-

Home in Nigeria, ex-refugees find themselves in a war zone

Home in Nigeria, ex-refugees find themselves in a war zone

-

Doncic's Lakers hold off Wembanyama's Spurs, Blazers silence Thunder

-

For Turkey's LGBTQ community, draft law sparks existential alarm

For Turkey's LGBTQ community, draft law sparks existential alarm

-

Musk's $1 trillion pay package to face Tesla shareholder vote

-

Tonga rugby league star out of intensive care after seizure

Tonga rugby league star out of intensive care after seizure

-

Argentine ex-president Kirchner goes on trial in new corruption case

-

Dams, housing, pensions: Franco disinformation flourishes online

Dams, housing, pensions: Franco disinformation flourishes online

-

Endo returns as Japan look to build on Brazil win

-

Franco captivates young Spaniards 50 years after death

Franco captivates young Spaniards 50 years after death

-

German steel industry girds for uncertain future

-

IPL champions Bengaluru could be sold for 'as much as $2 billion'

IPL champions Bengaluru could be sold for 'as much as $2 billion'

-

Budget impasse threatens Belgium's ruling coalition

-

New Zealand ex-top cop admits to having material showing child abuse, bestiality

New Zealand ex-top cop admits to having material showing child abuse, bestiality

-

BoE set for finely balanced pre-budget rate call

-

Australian kingpin obtains shorter sentence over drug charge

Australian kingpin obtains shorter sentence over drug charge

-

Weatherald's unenviable Ashes task: fill giant hole at top left by Warner

-

Ovechkin first to score 900 NHL goals as Capitals beat Blues

Ovechkin first to score 900 NHL goals as Capitals beat Blues

-

On Mexico City's streets, vendors fight to make it to World Cup

-

Asian markets bounce from selloff as US jobs beat forecasts

Asian markets bounce from selloff as US jobs beat forecasts

-

Philippine death toll tops 140 as typhoon heads towards Vietnam

-

Kyrgios targets 'miracle' Australian Open return after knee improves

Kyrgios targets 'miracle' Australian Open return after knee improves

-

'AI president': Trump deepfakes glorify himself, trash rivals

-

Belgium probes drone sightings after flights halted overnight

Belgium probes drone sightings after flights halted overnight

-

Five things to know about 'forest COP' host city Belem

-

World leaders to rally climate fight ahead of Amazon summit

World leaders to rally climate fight ahead of Amazon summit

-

Engine fell off US cargo plane before deadly crash: officials

-

Mexican leader calls for tougher sexual harassment laws after attack

Mexican leader calls for tougher sexual harassment laws after attack

-

Meghan Markle set for big screen return: reports

-

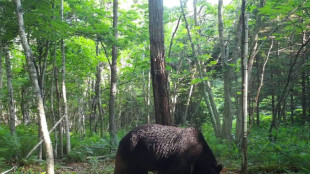

Japan deploys troops after wave of deadly bear attacks

Japan deploys troops after wave of deadly bear attacks

-

Diageo PLC Issues Fiscal 26 Q1 Trading Statement

-

NV Gold Announces Closing of First Tranche of Private Placement

NV Gold Announces Closing of First Tranche of Private Placement

-

FIFA announce new peace prize to be awarded at World Cup draw in Washington

-

Australia's Cummins hints at return for second Ashes Test

Australia's Cummins hints at return for second Ashes Test

-

Boeing settles with one plaintiff in 737 MAX crash trial

-

Man City win as Inter stay perfect, Barca held in Champions League

Man City win as Inter stay perfect, Barca held in Champions League

-

French superstar DJ Snake wants new album to 'build bridges'

-

Barca rescue draw at Club Brugge in six-goal thriller

Barca rescue draw at Club Brugge in six-goal thriller

-

Foden hits top form as Man City thrash Dortmund

-

NBA officials brief Congress committee over gambling probe

NBA officials brief Congress committee over gambling probe

-

Inter beat Kairat Almaty to maintain Champions League perfection

-

Newcastle sink Bilbao to extend Champions League winning run

Newcastle sink Bilbao to extend Champions League winning run

-

Wall Street stocks rebound after positive jobs data

-

LPGA, European tour partner with Saudis for new Vegas event

LPGA, European tour partner with Saudis for new Vegas event

-

Eyes turn to space to feed power-hungry data centers

-

Jazz lose Kessler for season with shoulder injury

Jazz lose Kessler for season with shoulder injury

-

League scoring leader Messi among MLS Best XI squad

-

MLS bans Suarez for Miami's winner-take-all playoff match

MLS bans Suarez for Miami's winner-take-all playoff match

-

McIlroy appreciates PGA of America apology for Ryder Cup abuse

-

Garnacho equaliser saves Chelsea in Qarabag draw

Garnacho equaliser saves Chelsea in Qarabag draw

-

Promotions lift McDonald's sales in tricky consumer market

BoE set for finely balanced pre-budget rate call

The Bank of England is expected to hold its key interest rate unchanged on Thursday but some analysts are not ruling out a surprise cut ahead of the UK government's annual budget.

Most analysts see the BoE keeping its main borrowing cost at 4.0 percent following a regular meeting, as British inflation stays well above the central bank's target.

However, "a spate of weak economic data... means a surprise cut cannot be ruled out", noted Kathleen Brooks, research director at XTB trading group.

Focus will also be on the BoE's latest forecasts for UK inflation and economic output, around three weeks before Prime Minister Keir Starmer's Labour administration presents the budget.

A cut to interest rates could ease pressure on the government after finance minister Rachel Reeves on Tuesday paved the way for controversial tax hikes in her November 26 budget.

The chancellor of the exchequer warned of "necessary choices" as Britain struggles with high debt and inflation.

"As I take my decisions on both tax and spend, I will do what is necessary to protect families from high inflation and interest rates," Reeves told the nation in a surprise pre-budget speech in Downing Street.

Britain's retail banks tend to pass on BoE rate cuts to their customers, easing the cost of mortgages and business loans.

- 'Close call' -

The main task of the BoE, which acts independently of the UK government, is to keep Britain's annual inflation rate at 2.0 percent.

The latest official data has the figure at 3.8 percent, although this was below the central bank's estimate that it would peak at 4.0 percent in September, when it kept borrowing costs steady following a cut in August.

There was no monetary policy meeting in October.

The BoE's reduction in August brought its main rate to the lowest level in two-and-a-half years amid concerns over the impact of US tariffs on the UK economy.

It was the bank's fifth cut since the BoE began a trimming cycle in August 2024, one month after Labour won a general election.

Thursday's decision by the bank's nine policymakers "will be a close call", predicted Neil Wilson, UK investor strategist at Saxo.

He added that the outcome could hinge on BoE governor Andrew Bailey.

"He could see it as prudent to await the outcome of the budget, or act sooner and back up his more dovish shift lately," Wilson said.

Britain's economic growth slowed to 0.3 percent in the second quarter following a 0.7 percent expansion in gross domestic product in the first three months of this year.

T.Ward--AMWN