-

French doctor accused of poisoning patients sounds defiant ahead of trial

French doctor accused of poisoning patients sounds defiant ahead of trial

-

Controversy stalks sparkling sprint talent Richardson

-

Ariana Grande wins top MTV Video Music Award

Ariana Grande wins top MTV Video Music Award

-

'Last generation': Greek island's fading pistachio tradition

-

China 'elephant in the room' at fraught Pacific Islands summit

China 'elephant in the room' at fraught Pacific Islands summit

-

Sweden's Sami fear for future amid rare earth mining plans

-

'Trump Whisperer' ex-minister joins Japan PM race

'Trump Whisperer' ex-minister joins Japan PM race

-

Bills rally to stun Ravens, Stafford hits milestone in Rams win

-

ICC to hear war crimes charges against fugitive warlord Kony

ICC to hear war crimes charges against fugitive warlord Kony

-

Trump warns foreign companies after S.Korean workers detained

-

Asian shares rise as Japan politics weigh on yen

Asian shares rise as Japan politics weigh on yen

-

Norway votes in election influenced by wars and tariff threats

-

French parliament set to eject PM in blow to Macron

French parliament set to eject PM in blow to Macron

-

ECB set to hold rates steady with eye on France crisis

-

Russell Crowe shaken by Nazi role in festival hit 'Nuremberg'

Russell Crowe shaken by Nazi role in festival hit 'Nuremberg'

-

New Zealand fugitive father killed in shootout with police

-

Trump threatens Russia with sanctions after biggest aerial attack on Ukraine

Trump threatens Russia with sanctions after biggest aerial attack on Ukraine

-

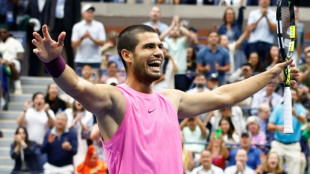

Alcaraz says completing career Slam his 'first goal'

-

New Zealand fugitive father dead after nearly four years on the run: police

New Zealand fugitive father dead after nearly four years on the run: police

-

Alcaraz outshines rival Sinner to win second US Open

-

Australia's 'mushroom murderer' handed life in prison with parole

Australia's 'mushroom murderer' handed life in prison with parole

-

Racing betting tax hike will bring 'communities to their knees': Gosden

-

'Predictable' Sinner vows change

'Predictable' Sinner vows change

-

'Blood Moon' rises during total lunar eclipse

-

Rodgers wins in Steelers debut, Stafford hits milestone in Rams win

Rodgers wins in Steelers debut, Stafford hits milestone in Rams win

-

Apex Critical Metals Appoints Alex Knox, P.Geo as Foundational Member of its Technical Advisory Board

-

Hemogenyx Pharmaceuticals PLC Announces Manufacturing Partnership with Made Scientific

Hemogenyx Pharmaceuticals PLC Announces Manufacturing Partnership with Made Scientific

-

Gaming Realms PLC Announces Interim Results

-

Guardian Metal Resources PLC Announces Intention to List in the US

Guardian Metal Resources PLC Announces Intention to List in the US

-

Pantheon Resources PLC Announces Dubhe-1 Update

-

Amazing AI PLC Announces Bitcoin Treasury Custodian

Amazing AI PLC Announces Bitcoin Treasury Custodian

-

Christopher E. O'Brien Appointed Chairman of General Holdings Limited

-

Paul Scribner Named Chief Executive Officer of General Holdings Limited

Paul Scribner Named Chief Executive Officer of General Holdings Limited

-

DEEP Robotics Unveils Multi-Robot Collaborative System, Ushering a New Era of Intelligent Power Inspection

-

IXOPAY Integrates J.P. Morgan Payments, Expanding Global Payment Connectivity for Merchants

IXOPAY Integrates J.P. Morgan Payments, Expanding Global Payment Connectivity for Merchants

-

Australian judge to hand down sentence for 'mushroom murderer'

-

Chloe Zhao tackles Shakespeare's true tragedy in 'Hamnet'

Chloe Zhao tackles Shakespeare's true tragedy in 'Hamnet'

