-

North Korea fires multiple ballistic missiles, first launch in months

North Korea fires multiple ballistic missiles, first launch in months

-

'Music to my ears': Trump brushes off White House demolition critics

-

Colombia's president embraces war of words with Trump

Colombia's president embraces war of words with Trump

-

Argentina's central bank intervenes to halt run on peso

-

Trump says doesn't want 'wasted' meeting with Putin

Trump says doesn't want 'wasted' meeting with Putin

-

New JPMorgan skyscraper underlines Manhattan office comeback

-

PSG hit seven, Barcelona, Arsenal run riot as Champions League rains goals

PSG hit seven, Barcelona, Arsenal run riot as Champions League rains goals

-

Colombian court overturns ex-president Uribe's witness tampering conviction

-

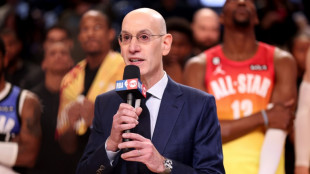

WNBA players to receive 'big increase' in salaries: Silver

WNBA players to receive 'big increase' in salaries: Silver

-

Dembele challenges PSG to 'keep it up' after Leverkusen thumping

-

Dembele scores on return as PSG hammer Leverkusen 7-2

Dembele scores on return as PSG hammer Leverkusen 7-2

-

Newcastle too good for 'little Magpie' Mourinho's Benfica

-

GM cuts EV production in Canada, cites Trump backpedal

GM cuts EV production in Canada, cites Trump backpedal

-

Gyokeres ends goal drought in Arsenal thrashing of Atletico

-

Netflix shares sink as quarterly profit misses mark

Netflix shares sink as quarterly profit misses mark

-

Haaland scores again as Man City beat Villarreal

-

French ex-president Sarkozy enters prison after funding conviction

French ex-president Sarkozy enters prison after funding conviction

-

Louvre director faces grilling over $102 mn jewels heist

-

Trump and Putin's Budapest summit shelved

Trump and Putin's Budapest summit shelved

-

Liverpool disrupted by flight delay, Gravenberch out of Frankfurt trip

-

Djokovic pulls out of Paris Masters

Djokovic pulls out of Paris Masters

-

OpenAI unveils search browser in challenge to Google

-

Lopez, Rashford inspire Barca rout of Olympiacos

Lopez, Rashford inspire Barca rout of Olympiacos

-

Wolvaardt stars as South Africa crush Pakistan in rain-hit World Cup contest

-

Trump urged Ukraine to give up land in 'tense' talks: Kyiv source

Trump urged Ukraine to give up land in 'tense' talks: Kyiv source

-

Kids paid 'a huge price' for Covid measures: ex-UK PM Johnson

-

Louvre jewel heist valued at $102 mn: French prosecutor

Louvre jewel heist valued at $102 mn: French prosecutor

-

Adidas hikes profit forecast as contains US tariff impact

-

Sundance film festival sets tributes to late co-founder Redford

Sundance film festival sets tributes to late co-founder Redford

-

Wife of Colombian killed in US strike says life taken unjustly

-

Dodging Trump's tariffs, Brazil's Embraer lands record orders

Dodging Trump's tariffs, Brazil's Embraer lands record orders

-

West Indies beat Bangladesh in super over after setting ODI spin record

-

GM shares soar on better tariff outlook and EV backpedal

GM shares soar on better tariff outlook and EV backpedal

-

Stocks rise on China-US hopes, gold and silver slump

-

What we know about the downfall of Prince Andrew

What we know about the downfall of Prince Andrew

-

Colombia, US vow to improve anti-drug strategy amid Trump-Petro feud

-

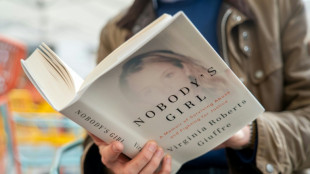

Virginia Giuffre memoir goes on sale, piling pressure on Prince Andrew

Virginia Giuffre memoir goes on sale, piling pressure on Prince Andrew

-

Artificial insemination raises hopes for world's rarest big cat

-

Maresca says Chelsea's red-card run is teaching opportunity

Maresca says Chelsea's red-card run is teaching opportunity

-

Oasis guitars among music memorabilia worth £3 mn at UK auction

-

Stocks rise on China-US hopes, Japan's new PM lifts Tokyo

Stocks rise on China-US hopes, Japan's new PM lifts Tokyo

-

Jane Birkin's Hermes handbag up for auction in Abu Dhabi

-

Scotland rugby coach Townsend 'doesn't see conflicts' with Red Bull role

Scotland rugby coach Townsend 'doesn't see conflicts' with Red Bull role

-

Pakistan-South Africa Test in balance after Maharaj takes seven

-

Ozempic-maker Novo Nordisk to shake up board

Ozempic-maker Novo Nordisk to shake up board

-

Europe backs Trump's Ukraine peace push as Kremlin hedges on summit

-

Rees-Zammit back for Wales as Tandy names first squad

Rees-Zammit back for Wales as Tandy names first squad

-

Maharaj takes seven wickets with South Africa-Pakistan Test in balance

-

Tunisian city on general strike over factory pollution

Tunisian city on general strike over factory pollution

-

France intensifies hunt for Louvre raiders as museum security scrutinised

Argentina's central bank intervenes to halt run on peso

Argentina's central bank said Tuesday it had sold $45.5 million dollars on the foreign exchange market to try and halt a run on the peso days ahead of midterm elections that have put pressure on the currency despite substantial US financial aid.

Argentines have scrambled to buy dollars amid fears of peso devaluation ahead of Sunday's vote, which is being closely watched by President Javier Milei's allies in Washington.

Since a run on the peso began on September 8 -- in the aftermath of a defeat for Milei's party in bellwether elections in Buenos Aires province -- it has lost 8.48 percent to the dollar.

Legislative elections Sunday will determine whether the budget-slashing Milei, whose party is in the minority, will wield more power in parliament in the second half of his term.

US counterpart Donald Trump, a staunch Milei ally, has already warned that "if he loses, we are not going to be generous with Argentina."

The peso closed Tuesday at 1,515 to the greenback at Argentina's official exchange rate -- a drop of just over 1.3 percent from Monday.

At the alternative rate used for foreign transactions, the peso measured 1,490.50 to the dollar -- just shy of the outer limit of a floating exchange rate band set by the government amid high currency volatility.

Before Tuesday's dollar sale, the central bank's last market intervention was in September, when it sold over $1.1 billion in three days to prop up the peso, which economists say is substantially overvalued.

Last week, US Treasury Secretary Scott Bessent announced efforts to secure a new $20 billion "facility" to support the South American country's embattled economy.

The announcement brought the total promised assistance from the United States to a whopping $40 billion, causing Argentine stocks to surge.

But there are signs of trouble ahead.

Inflation, which Milei has slashed by two-thirds in two years in office, has been creeping up again for three consecutive months to reach 2.1 percent month-on-month in September -- the highest since April.

There are also signs of economic stagnation, with declining consumption, a slowdown in manufacturing, and interest rates above 100 percent per year.

H.E.Young--AMWN