-

Australia must deploy 'unconventional' means to deter China, Russia: think tank

Australia must deploy 'unconventional' means to deter China, Russia: think tank

-

US Republicans seek to shield oil giants as climate lawsuits advance

-

Major media outlets reject Pentagon reporting rules

Major media outlets reject Pentagon reporting rules

-

Gattuso not underestimating anyone ahead of World Cup qualifying play-offs

-

England clinch 2026 World Cup qualification, Portugal forced to wait

England clinch 2026 World Cup qualification, Portugal forced to wait

-

Brash Trump approach brings Gaza deal but broader peace in question

-

South Africa, Ivory Coast, Senegal qualify for 2026 World Cup

South Africa, Ivory Coast, Senegal qualify for 2026 World Cup

-

USA Basketball names Heat's Spoelstra as coach through 2028

-

Mixed day for global stocks amid trade angst, Powell comments

Mixed day for global stocks amid trade angst, Powell comments

-

Brazil, other nations agree to quadruple sustainable fuels

-

Hungary deny Portugal, Ronaldo early World Cup berth

Hungary deny Portugal, Ronaldo early World Cup berth

-

Qatar and Saudi Arabia qualify for 2026 World Cup

-

England qualify for World Cup with rout of Latvia

England qualify for World Cup with rout of Latvia

-

Merino double helps Spain thrash Bulgaria

-

Trump threatens to end cooking oil purchases from China

Trump threatens to end cooking oil purchases from China

-

Strong dealmaking boosts profits at US banking giants

-

French telecoms join forces to break up embattled SFR

French telecoms join forces to break up embattled SFR

-

Trump says FIFA chief would back moving World Cup games

-

Italian Pro-Palestinian activists clash with police, demand Israel boycott before World Cup qualifier

Italian Pro-Palestinian activists clash with police, demand Israel boycott before World Cup qualifier

-

Hamas launches Gaza crackdown as Trump vows to disarm group

-

Murdered Kenyan's niece calls for UK ex-soldier's extradition

Murdered Kenyan's niece calls for UK ex-soldier's extradition

-

Trump says 'we will disarm' Hamas, urges return of Gaza bodies

-

Qatar hold on to beat UAE and qualify for 2026 World Cup

Qatar hold on to beat UAE and qualify for 2026 World Cup

-

South Africa beat Rwanda to qualify for 2026 World Cup

-

Trump to attend signing of Thailand-Cambodia 'peace deal'

Trump to attend signing of Thailand-Cambodia 'peace deal'

-

Vacherot relishing start of 'second career' after surprise Shanghai win

-

Hamas launches Gaza crackdown as truce holds

Hamas launches Gaza crackdown as truce holds

-

US indicts Cambodian tycoon over $15bn crypto scam empire

-

Myanmar scam centres booming despite crackdown, using Musk's Starlink: AFP investigation

Myanmar scam centres booming despite crackdown, using Musk's Starlink: AFP investigation

-

China, EU stand firm on shipping emission deal despite US threats

-

Theatrics trumped all at Trump's Gaza summit

Theatrics trumped all at Trump's Gaza summit

-

Celebrated soul musician D'Angelo dead at 51: US media

-

Shanghai star Vacherot requests Paris Masters invite after Basel wild card

Shanghai star Vacherot requests Paris Masters invite after Basel wild card

-

Reunited hostage describes stark differences in couple's Gaza captivity

-

Survivors in flood-hit Mexico need food, fear more landslides

Survivors in flood-hit Mexico need food, fear more landslides

-

US Fed chair flags concern about sharp slowdown in job creation

-

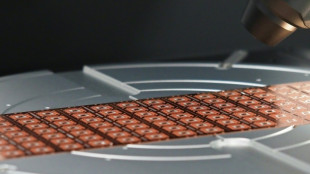

Chipmaker Nexperia says banned from exporting from China

Chipmaker Nexperia says banned from exporting from China

-

French PM backs suspending pensions reform to save government

-

Animal welfare transport law deadlocked in EU

Animal welfare transport law deadlocked in EU

-

Rain stops Sri Lanka's momentum in New Zealand washout at World Cup

-

Bangladesh factory blaze kills at least 16: fire official

Bangladesh factory blaze kills at least 16: fire official

-

Moreira arrival completes MotoGP grid for 2026

-

Ancelotti warns Brazil to toughen up after defeat to Japan

Ancelotti warns Brazil to toughen up after defeat to Japan

-

Military seizes power in Madagascar as president impeached

-

French PM backs suspending pensions reform in key move for survival

French PM backs suspending pensions reform in key move for survival

-

Japan make waves with friendly win over Brazil

-

US Treasury chief accuses China of wanting to hurt world economy

US Treasury chief accuses China of wanting to hurt world economy

-

IMF lifts 2025 global growth forecast, warns of ongoing trade 'uncertainty'

