-

Barca duo Raphinha, Joan Garcia injured, out for PSG clash

Barca duo Raphinha, Joan Garcia injured, out for PSG clash

-

Trump hopes more opponents to be charged after 'dirty cop' Comey

-

US Fed's preferred inflation gauge rises, with more cost pressures expected

US Fed's preferred inflation gauge rises, with more cost pressures expected

-

Facebook, Instagram to offer paid ad-free UK subscriptions

-

Former UK PM Blair could lead transitional authority in Gaza: reports

Former UK PM Blair could lead transitional authority in Gaza: reports

-

Netanyahu says Palestinian state would be 'national suicide' for Israel

-

The nations and firms threatened by Trump's pharma tariffs

The nations and firms threatened by Trump's pharma tariffs

-

Trailblazing rugby chief Griffin proud of 'incredible' strides for women's game

-

Brother of Oasis stars denies rape, other charges

Brother of Oasis stars denies rape, other charges

-

EU steps up 'drone wall' plans after Russian incursions

-

Stocks rise as traders weigh US inflation, Trump tariffs

Stocks rise as traders weigh US inflation, Trump tariffs

-

Kenyan jeans factory to fire workers as US deal expires

-

Arteta hails Saliba's impact as new Arsenal deal looms

Arteta hails Saliba's impact as new Arsenal deal looms

-

England's Jones channels grief in bid for Women's Rugby World Cup glory

-

UN identifies 158 firms linked to Israeli settlements

UN identifies 158 firms linked to Israeli settlements

-

Canada's Patrick Watson channels dread into new 'Uh Oh' album

-

Trump brands indicted opponent Comey a 'dirty cop'

Trump brands indicted opponent Comey a 'dirty cop'

-

Walker an all-time great, says Guardiola ahead of Man City return

-

Alonso warns against overconfidence before Madrid derby

Alonso warns against overconfidence before Madrid derby

-

Fritz says path to Grand Slam glory goes through Alcaraz, Sinner

-

UK court drops terror case against Kneecap rapper

UK court drops terror case against Kneecap rapper

-

UK's Starmer urges liberals to fight 'the lies' told by far right

-

Bagnaia and Pennetta among first Winter Olympic torch carriers: organisers

Bagnaia and Pennetta among first Winter Olympic torch carriers: organisers

-

Sarkozy conviction exposes political divide in crisis-hit France

-

Ryder Cup begins in electric atmosphere at Bethpage Black

Ryder Cup begins in electric atmosphere at Bethpage Black

-

UK to launch digital ID scheme to curb illegal migration

-

Stocks diverge as traders weigh US inflation, Trump pharma tariff

Stocks diverge as traders weigh US inflation, Trump pharma tariff

-

Chelsea's Palmer sidelined with groin injury

-

India retires Soviet fighter jet after six decades

India retires Soviet fighter jet after six decades

-

Slovak parliament approves anti-LGBTQ constitutional change

-

Train tragedy hunger striker captures hearts in Greece

Train tragedy hunger striker captures hearts in Greece

-

I.Coast historic beachside town boasts new modern art museum

-

PSG captain Marquinhos out with thigh injury

PSG captain Marquinhos out with thigh injury

-

UK court drops terror charge against Kneecap rapper

-

Turkish Airlines inks big Boeing deal after Erdogan visits US

Turkish Airlines inks big Boeing deal after Erdogan visits US

-

Liverpool's Leoni faces year out after ACL injury on debut

-

'We are not afraid,' jailed Istanbul mayor tells court

'We are not afraid,' jailed Istanbul mayor tells court

-

Trump announces steep new tariffs, EU claims pharmaceutical immunity

-

Canada's women tilt for World Cup thanks to 'incredible' crowdfunding

Canada's women tilt for World Cup thanks to 'incredible' crowdfunding

-

India retires 'flying coffin' Soviet fighter jet after six decades

-

Erasmus makes late Springboks change as Nche injured

Erasmus makes late Springboks change as Nche injured

-

Ukrainian YouTuber arrested in Japan over Fukushima livestream

-

Foreign doctors in Gaza describe worst wounds 'they've ever seen'

