-

Armani's will lays path to potential buyout by rival

Armani's will lays path to potential buyout by rival

-

Afghan deputy PM visits earthquake hit area

-

Russian central bank cuts interest rate as economy slows

Russian central bank cuts interest rate as economy slows

-

India hardliners give Nepal protests baseless religious twist

-

Chelsea's Delap out for up to three months: Maresca

Chelsea's Delap out for up to three months: Maresca

-

Microsoft avoids EU antitrust fine with Teams commitments

-

Stocks, dollar diverge with focus on rates

Stocks, dollar diverge with focus on rates

-

Norway sovereign wealth fund drops French miner over environmental fears

-

Ukrainian athletes show true grit to be at world championships, says federation chief

Ukrainian athletes show true grit to be at world championships, says federation chief

-

S. Koreans greeted with applause at home after US detention

-

Newcastle's Howe says Isak relationship was 'difficult' before Liverpool move

Newcastle's Howe says Isak relationship was 'difficult' before Liverpool move

-

South Africa jailbreak fugitive loses bid to block Netflix documentary

-

Rojas targets fifth world triple jump title on injury return

Rojas targets fifth world triple jump title on injury return

-

Japan athletics chief fights back tears over memory of Covid-hit Olympics

-

Pacific leaders agree new summit rules after China, Taiwan bans

Pacific leaders agree new summit rules after China, Taiwan bans

-

Nepalis assess damage after terror of deadly protests

-

Newcastle's Wissa to see specialist over knee injury

Newcastle's Wissa to see specialist over knee injury

-

Jackson happy to be 'where I'm wanted' after joining Bayern

-

Liverpool's Slot urges patience with 'best striker' Isak after record move

Liverpool's Slot urges patience with 'best striker' Isak after record move

-

Board of Spain's Sabadell bank rejects BBVA takeover bid

-

Hunt for shooter of Charlie Kirk enters third day in US

Hunt for shooter of Charlie Kirk enters third day in US

-

'Volatile': Londoners and asylum seekers on edge due to protests

-

New David Bowie museum unmasks the man behind the make up

New David Bowie museum unmasks the man behind the make up

-

Man Utd keeper Onana joins Trabzonspor on loan

-

UK economy stalls in July in fresh government setback

UK economy stalls in July in fresh government setback

-

Nepal seeks new leader as army reclaims streets after protest violence

-

Indonesia seizes part of nickel site over forest violations

Indonesia seizes part of nickel site over forest violations

-

Stocks rally into weekend with US rate cut 'seemingly locked in'

-

Springboks, Pumas out to keep Rugby Championship hopes alive

Springboks, Pumas out to keep Rugby Championship hopes alive

-

Scrutiny on Thai zoo grows after lion attack

-

UK economy stalls in July

UK economy stalls in July

-

Charlie Kirk's killing: what we know

-

S. Korean workers arrive home after US detention

S. Korean workers arrive home after US detention

-

US tariffs deal stokes 'monster' pick-up fears in Europe

-

Saint Lucia's Alfred says Olympic gold shows talent counts, not your passport

Saint Lucia's Alfred says Olympic gold shows talent counts, not your passport

-

Springboks hard man Wiese to take the All Blacks head-on

-

Tinch's journey to be hurdles title contender sparked by stepdad's joke

Tinch's journey to be hurdles title contender sparked by stepdad's joke

-

Russia, Belarus start military drills as West watches warily

-

UN General Assembly to vote on a Hamas-free Palestinian state

UN General Assembly to vote on a Hamas-free Palestinian state

-

For theatre legend John Kani, art must 'speak truth to power'

-

Ukraine's energy strikes hit Russians at the pump

Ukraine's energy strikes hit Russians at the pump

-

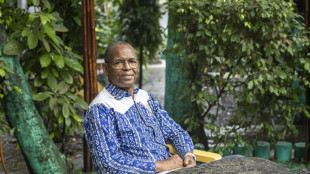

Guinea's Tierno Monenembo: stolen words and diehard critic of military rule

-

Norman says 'we changed the game' as he officially departs LIV Golf

Norman says 'we changed the game' as he officially departs LIV Golf

-

From Discord to Bitchat, tech at the heart of Nepal protests

-

Crawford chases history in super middleweight title showdown with Alvarez

Crawford chases history in super middleweight title showdown with Alvarez

-

'I chose myself': Israeli transgender ref's journey to the top

-

'No pressure' for teen Lutkenhaus, Team USA's youngest worlds athlete

'No pressure' for teen Lutkenhaus, Team USA's youngest worlds athlete

-

De Minaur vows to 'make life difficult' for Belgium in Davis Cup

-

Inoue out to prove pound-for-pound credentials against Akhmadaliev

Inoue out to prove pound-for-pound credentials against Akhmadaliev

-

Manchester derby offers chance to salve wounds, Isak prepares for Liverpool bow

Board of Spain's Sabadell bank rejects BBVA takeover bid

Spanish bank Sabadell on Friday said its board had rejected larger national rival BBVA's hostile takeover bid and urged shareholders to shun it as the clock ticked down on their final decision.

The proposed deal aims to create a European banking powerhouse capable of competing with industry heavyweights such as Santander, BNP Paribas and HSBC.

BBVA, Spain's second-largest bank with a large footprint in Latin America and Turkey, announced its all-share bid in May 2024, valuing Sabadell at around 15 billion euros ($18 billion).

After gaining approval from the European Central Bank and Spain's competition and stock market regulators, BBVA must now win over Sabadell's shareholders during a 30-day period that started on Monday.

"The price of the offer does not adequately reflect the intrinsic value of Banco Sabadell's shares, underestimating the project very significantly," the bank's board said in a report released on Friday.

Believing the takeover "destroys value for Banco Sabadell shareholders", the board "unanimously rejects the offer and therefore considers that the best option for shareholders... is not to accept it".

Founded in 1881 near Barcelona, Sabadell has a dispersed ownership structure. No investor holds more than seven percent of the bank, making the outcome of the takeover bid uncertain.

Sabadell's bosses are determined to maintain the independence of Spain's fourth-biggest bank and had already expressed their opposition to the takeover.

It has sold its UK subsidiary TSB to BBVA's biggest rival Santander, in what was seen as an effort to weaken its appeal as a takeover target.

Analysts said selling TSB would also give Sabadell more cash for dividends, share buybacks or acquisitions that could reduce the appeal of BBVA's offer to shareholders.

Spain's left-wing government is concerned about reduced competition and imposed strict conditions on the operation in June, requiring a three-year freeze on any merger between the two lenders.

O.M.Souza--AMWN