-

Stokes prefers media heat in Australia to 'miserable, cold' England

Stokes prefers media heat in Australia to 'miserable, cold' England

-

Italy's luxury brands shaken by sweatshop probes

-

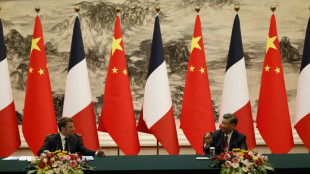

France's Macron visits China with Ukraine on the agenda

France's Macron visits China with Ukraine on the agenda

-

In Data Center Alley, AI sows building boom, doubts

-

Women don fake mustaches in LinkedIn 'gender bias' fight

Women don fake mustaches in LinkedIn 'gender bias' fight

-

Doctor to be sentenced for supplying Matthew Perry with ketamine

-

Football world braces for 2026 World Cup draw with Trump presiding

Football world braces for 2026 World Cup draw with Trump presiding

-

What are 'rare earths' for?

-

Honduran ex-president leaves US prison after Trump pardons drug crimes

Honduran ex-president leaves US prison after Trump pardons drug crimes

-

Chanderpaul, Hope see West Indies to 68-2 after New Zealand's 231

-

YouTube says children to be 'less safe' under Australia social media ban

YouTube says children to be 'less safe' under Australia social media ban

-

Polarised South Korea marks martial law anniversary

-

US, Russia find 'no compromise' on key territory issue after Ukraine talks

US, Russia find 'no compromise' on key territory issue after Ukraine talks

-

Family voices new alarm for Hong Kong's jailed Jimmy Lai

-

San Francisco sues producers over ultra-processed food

San Francisco sues producers over ultra-processed food

-

Honduras' Hernandez: Convicted drug trafficker pardoned by Trump

-

Romero bicycle kick rescues point for Spurs against Newcastle

Romero bicycle kick rescues point for Spurs against Newcastle

-

Barca make Atletico comeback to extend Liga lead

-

Leverkusen knock Dortmund out of German Cup

Leverkusen knock Dortmund out of German Cup

-

Steve Witkoff, neophyte diplomat turned Trump's global fixer

-

Man City's Haaland makes 'huge' Premier League history with 100th goal

Man City's Haaland makes 'huge' Premier League history with 100th goal

-

Sabrina Carpenter condemns 'evil' use of her music in White House video

-

Tech boss Dell gives $6.25bn to 'Trump accounts' for kids

Tech boss Dell gives $6.25bn to 'Trump accounts' for kids

-

Trump hints economic adviser Hassett may be Fed chair pick

-

US stocks resume upward climb despite lingering valuation worries

US stocks resume upward climb despite lingering valuation worries

-

Haaland century makes Premier League history in Man City's nine-goal thriller

-

Serena Williams denies she plans tennis return despite registering for drug tests

Serena Williams denies she plans tennis return despite registering for drug tests