Foreign doctors in Gaza describe worst wounds 'they've ever seen'

-

India-Pakistan to clash in first Asia Cup final

-

Title-chasing Marquez third-fastest in Japan MotoGP practice

Title-chasing Marquez third-fastest in Japan MotoGP practice

-

South Asia monsoon: climate change's dangerous impact on lifeline rains

-

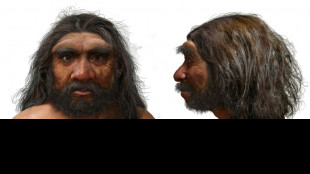

Million-year-old skull could change human evolution timeline

Million-year-old skull could change human evolution timeline

-

Gauff launches China Open title defence in style

-

Netanyahu set for defiant UN speech as Trump warns on annexation

Netanyahu set for defiant UN speech as Trump warns on annexation

-

The world's last linen beetling mill eyes strong future

Stocks diverge as traders weigh US inflation, Trump pharma tariff

European stocks rose Friday after losses in Asia, as traders awaited key US inflation data and digested President Donald Trump's fresh tariffs set to impact pharmaceuticals and other sectors.

The dollar dropped ahead of the Federal Reserve's preferred gauge of inflation -- the personal consumption expenditure (PCE) index -- with traders keenly seeking clues on how much further the US central bank could cut interest rates this year.

Official data Thursday showing faster-than-expected US economic growth in the second quarter dampened slightly expectations of a Fed cut next month, which would follow on from its September reduction, the first this year.

"On the surface, strong GDP should be good news but the problem is, such strong growth doesn't support further Federal Reserve rate cuts, and it could even boost inflation expectations on top of potential tariff-led pressures," noted Swissquote Bank senior analyst Ipek Ozkardeskaya.

Trump's announcement Thursday of steep new tariffs on medicines and other goods drew pushback from some allies, with the European Union claiming immunity for its pharmaceutical industry under a bilateral trade deal.

A 100-percent levy on pharmaceuticals, starting October 1, is the harshest trade policy by the president since April's shock unveiling of "reciprocal" tariffs on virtually every US trading partner across the globe.

In reaction, share prices of Asian pharma firms largely fared worse compared with European peers.

Shanghai Fosun shed around six percent and South Korea's Daewoong was off more than three percent. Japan's Daiichi Sankyo and Astellas Pharma were also well in the red.

Sydney-listed CSL shed nearly two percent, while Sun Pharmaceutical Industries was a major loser in India.

Key industry player India "could be spared" from the levies for now, however, according to MUFG bank analyst Michael Wan.

"It is still unclear how branded or patented pharmaceutical products will be defined, but our working assumption is that this will not incorporate generic drugs and pharmaceuticals shipped by the likes of India to the US," he wrote in a client note.

Shares prices of British pharma giants GSK and AstraZeneca were both rising in London midday deals, with both companies having recently announced major investment plans in the United States.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.3 percent at 9,243.75 points

Paris - CAC 40: UP 0.4 percent at 7,821.61

Frankfurt - DAX: UP 0.3 percent at 23,596.41

Tokyo - Nikkei 225: DOWN 0.9 percent at 45,354.99 (close)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 26,128.20 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,828.11 (close)

New York - Dow: DOWN 0.4 percent at 45,947.32 (close)

Euro/dollar: UP at $1.1669 from $1.1658 on Thursday

Pound/dollar: UP at $1.3347 from $1.3335

Dollar/yen: UP at 149.89 yen from 149.81 yen

Euro/pound: DOWN at 87.41 pence from 87.42 pence

Brent North Sea Crude: DOWN 0.1 percent at $68.52 per barrel

West Texas Intermediate: DOWN 0.1 percent at $64.90 per barrel

burs-bcp/ajb/lth

S.Gregor--AMWN