-

Trump signs order to lower US tariffs on Japan autos to 15%

Trump signs order to lower US tariffs on Japan autos to 15%

-

Germany lose opening World Cup qualifier as Spain cruise

-

Nagelsmann slams 'lack of emotion' in Germany's loss to Slovakia

Nagelsmann slams 'lack of emotion' in Germany's loss to Slovakia

-

Germany fall 2-0 to Slovakia in World Cup qualifying opener

-

Cape Verde islanders win to stay on course for World Cup debut

Cape Verde islanders win to stay on course for World Cup debut

-

Breetzke stars as South Africa edge England by five runs for ODI series win

-

Germany fall 2-0 to Slovakia in 2026 World Cup qualifying opener

Germany fall 2-0 to Slovakia in 2026 World Cup qualifying opener

-

Flamengo's Henrique out for 12 games for alleged match-fixing

-

Cash on hand to clinch point for Poland against Netherlands

Cash on hand to clinch point for Poland against Netherlands

-

Spain thrash Bulgaria in opening 2026 World Cup qualifier

-

Argentine Congress overturns Milei veto on disability funds

Argentine Congress overturns Milei veto on disability funds

-

Japanese star Oda chasing career Slam at US Open

-

Djokovic aims to 'mess up' Sinner-Alcaraz plans at US Open

Djokovic aims to 'mess up' Sinner-Alcaraz plans at US Open

-

Trump's Fed pick plans to keep White House job while at central bank

-

In face of US 'threat,' how does Venezuela's military stack up?

In face of US 'threat,' how does Venezuela's military stack up?

-

Israel military says controls 40 percent of Gaza City

-

Tennis icon Borg battling cancer says publicity for autobiography

Tennis icon Borg battling cancer says publicity for autobiography

-

Argentina charges Nazi's daughter for concealing decades-old art theft

-

Portugal releases first details of 16 killed in funicular crash

Portugal releases first details of 16 killed in funicular crash

-

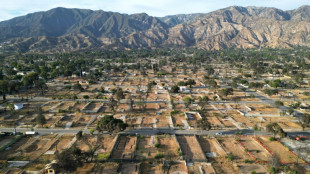

US sues power company over deadly Los Angeles wildfire

-

After change of club and Italy coach, fresh beginnings for Donnarumma

After change of club and Italy coach, fresh beginnings for Donnarumma

-

Levy makes shock decision to quit as Spurs chairman

-

UK court convicts asylum seeker of sexual assault

UK court convicts asylum seeker of sexual assault

-

Fashion, cinema stars hail 'love affair' with Armani

-

France star Mbappe calls for players to get more time off

France star Mbappe calls for players to get more time off

-

Trump's Fed governor pick vows to uphold central bank independence

-

Norris brushes off Dutch setback before Italian GP battle with Piastri

Norris brushes off Dutch setback before Italian GP battle with Piastri

-

In-form Breetzke stars as South Africa post 330-8 against England

-

France says 26 countries commit to Ukraine deployment if peace agreed

France says 26 countries commit to Ukraine deployment if peace agreed

-

White House quietly drops WTO, ILO from foreign aid cut list

-

Wales edge Kazakhstan to boost World Cup hopes

Wales edge Kazakhstan to boost World Cup hopes

-

Ayuso sprints to Vuelta stage 12 victory as tensions ease

-

Could humans become immortal, as Putin was heard telling Xi?

Could humans become immortal, as Putin was heard telling Xi?

-

Stock markets advance with eyes on US jobs data

-

Xi tells Kim North Korea's importance to China 'will not change'

Xi tells Kim North Korea's importance to China 'will not change'

