-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

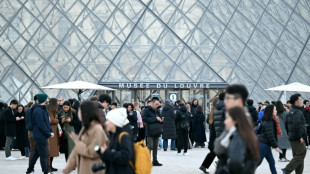

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

Bondi Beach gunmen had possible Islamic State links, says ABC

-

Lakers fend off Suns fightback, Hawks edge Sixers

-

Louvre trade unions to launch rolling strike

Louvre trade unions to launch rolling strike

-

Far-right Kast wins Chile election landslide

-

Asian markets drop with Wall St as tech fears revive

Asian markets drop with Wall St as tech fears revive

-

North Korean leader's sister sports Chinese foldable phone

-

Iran's women bikers take the road despite legal, social obstacles

Iran's women bikers take the road despite legal, social obstacles

-

Civilians venture home after militia seizes DR Congo town

-

Countdown to disclosure: Epstein deadline tests US transparency

Countdown to disclosure: Epstein deadline tests US transparency

-

Desperate England looking for Ashes miracle in Adelaide

-

Far-right Kast wins Chile election in landslide

Far-right Kast wins Chile election in landslide

-

What we know about Australia's Bondi Beach attack

-

Witnesses tell of courage, panic in wake of Bondi Beach shootings

Witnesses tell of courage, panic in wake of Bondi Beach shootings

-

Chiefs out of playoffs after decade as Mahomes hurts knee

-

Chilean hard right victory stirs memories of dictatorship

Chilean hard right victory stirs memories of dictatorship

-

Volunteers patrol Thai villages as artillery rains at Cambodia border

Liberty Tax(R) Offering Free Consultations to Help Taxpayers Navigate OBBBA Changes Ahead of an Expected Record Refund Season

With an expected historic refund season on the horizon, new law brings major shifts to credits, deductions, and planning for families and small businesses.

HURST, TX / ACCESS Newswire / December 15, 2025 / With the newly passed OBBBA ushering in some of the most significant tax changes in years, Liberty Tax® is stepping up to ensure local taxpayers don't miss out on valuable new savings. The company is offering free OBBBA Tax Impact Consultations, designed to help families, workers, and small business owners understand, and maximize the law's many new deductions and credits.

"The OBBBA represents one of the largest updates to the tax code in over a decade," said Scott Terrell, CEO of Liberty Tax. "These new rules can be confusing, but our offices are staffed with local experts who understand exactly how these changes affect real families and small businesses."

What the OBBBA Means for Taxpayers

The new federal law includes a powerful mix of permanent tax cuts and temporary money-saving opportunities:

Individual Tax Rates & Standard Deduction

The current rate brackets (10%, 12%, 22%, 24%, 32%, 35%, and 37%) are made permanent, along with the nearly doubled standard deduction that many taxpayers have used in recent years.Child Tax Credit

A boosted $2,200 Child Tax Credit per qualifying child, with future inflation adjustments beginning in 2026.New Temporary Deductions (through 2028) - even for many non-itemizers

Up to $25,000 for certain "qualified" tip income

Up to $12,500 for "qualified" overtime pay (up to $25,000 for joint filers)

Up to $10,000 of interest on new auto loans for U.S.-assembled vehicles

An additional deduction of up to $6,000 for seniors age 65 and older

State and Local Tax (SALT) Deduction

This is especially important for taxpayers in higher-tax areas or with significant property taxes. The SALT deduction cap is temporarily raised to $40,000 (from $10,000) through 2029, with a small annual increase, before it is scheduled to drop back to $10,000 in 2030.Small Business & Self-Employed Expensing

The OBBBA makes key business provisions permanent, including 100% bonus depreciation for qualifying equipment and immediate expensing of domestic research and development (R&D) costs-changes that can significantly affect cash flow and tax planning for small businesses.Clean Energy & Other Credits

Many clean energy tax credits from the Inflation Reduction Act, including credits for some electric vehicles and residential clean energy systems, are being repealed or phased out, potentially changing the value of certain purchases going forward."Trump Accounts" for Minors

The law creates a new type of tax-advantaged savings account for children, sometimes referred to as "Trump Accounts," with a potential one-time $1,000 government contribution for eligible children born between 2025 and 2028.

"The OBBBA impacts every household differently," said Scott Terrell. "That's why sitting down with a Liberty Tax expert for a one-on-one review is essential."

A potential Record-Breaking Refund Season Ahead

Financial analysts, economist and federal reports point to a massive surge in tax refunds for 2026, driven by no inflation adjustments to withholdings tables, expanded credits, and many changes to the tax code. As highlighted by the House Ways and Means Committee:

"2026 tax refunds projected to be largest ever" and tax filers could see refunds averaging roughly $1,000 higher than last year... setting the stage for a potentially record-breaking refund season.**

Free OBBBA Tax Impact Consultations: Your Personalized Savings Snapshot

To support local taxpayers, Liberty Tax is offering a complimentary consultation focused specifically on the OBBBA. During this session, our tax professionals will:

Review your 2024 tax situation and how it may change for the 2025 filing season

Identify which new deductions or credits you may qualify for under the OBBBA

Discuss how the changes may affect your refund, balance due, or estimated taxes

Help small business owners understand new expensing and planning opportunities

Outline next steps and documents to gather before filing your return

Consultations are available by appointment and, in many locations, on a walk-in basis. For more information or to book an appointment, contact Liberty Tax at (866) 871-1040 or visit www.LibertyTax.com. Tax filers who choose to partner with Liberty Tax will receive 5-star customer service along with year-round support and our accuracy guarantee.

About Liberty Tax

At Liberty Tax, our clients are looking for someone they can trust, a price they can afford, and to either owe less on taxes or get their largest possible refund. Our 12,000+ tax professionals across the United States offer free tax consultations, in-office and remote tax prep, and a variety of other services. Our offices average a 4.5-star rating on Google and 87% of all our reviews are positive. We're committed to building long-term relationships and establishing ourselves as trusted tax experts for life. See why our customers choose us at: www.libertytax.com

The information provided herein is for general informational purposes only and it is not intended as legal, financial, or tax advice. Liberty Tax® and its franchisees are not responsible for any changes in tax law or individual eligibility for deductions or credits. Consult your Liberty Tax professional for guidance specific to your unique tax circumstances.

Contact Information

Marketing Team

Marketing Manager

[email protected]

866.871.1040

SOURCE: Liberty Tax

View the original press release on ACCESS Newswire

D.Cunningha--AMWN