvania steel plant explosions

One dead, dozens injured in Pennsylvania steel plant explosions

-

Trump signs order to extend China tariff truce by 90 days: US media

-

Pollock earns first enhanced England contract as Farrell misses out

Pollock earns first enhanced England contract as Farrell misses out

-

Iraq announces nationwide power outage amid 'record' heat

-

Harry and Meghan sign reduced deal with Netflix

Harry and Meghan sign reduced deal with Netflix

-

Child dies in Italy as European heatwave sets records and sparks wildfires

-

Trump says dealing 'nicely' with China as tariff deadline looms

Trump says dealing 'nicely' with China as tariff deadline looms

-

Trump expects 'constructive conversation' with Putin

-

Trump says Nvidia to give US cut of China chip sales

Trump says Nvidia to give US cut of China chip sales

-

No bread, no fuel, no dollars: how Bolivia went from boom to bust

-

Europeans plan Ukraine talks with Trump before he meets Putin

Europeans plan Ukraine talks with Trump before he meets Putin

-

Women's Rugby World Cup to adopt flashing mouthguards to signal head impact

| RBGPF | 0% | 73.08 | $ | |

| CMSC | 0.04% | 23.06 | $ | |

| SCU | 0% | 12.72 | $ | |

| BCC | -1.67% | 80.74 | $ | |

| RELX | 0.08% | 48.04 | $ | |

| NGG | 0.31% | 71.23 | $ | |

| CMSD | -0.04% | 23.571 | $ | |

| JRI | -0.34% | 13.39 | $ | |

| RIO | 0.45% | 62.14 | $ | |

| RYCEF | -0.84% | 14.3 | $ | |

| BCE | 0% | 24.35 | $ | |

| SCS | 0.5% | 15.96 | $ | |

| GSK | -0.24% | 37.71 | $ | |

| AZN | 0.72% | 74.07 | $ | |

| BTI | 1.87% | 58.33 | $ | |

| VOD | 1.3% | 11.51 | $ | |

| BP | -0.56% | 33.95 | $ |

Markets boosted by China-US truce extension, inflation in focus

Stock markets mostly rose Tuesday, with Tokyo hitting a record, as investors welcomed the extension of a China-US tariff truce but looked ahead apprehensively to the release of key US inflation data later in the day.

Donald Trump's widely expected trade announcement avoids the reimposition of sky-high levies and allows officials from Washington and Beijing to continue talking into November to settle their standoff.

In an executive order, the White House reiterated its position that there are "large and persistent annual US goods trade deficits" and they "constitute an unusual and extraordinary threat to the national security and economy of the United States".

However, William Yang, an analyst at the International Crisis Group, said: "Beijing will be happy to keep the US-China negotiation going, but it is unlikely to make concessions."

With the president's tariffs set and talks with various trading partners ongoing, markets are now turning their focus back towards the possible economic outlook and the impact of Trump's trade war.

First up is the US consumer price index (CPI) later in the day, which could play a major role in the Federal Reserve's decision-making with regard to interest rates.

Bets on a cut have ramped up in recent weeks owing to signs that the world's number one economy is showing signs of slowing, with figures indicating that the labour market softened considerably in the past three months.

Expectations are for CPI to come slightly above June's reading, but analysts warned investors were walking a fine line with a forecast-topping print likely to dent rate cut hopes and a too-weak read stoking economic fears.

"I'd imagine, for equities at least, given the comfort blanket that the surge in September cut expectations has provided recently, that a hotter-than-expected figure could see some fairly sizeable downside," said Pepperstone's Michael Brown.

While there have been warnings that the tariffs will stoke inflation, National Australia Bank's Ray Attrill said: "The larger tariff impacts... probably will not be felt until August/September, with firms now only gaining some clarity on the degree of reciprocal tariffs.

"The current profit reporting season has noted firms on the whole were waiting for greater clarity on final tariff rates before adjusting prices."

Also on the agenda this week are wholesale prices and retail sales, with the Fed's favoured gauge of inflation at the end of the month. Bank officials are then set to make their decision in the middle of September.

Forecasts are for a reduction at that gathering and one more before the end of the year.

Asia's markets rally was led by Tokyo's Nikkei 225, which briefly soared almost three percent to hit a record high of 42,999.71 on renewed optimism over the Japanese economy after officials reached a deal to avert the worst of Trump's tariffs.

IwaiCosmo Securities said in a market commentary that "easing tensions over US-China trade talks, as well as speculation about the US's imminent lowering of (interest) rates" had helped boost investors' hopes about the recovery of Japanese companies.

The gains came as traders returned to work after a long weekend.

Hong Kong, Shanghai, Taipei, Mumbai, Jakarta and Manila also advanced with London, Paris and Frankfurt.

Sydney was also given a lift by news that the Australian central bank had cut interest rates.

Seoul, Singapore and Wellington dropped.

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: UP 2.2 percent at 42,718.17 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 24,968.68 (close)

Shanghai - Composite: UP 0.5 percent at 3,665.92 (close)

London - FTSE 100: UP 0.3 percent at 9,153.20

Euro/dollar: UP at $1.1621 from $1.1617 on Monday

Pound/dollar: UP at $1.3458 from $1.3435

Dollar/yen: UP at 148.25 yen from 148.12 yen

Euro/pound: DOWN at 86.35 pence from 86.47 pence

West Texas Intermediate: UP 0.3 percent at $64.14 per barrel

Brent North Sea Crude: UP 0.4 percent at $66.89 per barrel

New York - Dow: DOWN 0.5 percent at 43,975.09 (close)

H.E.Young--AMWN