-

Defense challenge evidence in killing of US health insurance CEO

-

Man City's Haaland makes Premier League history with 100th goal

Man City's Haaland makes Premier League history with 100th goal

-

Putin and US negotiators hold high-stakes Ukraine talks in Moscow

-

Spain overpower Germany to win second women's Nations League

Spain overpower Germany to win second women's Nations League

-

'HIV-free generations': prevention drug rollout brings hope to South Africa

-

US medical agency will scale back testing on monkeys

US medical agency will scale back testing on monkeys

-

Faberge's rare Winter Egg fetches record £22.9 mn at auction

-

Snooker great O'Sullivan loses to Zhou in UK Championship first round

Snooker great O'Sullivan loses to Zhou in UK Championship first round

-

Pentagon chief says US has 'only just begun' striking alleged drug boats

-

Putin receives top US negotiators in high-stakes Ukraine talks

Putin receives top US negotiators in high-stakes Ukraine talks

-

Under Trump pressure, Honduras vows accurate vote count

-

O'Neill salutes Celtic players for 'terrific' response

O'Neill salutes Celtic players for 'terrific' response

-

Pope urges halt to attacks in Lebanon as first voyage abroad ends

-

Amazon unveils new AI chip in battle against Nvidia

Amazon unveils new AI chip in battle against Nvidia

-

Pope plans trip to Africa, starting with Algeria

-

Woods recovery 'not as fast as I'd like', no timetable for return

Woods recovery 'not as fast as I'd like', no timetable for return

-

'Come and kill me': sick ants invite destruction to save colony

-

Red Bull promote rookie Hadjar to partner Verstappen

Red Bull promote rookie Hadjar to partner Verstappen

-

Zelensky calls for peace, Putin defiant ahead of US-Russia talks

-

Mbappe more than his goals: Real Madrid coach Alonso

Mbappe more than his goals: Real Madrid coach Alonso

-

Sport court allows Russian, Belarusian skiers to qualify for Olympics

-

Cyclone turns Sri Lanka's tea mountains into death valley

Cyclone turns Sri Lanka's tea mountains into death valley

-

IOC president calls for end to 'finger-pointing' in doping fight

Charlie's Holdings (OTCQB: CHUC) Begins SBX Roll-Out and Reports 336% Growth to $7.1 Million Revenue for Q3 2025

$1.0 Million Sale of one PACHA SKU ̶ to a Strategic Buyer ̶ Represents Additional Income Over and Above the Company's $7.1 Million Ordinary Revenue.

Company Projects Continued Strong Growth and an All-Time Revenue Record in Q4

COSTA MESA, CA / ACCESS Newswire / November 19, 2025 / Charlie's Holdings, Inc. (OTCQB:CHUC) ("Charlie's" or the "Company"), an industry leader in the premium vapor products space, today reported results for the three months ended September 30, 2025, and provided an update on recent business highlights.

Key Financial Highlights for Q3 2025 (compared with Q3 2024)

Revenue increased 336% to $7.1 million

Net income of $0.6 million, from a loss of $1.0 million

Cash balance of $1.1 million, compared to $0.2 million

Total assets of $10.6 million, compared to $3.9 million

Total shareholders' equity of $3.2 million, compared to a deficit of ($1.8) million

Key Balance Sheet Highlights for Q3 2025 (compared with Q4 2024)

Recent Business Highlights

Successful SBX introduction in 7 strategically advantaged states; Phase I roll-out began in Q3; Phase II roll-out for multiple regional convenience store chains and distributors will continue in Q4 2025. SBX now represents the majority of the Company's sales.

On August 8, 2025, the Company entered into and closed a PMTA asset sale for one PACHA synthetic product and related asset, bringing the total PMTA Products purchased by the strategic Buyer to sixteen. The purchase price for this latest PMTA asset was $1.0 million paid at closing. Accordingly, PMTA Products Strategic Partnerships have now generated $7.5 million in income with an additional $4.2 million in contingent payments possible over the next 12 months.

On August 26, 2025, the Company announced that, in order to facilitate increased SBX inventory purchases and to fuel the Company's growth in the mass market convenience store channel, it signed a very favorable $2 million credit facility with Michael D. King, one of the independent members of Charlie's Board of Directors.

The Company announced that it will open its first US manufacturing facility in Q4 2025 for filling of select product lines. In addition to mitigating shipping delays and tariff costs, the US-filled line will enable Charlie's to meet new domestic manufacturing requirements that have been announced by large states. The Company's new line will meet these new domestic manufacturing requirements and will appeal, broadly, to adult consumers who prefer "Made in America" products.

To prevent youth access to nicotine and non-nicotine vapor products, the Company has reported that it continues its efforts to develop age-gating technology for certain of its products in development.

Management Commentary

"Early SBX sales continue to exceed Company expectations… by a wide margin!" reported Ryan Stump, Charlie's Chief Operating Officer. "Already in Q4, we sold more SBX - $6 million worth during a two-day convenience store tradeshow - than we ever sold in an entire MONTH… In fact, our two days of show sales equate to 75% of what we sold in ALL OF 2024! Without question, SBX is greatly expanding Charlie's retail distribution in convenience stores that wish to carry flavored disposable vapes that are not in violation of the FDA's PMTA review process."

