-

Barca to make long-awaited Camp Nou return on November 22

Barca to make long-awaited Camp Nou return on November 22

-

COP30 talks enter homestretch with UN warning against 'stonewalling'

-

France makes 'historic' accord to sell Ukraine 100 warplanes

France makes 'historic' accord to sell Ukraine 100 warplanes

-

Delhi car bombing accused appears in Indian court, another suspect held

-

Emirates orders 65 more Boeing 777X planes despite delays

Emirates orders 65 more Boeing 777X planes despite delays

-

Ex-champion Joshua to fight YouTube star Jake Paul

-

Bangladesh court sentences ex-PM to be hanged for crimes against humanity

Bangladesh court sentences ex-PM to be hanged for crimes against humanity

-

Trade tensions force EU to cut 2026 eurozone growth forecast

-

'Killed without knowing why': Sudanese exiles relive Darfur's past

'Killed without knowing why': Sudanese exiles relive Darfur's past

-

Stocks lower on uncertainty over tech rally, US rates

-

Death toll from Indonesia landslides rises to 18

Death toll from Indonesia landslides rises to 18

-

Macron, Zelensky sign accord for Ukraine to buy French fighter jets

-

India Delhi car bomb accused appears in court

India Delhi car bomb accused appears in court

-

Bangladesh ex-PM sentenced to be hanged for crimes against humanity

-

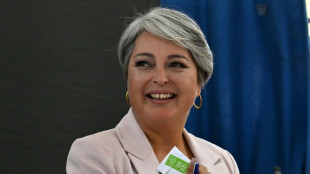

Leftist, far-right candidates advance to Chilean presidential run-off

Leftist, far-right candidates advance to Chilean presidential run-off

-

Bangladesh's Hasina: from PM to crimes against humanity convict

-

Rugby chiefs unveil 'watershed' Nations Championship

Rugby chiefs unveil 'watershed' Nations Championship

-

EU predicts less eurozone 2026 growth due to trade tensions

-

Swiss growth suffered from US tariffs in Q3: data

Swiss growth suffered from US tariffs in Q3: data

-

Bangladesh ex-PM sentenced to death for crimes against humanity

-

Singapore jails 'attention seeking' Australian over Ariana Grande incident

Singapore jails 'attention seeking' Australian over Ariana Grande incident

-

Tom Cruise receives honorary Oscar for illustrious career

-

Fury in China over Japan PM's Taiwan comments

Fury in China over Japan PM's Taiwan comments

-

Carbon capture promoters turn up in numbers at COP30: NGO

-

Japan-China spat over Taiwan comments sinks tourism stocks

Japan-China spat over Taiwan comments sinks tourism stocks

-

No Wemby, no Castle, no problem as NBA Spurs rip Kings

-

In reversal, Trump supports House vote to release Epstein files

In reversal, Trump supports House vote to release Epstein files

-

Gauff-led holders USA to face Spain, Argentina at United Cup

-

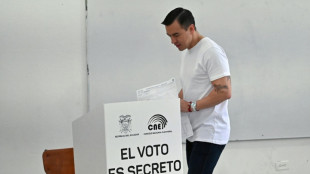

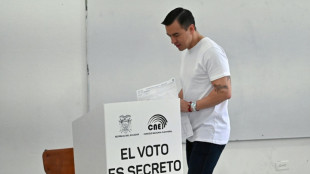

Ecuador voters reject return of US military bases

Ecuador voters reject return of US military bases

-

Bodyline and Bradman to Botham and Stokes: five great Ashes series

-

Iran girls kick down social barriers with karate

Iran girls kick down social barriers with karate

-

Asian markets struggle as fears build over tech rally, US rates

-

Australia's 'Dad's Army' ready to show experience counts in Ashes

Australia's 'Dad's Army' ready to show experience counts in Ashes

-

UN Security Council set to vote on international force for Gaza

-

Japan-China spat sinks tourism stocks

Japan-China spat sinks tourism stocks

-

Ecuador voters set to reject return of US military bases

-

Trump signals possible US talks with Venezuela's Maduro

Trump signals possible US talks with Venezuela's Maduro

-

Australian Paralympics gold medallist Greco dies aged 28

-

Leftist, far-right candidates go through to Chilean presidential run-off

Leftist, far-right candidates go through to Chilean presidential run-off

-

Zelensky in Paris to seek air defence help for Ukraine

-

Bangladesh verdict due in ex-PM's crimes against humanity trial

Bangladesh verdict due in ex-PM's crimes against humanity trial

-

A pragmatic communist and a far-right leader: Chile's presidential finalists

-

England ready for World Cup after perfect campaign

England ready for World Cup after perfect campaign

-

Cervical cancer vaccine push has saved 1.4 million lives: Gavi

-

Avrio Announces the Appointment of James O'Neill as Chief Investment Officer to Lead Global Investment and Capital Markets Strategy

