-

OMG! German influencers face tax dodging crackdown

OMG! German influencers face tax dodging crackdown

-

Merz to host German auto sector crisis meeting

-

Afghan Taliban foreign minister begins first India visit

Afghan Taliban foreign minister begins first India visit

-

French court to rule in Gisele Pelicot rape appeal trial

-

Kimmel hopes boycott outrage drew free speech 'red line'

Kimmel hopes boycott outrage drew free speech 'red line'

-

Top nature group to unveil new 'red list' of threatened species

-

Grieving Singapore father on mission to save teens from drug vapes

Grieving Singapore father on mission to save teens from drug vapes

-

Wilson drills game-winner as Aces hold off Mercury in WNBA Finals

-

What we know about the new Gaza deal

What we know about the new Gaza deal

-

Son Heung-min set to make South Korean history in Brazil friendly

-

Stocks mixed as traders assess AI rally, US rates and shutdown

Stocks mixed as traders assess AI rally, US rates and shutdown

-

Jays down Yankees to advance in MLB playoffs as Tigers, Cubs stay alive

-

Hamas, Israel agree hostage release, ceasefire under Trump plan

Hamas, Israel agree hostage release, ceasefire under Trump plan

-

EU chief faces confidence votes in fractious parliament

-

Macron seeks new PM to end France crisis

Macron seeks new PM to end France crisis

-

US federal workers apply for loans as shutdown hits military morale

-

Pro-Palestinian protest threat racks up tension for Italy's World Cup qualifier with Israel

Pro-Palestinian protest threat racks up tension for Italy's World Cup qualifier with Israel

-

Israel, Hamas agree to first phase of peace plan

-

How Donald Trump pulled off his Gaza deal

How Donald Trump pulled off his Gaza deal

-

Trump calls for jailing of Illinois Democrats as troops arrive

-

Genflow Biosciences PLC Announces Update, Equity Issue and PDMR Notification

Genflow Biosciences PLC Announces Update, Equity Issue and PDMR Notification

-

Tocvan Announces Discovery of New Target with Historic Underground Workings in North Alteration Zone at Gran Pilar Gold-Silver Project

-

Suspect in US court months after deadly Los Angeles fire

Suspect in US court months after deadly Los Angeles fire

-

Trump says Israel, Hamas agree to first phase of peace plan

-

Boca Juniors manager Russo dies aged 69: Argentine Football Association

Boca Juniors manager Russo dies aged 69: Argentine Football Association

-

US faces travel delays as government shutdown wears on

-

Tigers rally to beat Mariners, stay alive in MLB playoffs

Tigers rally to beat Mariners, stay alive in MLB playoffs

-

Breast cancer screening scandal outrages Spain

-

Man Utd win on women's Champions League debut, Chelsea held by Twente

Man Utd win on women's Champions League debut, Chelsea held by Twente

-

Country music star clashes with Trump govt over immigration raids

-

Macron to name new French PM within 48 hours

Macron to name new French PM within 48 hours

-

Flintoff did not feel 'valued' by new Superchargers owners

-

Zidane's son Luca 'proud' to play for Algeria

Zidane's son Luca 'proud' to play for Algeria

-

'Daily struggle for survival' for Haiti children, UN report says

-

Trump says may go to Middle East, with Gaza deal 'very close'

Trump says may go to Middle East, with Gaza deal 'very close'

-

Kane out but Tuchel wants more of the same from England

-

US facing worsening flight delays as shutdown snarls airports

US facing worsening flight delays as shutdown snarls airports

-

Outgoing French PM sees new premier named in next 48 hours

-

Ratcliffe gives Amorim three years to prove himself at Man Utd

Ratcliffe gives Amorim three years to prove himself at Man Utd

-

'I ain't dead yet!': Dolly Parton reassures fans after scare

-

Jane Goodall's final wish: blast Trump, Musk and Putin to space

Jane Goodall's final wish: blast Trump, Musk and Putin to space

-

Salah scores twice as Egypt qualify for 2026 World Cup

-

New 'Knives Out' spotlights Trump-era US political landscape

New 'Knives Out' spotlights Trump-era US political landscape

-

Failed assassin of Argentina's Kirchner given 10-year prison term

-

Man arrested over deadly January fire in Los Angeles

Man arrested over deadly January fire in Los Angeles

-

La Liga confirm 'historic' Barcelona match in Miami

-

France's Le Pen vows to block any government

France's Le Pen vows to block any government

-

Mooney ton rescues Australia in stunning World Cup win over Pakistan

-

Afghan mobile access to Facebook, Instagram intentionally restricted: watchdog

Afghan mobile access to Facebook, Instagram intentionally restricted: watchdog

-

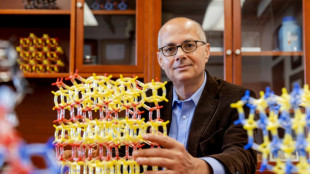

From refugee to Nobel: Yaghi hails science's 'equalizing force'