-

Most EU carmakers on track to meet emission targets: study

-

Alcaraz beats Sinner to win US Open and reclaim No.1 ranking

Alcaraz beats Sinner to win US Open and reclaim No.1 ranking

-

Tatum says earned his place as an actor after 'Roofman'

-

'Blood Moon' rises as Kenya looks to the stars for tourism

'Blood Moon' rises as Kenya looks to the stars for tourism

-

Phillies shortstop Turner, NL batting leader, strains hamstring

-

Super Spain hit six as Germany get first World Cup qualifying win

Super Spain hit six as Germany get first World Cup qualifying win

-

Trump booed at US Open after visit delays final

-

Captain Jelonch leads champions Toulouse to winning Top 14 start

Captain Jelonch leads champions Toulouse to winning Top 14 start

-

Wirtz stunner helps Germany bounce back against Northern Ireland

-

Rodgers wins in Steelers debut while Bucs win on Koo miss

Rodgers wins in Steelers debut while Bucs win on Koo miss

-

Merino at the treble as Spain thump Turkey

-

Tuchel warns England to beware Serbia threat

Tuchel warns England to beware Serbia threat

-

Vienna State Opera opens season with free, all-star gala concert

Asian shares rise as Japan politics weigh on yen

Asian markets rose on Monday, with Tokyo up nearly two percent after Japanese Prime Minister Shigeru Ishiba's decision to resign pushed down the value of the yen.

Investors were also digesting weak US jobs data, while crude prices climbed after eight key members of the OPEC+ alliance said they had agreed to again boost oil production.

"A combination of weak US labour market data coupled with rising political uncertainty in Japan dominated global markets as we started the week in Asia," Michael Wan at MUFG said in a note.

Tokyo's Nikkei index gained 1.9 percent, with Japanese exporters benefiting from a slide in the yen's value -- one dollar bought 148.14 yen in morning trade, up from 147.07 yen on Friday.

Japanese bond yields also climbed after Ishiba said Sunday he would step down after less than a year in power, heralding fresh uncertainty for the world's fourth-largest economy.

"I don't think we can say that the resignation of PM Ishiba is a complete surprise as it's been mooted for some time but the timing of the announcement is certainly unexpected," said Michael Brown, senior research strategist at Pepperstone.

"As for the market reaction, this obviously introduces significant downside risks for the (Japanese yen) and for long-end" Japanese government bonds (JGBs), he added.

Last week, the yield on 30-year JGBs hit a record high, following rises in the United States and Europe on the back of concerns about political uncertainty and public finances.

Potential candidates to be leader of Japan's ruling party are "all likely to propose looser fiscal stances than Ishiba, hence further pressuring the long end of the curve, where demand for JGBs had already been waning quite significantly", Brown said.

Hong Kong and Shanghai were 0.3 percent higher in morning trade, with Taipei up 0.5 percent and Seoul also gaining 0.3 percent.

Singapore rose 0.1 percent and Wellington was up 0.1 percent, but Sydney fell 0.3 percent.

Last week's US jobs data has cemented expectations of a Federal Reserve interest rate cut later this month.

In Asia, "rising expectations of Fed rate cuts and with that lower US yields should be a welcome development to some extent providing some breathing space and policy room for Asian central banks", said Wan of MUFG.

"Nonetheless, the key risk for Asian currencies would also lie in a sharp US slowdown and hard-landing recession through sharply slower exports to the US, which we stress is not our base case."

- Key figures at around 0200 GMT -

Tokyo - Nikkei 225: UP 1.9 percent at 43,816.02

Hong Kong - Hang Seng Index: UP 0.3 percent at 25,499.10

Shanghai - Composite: UP 0.3 percent at 3,825.83

Euro/dollar: DOWN at $1.1711 from $1.1722 on Friday

Pound/dollar: DOWN at $1.3501 from $1.3508

Dollar/yen: UP at 148.14 yen from 147.07 yen

Euro/pound: DOWN at 86.75 pence from 86.77 pence

West Texas Intermediate: UP 1.3 percent at $62.66 per barrel

Brent North Sea Crude: UP 1.3 percent at $66.32 per barrel

New York - Dow: DOWN 0.5 percent at 45,400.86 (close)

London - FTSE 100: DOWN 0.1 percent at 9,208.21 (close)

F.Bennett--AMWN