Avrio Announces the Appointment of James O'Neill as Chief Investment Officer to Lead Global Investment and Capital Markets Strategy

-

Graid Technology Finalizes Intel VROC Licensing Agreement, Expanding Leadership in Enterprise Storage Solutions

-

GPO Plus, Inc. Announces 20% Sequential Quarterly Revenue Growth and Accelerates Near-Term Expansion Initiatives

GPO Plus, Inc. Announces 20% Sequential Quarterly Revenue Growth and Accelerates Near-Term Expansion Initiatives

-

Datavault AI Signs Multi-Million Dollar RWA Services Agreement With Triton Geothermal to Provide Significant Revenue Opportunities

-

Gold Terra is Upsizing Its Private Placement from C$6.3 Million to C$7.0 Million

Gold Terra is Upsizing Its Private Placement from C$6.3 Million to C$7.0 Million

-

Compassion Center, the Las Vegas Community, and Loved Ones Honor the Life and Immeasurable Legacy of Julie "Nurse Juhlzie" Monteiro with Community Celebrations December 13-14, 2025

Solera Receives Offer Letter

Chairman Quagliano motioned that the unredacted offer letter and letter of intent be published publicly on the website, via press release, and included in the proxy letter. J. Wright suggested that language be added to the press release and notification stating, essentially, "The Board received this unsolicited offer and found it to be grossly inadequate."

LAKEWOOD, CO / ACCESS Newswire / October 30, 2025 / Board of Directors

Solera National Bancorp, Inc. c/o Chairman Michael Drew Quagliano

319 South Sheridan Boulevard Lakewood, CO 80226

Re:

Non-Binding Indication of Interest - Proposed Purchase of 100% of the Outstanding Common Stock of Solera National Bancorp, Inc.

Ladies and Gentlemen:

On behalf of Project Sun Holdings, LLC (the "Buyer"), a Delaware limited liability company to be formed, and certain institutional co-investors (collectively, "Buyer Group"), we are pleased to submit this non-binding indication of interest (this "Indication" or "NBO") for the proposed acquisition of one hundred percent (100%) of the outstanding common stock of Solera National Bancorp, Inc. (the "Company" or "Solera"), the parent company of Solera National Bank (the "Bank").

This Indication is intended to set out the principal terms upon which the Buyer Group would be prepared to pursue a transaction and to facilitate discussions between the parties. Except as expressly stated below with respect to confidentiality and exclusivity, this Indication is non-binding and is subject to, among other things, negotiation, documentation and the execution of definitive agreements acceptable to the parties.

Buyer Group

Buyer will act through NewCo (Project Sun Holdings, LLC), to be formed in Delaware, and will be supported by committed co-investors comprised of institutional partners. Buyer will provide proof of funds and evidence of equity commitments upon the Company's reasonable request.

Proposed Transaction

Buyer proposes to acquire 100% of the outstanding shares of the Company by way of an all-cash stock purchase of the Company's issued and outstanding common stock, on the terms described herein and subject to customary adjustments and the conditions set forth below.

Purchase Price

Buyer proposes an aggregate purchase price of US$70,000,000 ( Seventy Million Dollars) (the "Purchase Price"), payable in cash at the Closing, subject to customary adjustments for:

Net working capital (target and true-up mechanics to be agreed);

Loan portfolio adjustments deriving from confirmatory review of loan tapes, ACL adequacy, non-performing assets and TDRs; and

Permitted post-closing adjustments agreed in the definitive purchase agreement.

The Purchase Price represents approximately a 70.6% premium to the thirty (30)-day average price of Solera common stock of $9.54, as of September 24, 2025, and is intended as a firm, single-number offer for purposes of this Indication.

Form of Consideration and Escrow

Form: All cash at Closing, subject to the adjustments described above.

Escrow / Holdback: Buyer proposes that a portion of the Purchase Price equal to fifteen percent (15%) be held in escrow (or otherwise retained) to secure seller representations, warranties and indemnities for a period of up to twenty-four (24) months (or such other arrangement as the parties agree). The specific escrow mechanics, claims process and release schedule will be negotiated in definitive documentation.

Financing and Proof of Funds

Buyer has obtained firm equity commitments from lead investors and stands ready to fund the Purchase Price from equity and / or committed financing sources. Buyer will promptly provide reasonable evidence of financing and proof of funds upon execution of a confidentiality and exclusivity agreement and prior to the commencement of confirmatory due diligence.

Conditions to Closing

The proposed transaction will be subject to customary closing conditions, including, without limitation:

Satisfactory confirmatory due diligence (financial, legal, regulatory, tax, BSA/AML, IT and operational, without limitation) at the Buyer's reasonable judgment;

Execution of mutually acceptable definitive agreements, including a stock purchase agreement containing customary representations, warranties, covenants, indemnities, closing conditions and termination rights;

No material adverse change in the business, operations, financial condition or prospects of the Company and the Bank prior to Closing;

Receipt of all required regulatory approvals and non-objections, including (without limitation):

o OCC non-objection under the Change in Bank Control Act (12 U.S.C. §1817(j)) and implementing regulations (12 C.F.R. §5.50), with Buyer filing required prior notices promptly following execution of a definitive agreement; o Any additional approvals or clearances required by the Federal Reserve,

FDIC or other applicable regulators; and o Hart-Scott-Rodino (HSR) clearance, if applicable; and

Shareholder approval, if required under applicable law or the Company's organizational documents.