Stocks mixed as traders assess AI rally, US rates and shutdown

Asian markets were mixed Thursday as investors tried to assess the outlook for the global AI-fuelled rally, Federal Reserve interest rates and the ongoing US government shutdown.

News that Israel and Hamas had agreed to the first phase of a Gaza ceasefire provided some relief from geopolitical concerns -- and weighed on oil prices -- while gold retreated the day after hitting an all-tine high above $4,000.

Technology firms have been riding to ever-higher levels this year -- dragging equity markets with them as companies pump hundreds of billions of dollars into all things linked to AI.

But there is a growing concern that the returns might not match the investment sums, leading to warnings that valuations may have gone too far.

"AI is clearly a bubble," warned Neil Wilson at Saxo markets. "The question is when -- not if -- it blows up. And timing is incredibly hard," he added.

"(Software giant) Oracle had a stab at pricking the bubble yesterday by disclosing that the margins from its AI cloud business -- including server rentals using Nvidia chips -- are very slim.

"Tesla added to the gravity... as it dropped 4.5 percent on (its) lower-priced Model 3/Y reveal that underwhelmed analysts. Third-quarter earnings are still set to be strong, but doubts are being seeded for later."

But while the Oracle report dragged Wall Street on Tuesday, the S&P 500 and Nasdaq bounced back the day after to end at fresh records.

And Asia fought to extend the gains, with Tokyo rallying more than one percent on continued optimism about further stimulus following the election of business-friendly Sanae Takaichi as leader of Japan's ruling party.

Shanghai advanced as it reopened after a week-long holiday, while Sydney, Taipei and Manila were also up.

Hong Kong dipped along with Singapore, Wellington and Jakarta.

The US shutdown was not helping matters, with Republicans and Democrats no closer to reaching a deal to reopen the government as the row goes into a second week.

Democrats voted for a sixth time to block a Republican stopgap funding measure to reopen government departments -- they refuse to back any funding bill that does not offer an extension of expiring health care subsidies for 24 million people.

Minutes from the Fed's latest rate meeting showed divisions among decision-makers on cutting them, with some agreeing only after being persuaded in discussion over rising prices and a string of weak jobs figures.

"Policymakers that are becoming increasingly concerned about downside risks to employment likely favour additional and faster rate cuts going forward," HSBC's Ryan Wang said.

"Those that are more concerned about upside inflation risks are likely more circumspect about future cuts."

Geopolitical worries were eased after news that Israel and Hamas agreed Thursday to the first phase of a deal to end the Gaza war that has killed tens of thousands and at times fanned worries of a possible Middle East conflict.

Donald Trump announced a 20-point peace plan that will see Palestinian militant group Hamas release all hostages while Israel would pull its troops back to an agreed-upon line.

Oil prices, which have been elevated by worries over supplies from the region, slipped.

Gold, which hit a record of nearly $4,060 an ounce Wednesday -- partly on concerns about the crisis in Gaza -- was slightly lower.

In company news, Hong Kong-listed Hang Seng Bank soared more than 26 percent on reports that HSBC plans to take it private by buying its remaining shares. The deal values the lender at US$37 billion. HSBC tumbled more than six percent.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 1.4 percent at 48,405.93 (break)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 26,809.57

Shanghai - Composite: UP 1.0 percent at 3,921.28

Euro/dollar: UP at $1.1646 from $1.1628 on Wednesday

Pound/dollar: UP at $1.3416 from $1.3401

Dollar/yen: DOWN at 152.49 yen from 152.64 yen

Euro/pound: UP at 86.81 pence from 86.78 pence

West Texas Intermediate: DOWN 0.9 percent at $61.99 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $65.75 per barrel

New York - Dow: FLAT at 46,601.78

London - FTSE 100: UP 0.7 percent at 9,548.87 (close)

S.Gregor--AMWN