-

MLS Rapids and Red Bulls dump coaches after missing playoffs

MLS Rapids and Red Bulls dump coaches after missing playoffs

-

Injured NBA T-Wolves guard Edwards to miss at least a week

-

NBA reviewing policies to fight 'dire risks' of gambling: report

NBA reviewing policies to fight 'dire risks' of gambling: report

-

Trump to meet Japan PM as hopes grow for China deal

-

Fear of mass destruction in Jamaica as Hurricane Melissa churns in

Fear of mass destruction in Jamaica as Hurricane Melissa churns in

-

Slow but savage: Why hurricanes like Melissa are becoming more common

-

US authorities to release Sean 'Diddy' Combs in May 2028

US authorities to release Sean 'Diddy' Combs in May 2028

-

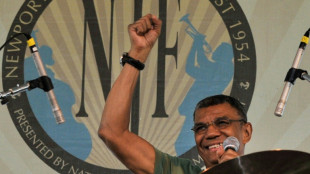

American jazz drummer Jack DeJohnette dies

-

Dimitrov wins on comeback as Paris Masters enters new era

Dimitrov wins on comeback as Paris Masters enters new era

-

US B-1B bombers fly off coast of Venezuela: flight tracking data

-

UK, Turkey sign $11-bn Eurofighter deal as Starmer visits

UK, Turkey sign $11-bn Eurofighter deal as Starmer visits

-

Freeman backed to cope as England's centre of attention against Australia

-

Rallies in Cameroon after rival rejects 92-year-old Biya's win

Rallies in Cameroon after rival rejects 92-year-old Biya's win

-

Russia's Lukoil to sell overseas assets after US sanctions

-

Frank confident Van de Ven has 'big future' at Spurs

Frank confident Van de Ven has 'big future' at Spurs

-

'A kind of freedom': Amsterdam celebrates 750 years

-

Amazon's Prime releases trailer for 'unprecedented' Paul McCartney documentary

Amazon's Prime releases trailer for 'unprecedented' Paul McCartney documentary

-

Ouattara wins landslide fourth term as Ivory Coast president

-

Turkey, UK sign $11 bn Eurofighter deal as Starmer visits

Turkey, UK sign $11 bn Eurofighter deal as Starmer visits

-

UK activists who tried to paint Taylor Swift jet spared jail

-

Rival rejects Cameroon's 92-year-old Biya's eighth term

Rival rejects Cameroon's 92-year-old Biya's eighth term

-

Napoli's De Bruyne unlikely to play again this year

-

Struggling Juventus sack coach Tudor

Struggling Juventus sack coach Tudor

-

Cameroon's veteran leader Paul Biya wins controversial eighth term

-

Juventus sack coach Igor Tudor

Juventus sack coach Igor Tudor

-

Timber warns Premier League leaders Arsenal against complacency

-

Putin terminates plutonium disposal agreement with US

Putin terminates plutonium disposal agreement with US

-

Asian stocks rally on US-China trade progress; Europe flat

-

Wales call up uncapped Cracknell into Autumn Nations squad in place of injured Faletau

Wales call up uncapped Cracknell into Autumn Nations squad in place of injured Faletau

-

Fears for trapped civilians in Sudan's El-Fasher after RSF claims control

-

Category 5 Hurricane Melissa strengthens as it heads for Jamaica

Category 5 Hurricane Melissa strengthens as it heads for Jamaica

-

Fears for trapped civilians in Sudan's El-Fasher as fighting flares

-

Asia stocks surge on US-China trade deal breakthrough

Asia stocks surge on US-China trade deal breakthrough

-

Trump in Japan as hopes grow for China trade deal

-

Australian Murray cod wallops swim record

Australian Murray cod wallops swim record

-

'Definitive solution' on Brazil-US trade within days: Lula

-

ECB to hold interest rates steady with inflation subdued

ECB to hold interest rates steady with inflation subdued

-

Murder, kidnap, censorship: the 'new normal' of Tanzania politics

-

Apprentice tames master as Love leads Packers past Rodgers, Steelers

Apprentice tames master as Love leads Packers past Rodgers, Steelers

-

Top seeds Philadelphia, San Diego win in MLS playoff openers

-

Argentina's Milei vows more reforms after stunning election win

Argentina's Milei vows more reforms after stunning election win

-

Trump departs for Japan ahead of key China meet

-

Ten people to stand trial over online harassment of French first lady

Ten people to stand trial over online harassment of French first lady

-

US shutdown poker: Which side has the winning hand?

-

Australia sues Microsoft over 'misleading' AI offer

Australia sues Microsoft over 'misleading' AI offer

-

Milei wins big in crucial Argentina midterms

-

Venezuela says US military exercises on nearby island a 'provocation'

Venezuela says US military exercises on nearby island a 'provocation'

-

Rookie Bearman claims career-best fourth for Haas

-

Who Does the Best Breast Augmentation in Las Vegas?

Who Does the Best Breast Augmentation in Las Vegas?

-

Isabella Bank Corporation Reports Third Quarter 2025 Results

SROA Capital Fund IX Surpasses Target Raising over $1.1 Billion in Total Commitments

WEST PALM BEACH, FL / ACCESS Newswire / October 27, 2025 / SROA Capital, LLC ("SROA"), a vertically integrated real estate investment and technology firm specializing in self-storage, today announced the final closing of SROA Capital Fund IX, LP, together with its parallel vehicles, ("Fund IX"). Fund IX is focused on equity investments in self-storage within the U.S., with total primary fund commitments of ~$865 million and ~$250 million in co-investment commitments from limited partners. Fund IX is SROA's largest fund to date, exceeding its $750 million target.

"The close of Fund IX demonstrates the confidence our investors have in our strategy, platform and team," said Benjamin S. Macfarland, III, Chief Executive Officer and Founder of SROA. "Fund IX is well-positioned to capitalize on what we view as an exceptional buying opportunity as we enter a new real estate cycle. We appreciate the trust our limited partners have placed in SROA, and we intend to build upon our decade-plus long track record of providing strong risk-adjusted returns. We remain focused on deploying this capital into the attractive opportunities we are seeing in the self-storage sector."

Owen Holm, Managing Director and Head of Investor Relations, added, "We are truly grateful for the continued support of our longstanding partners and new investors, including public pensions, foundations, endowments, insurance companies, asset managers, RIAs, and family offices. The success of this fundraise is a testament to the dedication, discipline, and hard work of our experienced team." With the close of Fund IX, SROA has raised over $2.6 billion in committed capital.

To date, Fund IX has closed 18 transactions across 25 states, totaling 284 properties and 13.5 million rentable square feet (RSF). As of today, SROA's investment vehicles own, and SROA's vertically integrated property management arm manages more than 680 facilities across 32 states, making it one of the largest owner-operators of self-storage in the U.S. SROA expects to deploy the remaining capital over the next 12 months.

About SROA Capital, LLC

SROA Capital, LLC is a vertically integrated real estate investment and technology company focused on investing in self-storage properties globally. SROA owns and operates over 31 million RSF in the U.S. under the brand Storage Rentals of America and ~1 million RSF in the U.K. under the brand Kangaroo Self-Storage. For more information, please visit www.sroacapital.com or contact a member of the Investor Relations team at [email protected].

Media Contact:

Daniel Benjamin, Account Director

BoardroomPR

[email protected]

SOURCE: SROA Capital

View the original press release on ACCESS Newswire

P.Stevenson--AMWN