-

Luis Suarez apologizes after Leagues Cup spitting incident

Luis Suarez apologizes after Leagues Cup spitting incident

-

Trump signs order to lower US tariffs on Japan autos to 15%

-

Germany lose opening World Cup qualifier as Spain cruise

Germany lose opening World Cup qualifier as Spain cruise

-

Nagelsmann slams 'lack of emotion' in Germany's loss to Slovakia

-

Germany fall 2-0 to Slovakia in World Cup qualifying opener

Germany fall 2-0 to Slovakia in World Cup qualifying opener

-

Cape Verde islanders win to stay on course for World Cup debut

-

Breetzke stars as South Africa edge England by five runs for ODI series win

Breetzke stars as South Africa edge England by five runs for ODI series win

-

Germany fall 2-0 to Slovakia in 2026 World Cup qualifying opener

-

Flamengo's Henrique out for 12 games for alleged match-fixing

Flamengo's Henrique out for 12 games for alleged match-fixing

-

Cash on hand to clinch point for Poland against Netherlands

-

Spain thrash Bulgaria in opening 2026 World Cup qualifier

Spain thrash Bulgaria in opening 2026 World Cup qualifier

-

Argentine Congress overturns Milei veto on disability funds

-

Japanese star Oda chasing career Slam at US Open

Japanese star Oda chasing career Slam at US Open

-

Djokovic aims to 'mess up' Sinner-Alcaraz plans at US Open

-

Trump's Fed pick plans to keep White House job while at central bank

Trump's Fed pick plans to keep White House job while at central bank

-

In face of US 'threat,' how does Venezuela's military stack up?

-

Israel military says controls 40 percent of Gaza City

Israel military says controls 40 percent of Gaza City

-

Tennis icon Borg battling cancer says publicity for autobiography

-

Argentina charges Nazi's daughter for concealing decades-old art theft

Argentina charges Nazi's daughter for concealing decades-old art theft

-

Portugal releases first details of 16 killed in funicular crash

-

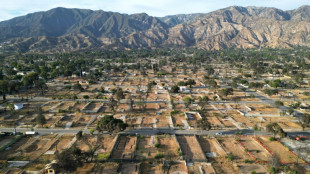

US sues power company over deadly Los Angeles wildfire

US sues power company over deadly Los Angeles wildfire

-

After change of club and Italy coach, fresh beginnings for Donnarumma

-

Levy makes shock decision to quit as Spurs chairman

Levy makes shock decision to quit as Spurs chairman

-

UK court convicts asylum seeker of sexual assault

-

Fashion, cinema stars hail 'love affair' with Armani

Fashion, cinema stars hail 'love affair' with Armani

-

France star Mbappe calls for players to get more time off

-

Trump's Fed governor pick vows to uphold central bank independence

Trump's Fed governor pick vows to uphold central bank independence

-

Norris brushes off Dutch setback before Italian GP battle with Piastri

-

In-form Breetzke stars as South Africa post 330-8 against England

In-form Breetzke stars as South Africa post 330-8 against England

-

France says 26 countries commit to Ukraine deployment if peace agreed

-

White House quietly drops WTO, ILO from foreign aid cut list

White House quietly drops WTO, ILO from foreign aid cut list

-

Wales edge Kazakhstan to boost World Cup hopes

-

Ayuso sprints to Vuelta stage 12 victory as tensions ease

Ayuso sprints to Vuelta stage 12 victory as tensions ease

-

Could humans become immortal, as Putin was heard telling Xi?

-

Stock markets advance with eyes on US jobs data

Stock markets advance with eyes on US jobs data

-

Xi tells Kim North Korea's importance to China 'will not change'

-

France detains seven over new cryptocurrency kidnapping

France detains seven over new cryptocurrency kidnapping

-

Europe pledges postwar 'reassurance force' for Ukraine: Macron

-

Hollywood hails Armani, designer to the stars

Hollywood hails Armani, designer to the stars

-

RFK Jr defends health agency shake up, Democrats call for his ouster

-

Bike-loving Dutch weigh ban on fat bikes from cycle lanes

Bike-loving Dutch weigh ban on fat bikes from cycle lanes

-

With restraint, Armani stitched billion-dollar fashion empire

-

France, Switzerland agree on Rhone, Lake Geneva water management

France, Switzerland agree on Rhone, Lake Geneva water management

-

US trade gap widest in 4 months as imports surged ahead of tariffs

-

Portugal mourns 16 killed in Lisbon funicular crash

Portugal mourns 16 killed in Lisbon funicular crash

-

Alarm in Germany as 'dangerous' Maddie suspect set to walk

-

Italian fashion icon Giorgio Armani dead at 91

Italian fashion icon Giorgio Armani dead at 91

-

Pro-Palestinian protests rock Spain's Vuelta cycling race

-

Tourists and locals united in grief after Lisbon funicular crash

Tourists and locals united in grief after Lisbon funicular crash

-

Comedy writer at centre of UK free-speech row in court on harassment charge

Oportun: Types of Financial Goals for Couples

SAN CARLOS, CA / ACCESS Newswire / September 03, 2025 / Finances can deeply influence a couple's relationship, often shaping how they plan, communicate, and handle stress. When couples align on money matters, it can strengthen trust, teamwork, and long-term stability. There are many goals to consider-from short- and long-term priorities to family planning and health. This article explores key categories of financial goals for couples, along with specific savings goals they may want to focus on together.

