-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

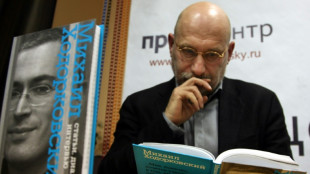

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Stocks steady ahead of key US inflation data

-

Jews flock to Ukraine for New Year pilgrimage despite travel warning

Jews flock to Ukraine for New Year pilgrimage despite travel warning

-

Trump autism 'announcement' expected Monday

-

Over 60,000 Europeans died from heat during 2024 summer: study

Over 60,000 Europeans died from heat during 2024 summer: study

-

Clashes as tens of thousands join pro-Palestinian demos in Italy

-

UK charity axes Prince Andrew's ex-wife over Epstein email

UK charity axes Prince Andrew's ex-wife over Epstein email

-

France, others to recognize Palestinian state at UN

-

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

-

Merz tasks banker with luring investment to Germany

-

Russia offers to extend nuclear arms limits with US by one year

Russia offers to extend nuclear arms limits with US by one year

-

Stocks turn lower ahead of key US inflation data

-

Gavi to undergo knee operation on meniscus injury: Barcelona

Gavi to undergo knee operation on meniscus injury: Barcelona

-

Frenchman denies killing wife in case that captivated France

-

Bavuma out of Test series in Pakistan as De Kock back for ODIs

Bavuma out of Test series in Pakistan as De Kock back for ODIs

-

Bavuma out of Test series as De Kock back for white-ball games

-

French town halls defy government warning to fly Palestinian flags

French town halls defy government warning to fly Palestinian flags

-

French zoo returns poorly panda and partner to China

-

IEA feels the heat as Washington pushes pro-oil agenda

IEA feels the heat as Washington pushes pro-oil agenda

-

Three things we learned from the Azerbaijan Grand Prix

-

Spanish bank BBVA raises offer for rival Sabadell

Spanish bank BBVA raises offer for rival Sabadell

-

Tens of thousands join pro-Palestinian demos, strikes in Italy

-

Man City's Silva fumes over lack of respect in schedule row

Man City's Silva fumes over lack of respect in schedule row

-

Israeli army operations stir fears in Syria's Quneitra

-

Chelsea's Palmer likely to avoid groin surgery: Maresca

Chelsea's Palmer likely to avoid groin surgery: Maresca

-

Horner formally leaves Red Bull after agreeing exit from F1 team

-

Newcastle sign Wales full-back Williams

Newcastle sign Wales full-back Williams

-

Nigerian women protest for reserved seats in parliament

-

Stocks mixed ahead of week's key US inflation data

Stocks mixed ahead of week's key US inflation data

-

Experts question Albania's AI-generated minister

-

Philippine protest arrests leave parents seeking answers

Philippine protest arrests leave parents seeking answers

-

New boss of Germany's crisis-hit railways vows 'new start'

-

Just not cricket: how India-Pakistan tensions spill onto the pitch

Just not cricket: how India-Pakistan tensions spill onto the pitch

-

PSG star Dembele expected to beat Yamal to Ballon d'Or

-

Burberry returns to London's top shares index

Burberry returns to London's top shares index

-

French town halls fly Palestinian flag despite government warning

-

China prepares to evacuate 400,000 as super typhoon makes landfall in Philippines

China prepares to evacuate 400,000 as super typhoon makes landfall in Philippines

-

Japan PM candidate vows 'Nordic' gender balance

-

Markets mixed as traders take stock after Fed-fuelled rally

Markets mixed as traders take stock after Fed-fuelled rally

-

Climate goals and fossil fuel plans don't add up, experts say

-

Amazon faces US trial over alleged Prime subscription tricks

Amazon faces US trial over alleged Prime subscription tricks

-

Google faces court battle over breakup of ad tech business

Vendome Acquisition Corporation I Announces the Separate Trading of Its Class A Ordinary Shares and Warrants, Commencing on August 22, 2025

PARK CITY, UT / ACCESS Newswire / August 21, 2025 / Vendome Acquisition Corporation I (Nasdaq:VNMEU) (the "Company") today announced that, commencing on August 22, 2025, holders of the units (the "Units") sold in the Company's initial public offering may elect to separately trade the Company's Class A ordinary shares (the "Ordinary Shares") and warrants (the "Warrants") included in the Units.

The Ordinary Shares and Warrants received from the separated Units will trade on the Nasdaq Global Market ("Nasdaq") under the symbols "VNME" and "VNMEW," respectively. Units that are not separated will continue to trade on Nasdaq under the symbol "VNMEU." No fractional Warrants will be issued upon separation of the Units and only whole Warrants will trade. Holders of Units will need to have their brokers contact Odyssey Transfer and Trust Company, the Company's transfer agent, in order to separate the Units into Ordinary Shares and Warrants.

The Company was formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. While the Company may pursue an initial business combination target in any industry, sector or geographic region, the Company intends to focus its search on target business in the consumer sector operating in North America, Southeast Asia, and Europe.

The Units were initially offered by the Company in an underwritten offering. D. Boral Capital LLC acted as sole book-running manager for the offering. Copies of the prospectus relating to the offering may be obtained from D. Boral Capital LLC, Attn: Guarav Verma, 590 Madison Avenue, 39th Floor, New York, New York 10022, by email at [email protected], or from the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov.

The registration statement relating to the securities of the Company was declared effective by the U.S. Securities and Exchange Commission (the "SEC") on June 30, 2025. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Forward Looking Statements

This press release contains statements that constitute "forward-looking statements," including with respect to the future operations of the Company. No assurance can be given that the Company will ultimately complete a business combination transaction in the sector it is targeting or at all. Management has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While they believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond management's control. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company's registration statement and final prospectus for the Company's initial public offering filed with the SEC, which could cause actual results to differ from forward-looking statements. Copies of these documents are available on the SEC's website, at www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. No assurance can be given that the Company will ultimately complete a business combination transaction.

Contact

Scott LaPorta

Vendome Acquisition Corporation I

Email: [email protected]

SOURCE: Vendome Acquisition Corporation 1

View the original press release on ACCESS Newswire

F.Schneider--AMWN