Buyer acknowledges and understands that OCC review and non-objection will be required before Closing and that the statutory waiting period under applicable rules is a gating regulatory requirement.

Timeline (Indicative)

Buyer proposes the following indicative timing, subject to the Company's cooperation in providing diligence access and to regulatory timing:

Offer Validity: This Indication is open for acceptance until 5:00 p.m. Eastern Time on October 3rd, 2025 (the "Expiration Date"), unless earlier withdrawn by Buyer.

Exclusivity / Diligence : Upon mutual execution of a confidentiality and exclusivity agreement, Buyer requests an exclusivity period of ninety (90) days for purposes of confirmatory due diligence and negotiation of definitive agreements.

Definitive Agreement: Buyer aims to execute a binding stock purchase agreement within forty-five (45) days of acceptance of this Indication.

Regulatory Filing & Closing: Buyer will promptly submit required regulatory notice(s) following execution of definitive documentation. Subject to regulatory timing and approvals, Buyer would expect to close within 30-60 days following receipt of applicable regulatory non-objection(s), though actual timing may be longer depending on regulators' review.

Due Diligence Scope

This Indication is based on the information available to the Buyer as of today. Confirmatory diligence will include, without limitation: loan tapes and credit files, underwriting and collateral schedules, ACL methodology, deposit composition, core processor agreements, BSA/AML program, CRA matters and exam history, employee and executive agreements, litigation and regulatory matters, tax and environmental matters, IT systems, and any material contracts. Buyer will require access to management and to data rooms and will follow customary diligence protocols regarding confidentiality and limited distribution.

Confidentiality and Exclusivity

Confidentiality: The contents of this Indication and any subsequent discussions shall be treated as strictly private and confidential and are intended solely for the information of the recipients and their professional advisers eventually retained for the purposes of the Proposed Transaction. Neither the Buyer's interest in the Company nor the content of this NBO shall be disclosed to any person other than the recipients' professional advisers without the Buyer's prior written consent.

Exclusivity: To permit Buyer to devote time and resources to confirmatory diligence and negotiation of definitive agreements, Buyer requests that the Company grant Buyer exclusive negotiation rights for ninety (90) days upon mutual execution of a short confidentiality/exclusivity agreement; such exclusivity shall be binding and subject to the terms of the confidentiality/exclusivity agreement to be executed by the parties.

Material Adverse Change / Interim Covenants

Pending execution of definitive agreements, Buyer requests that the Company refrain from taking extraordinary actions (including dividend declarations, significant asset dispositions, material incurrence of indebtedness, or entering into material related-party transactions) without Buyer's prior written consent, except as otherwise required by law or regulation.

Legal Effect; Non-Binding Nature

This Indication is non-binding, other than the Confidentiality and Exclusivity provisions expressly referenced above (which shall be binding if and when the parties execute a separate confidentiality/exclusivity agreement). No obligation of any kind (including any obligation to consummate the transaction) will arise unless and until definitive agreements have been executed and delivered by the parties and all conditions therein have been satisfied or waived. This Indication does not constitute a solicitation for proxies or a public offer.

Governing Law

This Indication and any non-contractual obligations arising out of or in connection with it shall be governed in all respects, including existence, validity, interpretation and effect (without regard to principles of conflicts of law) by the laws of New York, USA.

Any dispute howsoever deriving or arising from this Indication or in connection with the

Proposed Transaction shall be subject to the exclusive jurisdiction of the Courts of Delaware, USA.

Closing Remarks

Buyer believes this proposal offers a prompt, certain and well-capitalized path to a transaction that protects the interests of the Company's stakeholders, preserves franchise value and positions the Bank for operational and capital improvement under experienced stewardship. Buyer looks forward to the opportunity to discuss this Indication with the Board and to proceed in an expedited and cooperative manner.

If the Board is receptive to this Indication, we respectfully request a meeting with the Board and management at the earliest feasible date to present our proposal and to review next steps, including execution of a confidentiality/exclusivity agreement to permit confirmatory due diligence.

Sincerely,

/ / /

Mr. Davi Cunha

Davi Cunha

Sponsor / Authorized Signatory

Project Sun Holdings, LLC (NewCo to be formed)

Michael Quagliano

Executive Chairman of the Company & Board

Solera National Bancorp, Inc

Contacts:

Jay Hansen,

CFO

(303) 209-8600

SOURCE: Solera National Bancorp, Inc.

View the original press release on ACCESS Newswire

G.Stevens--AMWN