-

UN, Red Cross demand opening of all Gaza crossings to let in aid

UN, Red Cross demand opening of all Gaza crossings to let in aid

-

Pakistan fancy chances as spinners run riot in South Africa Test

Strong dealmaking boosts profits at US banking giants

Robust dealmaking activity and strong trading results helped boost US bank earnings Tuesday despite lingering worries about a softening job market and a potentially overvalued stock market.

Profits rose in the third quarter at JPMorgan Chase and three other US lending giants, reflecting strength in core business areas and the still-healthy condition of many consumers even after a lengthy stretch of persistently high costs that have stretched low-income households.

At JPMorgan, profits were $14.4 billion, up 12 percent from the year-ago level, with revenues of $46.4 billion, up 9 percent.

The bank, the biggest US lender in terms of assets, reported somewhat higher credit costs in the quarter as it disclosed details about a $170 million hit from the bankruptcy of Tricolor, a subprime auto lender.

But JPMorgan executives reiterated that consumers remain generally "resilient" and mostly on time with credit card payments, a tone echoed by other large banks.

"We've been waiting for the so-called consumer recession, but it doesn't materialize," said investment banker and author Christopher Whalen of Whalen Global Advisors.

The large banks "don't do business with subprime" customers, said Whalen, who suspects more troubles involving banks' corporate lending will surface in time.

- Stock market 'frothiness' -

More bank earnings will be released in the coming days, but Tuesday's batch showed increases all around with Citigroup profits rising 16 percent to $3.8 billion, Goldman Sachs up 39 percent to $3.9 billion and Wells Fargo up 9 percent to $5.6 billion.

Goldman Sachs pointed to its role as the "exclusive advisor" to Electronic Arts in a $55 billion deal to go private as it confidently described its merger and acquisition "pipeline" of pending and future deals.

Other banks also touted strong demand for financial advisory service. But they expressed concern about weakening US job data.

"While there have been some signs of a softening, particularly in job growth, the US economy generally remained resilient," said JPMorgan chief executive Jamie Dimon.

"However, there continues to be a heightened degree of uncertainty," said Dimon, pointing to tariffs, the risk of "sticky" inflation and other factors.

Executives also acknowledged concerns that sky-high equity valuations for artificial intelligence companies may be out of hand.

Citigroup Chief Financial Officer Mark Mason said the stream of stock market records suggests "some frothiness in different sectors," adding, "we'll have to see how that ultimately evolves."

- Problem loans limited so far -

Heading into the results, one overhang facing the sector was the question of exposure to a pair of recent high-profile bankruptcies.

Accounts of the collapse of Texas-based Tricolor have pointed to "apparent or alleged fraud," JPMorgan Chief Financial Officer Jeremy Barnum said on a conference call with reporters.

Barnum said it can be difficult to avert all cases where a "motivated party" is committed to deception, but that the firm was looking at fortifying its controls.

"This is not our finest moment," added Dimon, who said colleagues would "scour every issue" in light of the revelations on the case.

Citigroup also disclosed what it called "idiosyncratic downgrades" that more than doubled its corporate non-accrual loans compared with last year.

Mason said Citi had not experienced broad problems within its portfolio, noting the bank was not exposed to Tricolor or to First Brands, a US auto supply firm whose bankruptcy has hit some other lenders, including UBS and Jefferies.

"There's no particular concentration of exposure that I'm worried about," he said.

While the damage from such examples has been limited so far, more cases of problem corporate lending could surface. Whalen said the financial system is still flush from a period of great liquidity due to central bank actions.

"There's been so much credit available," he said. "It's just that they haven't gotten to the point where they're cleaning house."

P.Costa--AMWN