1. Short-term financial goals

Short-term financial goals are those aimed to be achieved within a few months to a couple of years. They help set couples up with a strong foundation to pursue other financial goals. Here are some common short-term goals:

Create and stick to a budget: Budgeting helps couples track their spending, stay on top of their finances, cover necessary expenses, and find ways to reduce spending. Planning a budget together can create awareness of each other's financial needs and priorities and strengthen trust.

Build an emergency fund: The sooner you start, the more prepared you'll be when an emergency hits. Everyone hopes an emergency doesn't happen, but being financially prepared can help couples focus on the issue rather than how to keep their finances afloat. Couples should generally aim to build a fund equal to three to six months of living expenses.

Pay off credit cards: Paying down high-interest credit card debt can save on interest, relieve financial stress, and improve credit scores. If one person is the primary debt holder, the couple should discuss responsibilities and a plan for paying it off.

Save for special events or vacations: Weddings, birthdays, anniversaries, travel and other fun activities may require saving. Couples can plan ahead to save up for these, allowing them to enjoy themselves without extra debt.

2. Long-term financial goals

Long-term financial goals often cover big life events and require years to decades of diligent saving. Here are some common long-term financial goals:

Buy a vehicle: Does a couple need one car or two? Couples should consider their transportation needs to determine how many and what kinds of vehicles they need. Factor insurance costs, maintenance and repairs into the budget for owning vehicles.

Buy a house: Saving for a down payment and closing costs on a home requires years of saving. It also means being able to cover the ongoing expenses (and headaches) of mortgage, insurance, property taxes, maintenance, repairs and improvements. Owning a home can provide long-term stability to a couple, which is especially important if they have children.

Retirement: It may feel far off, but couples must plan for retirement. They may contribute to retirement accounts, like 401(k)s and IRAs. They can also save in non-advantaged accounts to access funds early for early retirement. The sooner a couple starts, the more prepared they'll be when the time comes.

Pay off large debts: Paying off student loans, medical bills, and other large debts requires planning and diligent payment. Debt consolidation and refinancing can help couples achieve this more quickly.

3. Family financial goals

Family financial goals are those focused on creating financial security and stability for the couple's loved ones, including potential children and grandchildren. Here are some family financial goals to keep in mind:

Marriage: Marriage planning involves determining the budget and expenses involved in the wedding and honeymoon. But couples also must also determine if and how they'll merge and manage family finances.

Childcare expenses: Kids are expensive.Couples who want children should plan for childcare costs, such as daycare and education. That includes everyday basics, too, such as food, clothing, and diapers.

Children's college: Saving for college can take a long time. Couples can save more with tax-advantaged education savings accounts, like 529 plans. Meeting with an accountant to discuss relevant education tax credits and deductions can help identify more savings opportunities.

Estate planning and life insurance: An estate plan lets a couple specify their wishes for asset distribution when they pass away. It also lets them lay out plans for medical and financial decisions if incapacitated, establish trusts, and overall protect their property. Life insurance can help the surviving family members manage family finances.

4. Health and protection financial goals

Health and protection financial goals entail preparing financially for potential medical issues, the passing away of loved ones, and similar events. Addressing these goals can relieve financial strain on the couple and their loved ones in stressful or mournful situations. Here are some health and protection goals to consider:

Save for medical expenses: Saving for medical expenses can reduce uncertainty and strain. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) offer tax advantages, pushing the couple's healthcare savings further.

Get health insurance: Health insurance helps pay for medical costs, which can be astronomical and ongoing. Dental and vision insurance are also good to consider, as traditional medical insurance doesn't cover these.

Plan for retirement healthcare: Couples often have more healthcare needs in retirement. Couples may need additional insurance or savings to cover all their needs.

Plan for long-term care: Long-term care may entail high ongoing costs while reducing one's ability to earn income. Long-term care insurance and additional savings can help cover these costs and relieve strain on the other partner.

The bottom line

Reaching financial success together requires not just planning, but discussion on what each partner wants to accomplish. Couples should sit down to work out their financial goals together. Regular review and communication can help couples stay on the same page and create a bright financial future for themselves and their loved ones.

This article is intended for educational and informative purposes only. It should not be relied upon as personal advice regarding legal or financial matters, and you should consult legal or financial professionals of your choosing.

CONTACT:

Sonakshi Murze

Manager

[email protected]

SOURCE: Oportun

View the original press release on ACCESS Newswire

F.Bennett--AMWN