Henry Sicignano III, Charlie's President, explained, "If we had been able to finance and manufacture more product in Q3, we could have realized substantially more than $10 million in top line sales for the third quarter… and indeed, Q4 should eclipse this milestone." Mr. Sicignano continued, "With steady progress in the markets where SBX enjoys considerable competitive advantages, we believe $10 million in monthly sales, along with significantly improved net margins, could be achievable by mid-2026. Very exciting times for the Charlie's team… and for our shareholders."

Financial Results for the Three Months Ended September 30, 2025:

Revenue: For the three months ended September 30, 2025 revenue was $7.1 million, an increase of $5.5 million, or 336%, compared with $1.6 million for the three months ended September 30, 2024. The increase in revenue was primarily due to an increase in the sales of Charlie's (non-nicotine) SBX product line.

Gross Profit: For the three months ended September 30, 2025 gross profit was $1.8 million, an increase of $1.1 million, or 180%, compared with $0.86 million for the three months ended September 30, 2024. The resulting gross margin for the three months ended September 30, 2025 was 24.9%, compared with 38.8% for the three months ended September 30, 2024.

Total Operating Expenses: For the three months ended September 30, 2025, total operating expenses, including general and administrative, sales and marketing and research and development costs, were $2.1 million, an increase of $0.6 million, or 40%, compared with $1.5 million the three months ended September 30, 2024.

Net Income/Loss: For the three months ended September 30, 2025, net income was $0.6 million, compared with a net loss of $1.0 million for the three months ended September 30, 2024. Net income was negatively impacted by first-order product placement costs including displays, commissions, and promotional expenses, however the Company achieved an increase in net income for the quarter as a result of funds received from a strategic Buyer in the August 2025 PMTA asset sale.

About Charlie's Holdings, Inc.

Charlie's Holdings, Inc. (OTCQB:CHUC) is an industry leader in the premium vapor products space. The Company's products are sold around the world to select distributors, specialty retailers, and third-party online resellers through subsidiary company Charlie's Chalk Dust, LLC. Charlie's Chalk Dust has developed an extensive portfolio of brand styles, flavor profiles, and innovative product formats.

For additional information, please visit Charlie's corporate website at: Chuc.com and the Company's branded online websites: sbxvape.com, CharliesChalkDust.com, enjoypachamama.com, and Pacha.co.

Safe Harbor Statement

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding the Company's overall business, existing and anticipated markets and expectations regarding future sales and expenses. Words such as "expect," "anticipate," "should," "believe," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "could," "intend," variations of these terms or the negative of these terms, and similar expressions, are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company's control. The Company's actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: the Company's ongoing ability to quote its shares on the OTCQB; whether the Company will meet the requirements to up-list to a national securities exchange in the future; the Company's ability to successfully increase sales and enter new markets; whether the Company's PMTA's for its nicotine-containing products will be authorized by the FDA, and the FDA's decisions with respect to the Company's future PMTA's for nicotine products; the Company's ability to manufacture and produce products for its customers; the Company's ability to formulate new products; the acceptance of existing and future products; the complexity, expense and time associated with compliance with government rules and regulations affecting nicotine, synthetic nicotine, products containing nicotine substitutes, and products containing cannabidiol; litigation risks from the use of the Company's products; risks of government regulations; the impact of competitive products; and the Company's ability to maintain and enhance its brands, as well as other risk factors included in the Company's most recent quarterly report on Form 10-Q, annual report on Form 10-K, and other SEC filings. These forward-looking statements are made as of the date of this press release and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events or changes in its expectations.

Investors Contact:

[email protected]

Phone: 949-570-069

SOURCE: Charlie's Holdings, Inc.

View the original press release on ACCESS Newswire

O.Karlsson--AMWN