-

France detains seven over new cryptocurrency kidnapping

-

Europe pledges postwar 'reassurance force' for Ukraine: Macron

Europe pledges postwar 'reassurance force' for Ukraine: Macron

-

Hollywood hails Armani, designer to the stars

-

RFK Jr defends health agency shake up, Democrats call for his ouster

RFK Jr defends health agency shake up, Democrats call for his ouster

-

Bike-loving Dutch weigh ban on fat bikes from cycle lanes

-

With restraint, Armani stitched billion-dollar fashion empire

With restraint, Armani stitched billion-dollar fashion empire

-

France, Switzerland agree on Rhone, Lake Geneva water management

-

US trade gap widest in 4 months as imports surged ahead of tariffs

US trade gap widest in 4 months as imports surged ahead of tariffs

-

Portugal mourns 16 killed in Lisbon funicular crash

-

Alarm in Germany as 'dangerous' Maddie suspect set to walk

Alarm in Germany as 'dangerous' Maddie suspect set to walk

-

Italian fashion icon Giorgio Armani dead at 91

-

Pro-Palestinian protests rock Spain's Vuelta cycling race

Pro-Palestinian protests rock Spain's Vuelta cycling race

-

Tourists and locals united in grief after Lisbon funicular crash

-

Comedy writer at centre of UK free-speech row in court on harassment charge

Comedy writer at centre of UK free-speech row in court on harassment charge

-

Europe leaders call Trump after Ukraine security guarantees summit

Stock markets advance with eyes on US jobs data

Stock markets mostly climbed and global bonds stabilised on Thursday as investors looked to US jobs data to cement rate-cut bets.

The latest weekly data released Thursday showed more first-time claims for unemployment benefits in the United States than analysts had expected, while figures from payroll firm ADP showed slowing private sector hiring in August.

Investors are now looking to US government data due out Friday, and hoping for further cuts to interest rates by the Federal Reserve.

"All eyes will be on Friday's nonfarm payrolls report with bad news likely to be interpreted as good news as it will raise the market probability that the Fed cuts rates," noted Victoria Scholar, head of investment at Interactive Investor.

David Morrison, senior market analyst at financial services provider Trade Nation, said the employment data "is likely to play a central role in shaping the direction of equities, currencies and commodities over the coming fortnight".

Wall Street's main exchanges pushed higher, with traders brushing off news that President Donald Trump's administration asked the US Supreme Court for an expedited ruling preserving tariffs after a lower court ruled against them last week.

In Europe, Frankfurt rose despite Germany's main economic institutes cutting their growth forecasts.

But Paris stocks slid, weighed down by an eight-percent drop in shares of pharmaceutical firm Sanofi, after a disappointing trial of its drug for skin condition atopic dermatitis.

Elsewhere, the global bond market eased further after yields had earlier in the week jumped on concerns over mounting government debt.

"There are signs that the bond market rout could be over," said Kathleen Brooks, research director at trading group XTB.

She warned that risks still loomed, particularly a confidence vote in France next week that could topple the minority government.

A solid auction of 30-year Japanese government bonds offered further reprieve after yields had risen to record highs.

Tokyo's stock market closed higher.

But Hong Kong and Shanghai each dropped more than one percent as a tech-driven rally ran out of steam.

Analysts said the decline followed a Bloomberg report that China's financial regulators may implement measures to cool the pace of the rally in stocks.

Oil prices extended losses Thursday in anticipation of excess supply in the coming months, as OPEC+ nations are expected to further unwind production cuts.

In company news, shares in Japanese motor maker Nidec tumbled 22 percent after it launched a probe into "improper accounting" at its Chinese subsidiary.

- Key figures at around 1530 GMT -

New York - Dow: UP 0.4 percent at 45,449.73 points

New York - S&P 500: UP 0.4 percent at 6,473.46

New York - Nasdaq Composite: UP 0.4 percent at 21,576.03

London - FTSE 100: UP 0.4 percent at 9,216.87 (close)

Paris - CAC 40: DOWN 0.3 percent at 7,698.92 (close)

Frankfurt - DAX: UP 0.7 percent at 23,770.33 (close)

Tokyo - Nikkei 225: UP 1.5 percent at 42,580.27 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 25,058.51 (close)

Shanghai - Composite: DOWN 1.3 percent at 3,765.88 (close)

Euro/dollar: DOWN at $1.1641 from $1.1663 on Wednesday

Pound/dollar: DOWN at $1.3435 from $1.3445

Dollar/yen: UP at 148.67 yen from 148.12 yen

Euro/pound: DOWN at 86.64 pence from 86.75 pence

West Texas Intermediate: DOWN 0.7 percent at $63.54 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $67.08 per barrel

burs-rl/jxb

J.Oliveira--AMWN