-

Telefonica to shed around 5,500 jobs in Spain

Telefonica to shed around 5,500 jobs in Spain

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Noel takes narrow lead after Alta Badia slalom first run

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

Swiss court to hear landmark climate case against cement giant

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

Pets, pedis and peppermints: When the diva is a donkey

-

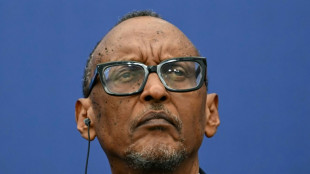

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

AI resurrections of dead celebrities amuse and rankle

-

NESR Becomes First Oilfield Services Company to Commission Original Artwork Created from Recycled Produced Water

-

SMX Strikes Joint Initiative with FinGo & Bougainville Refinery Ltd to Deliver Verifiable Identification for Trillion Dollar Gold Market

SMX Strikes Joint Initiative with FinGo & Bougainville Refinery Ltd to Deliver Verifiable Identification for Trillion Dollar Gold Market

-

Blue Gold and Trust Stamp Execute Strategic LOI to Develop Biometric, Passwordless Wallet Infrastructure for Gold-Backed Digital Assets

-

SK tes Announces Grand Opening of New Shannon Facility, Marking a Milestone for Sustainable Technology in Ireland

SK tes Announces Grand Opening of New Shannon Facility, Marking a Milestone for Sustainable Technology in Ireland

-

FDA Officially Confirms Kava is a Food Under Federal Law

-

Greenliant NVMe NANDrive(TM) SSDs Selected for Major Industrial, Aerospace and Mission Critical Programs

Greenliant NVMe NANDrive(TM) SSDs Selected for Major Industrial, Aerospace and Mission Critical Programs

-

World Renowned Law Firm Grant & Eisenhofer Files Class Action Lawsuit Against Canadian Banks CIBC and RBC Alleging Illegal Stock Market Manipulation of Quantum BioPharma Shares

-

NextTrip Announces Pricing of Private Placement Financing of $3 Million

NextTrip Announces Pricing of Private Placement Financing of $3 Million

-

Namibia Critical Metals Inc. Receives Proceeds of $1,154,762 from Exercise of Warrants

-

Shareholders Updates

Shareholders Updates

-

Applied Energetics Selected to Participate in Missile Defense Agency's Golden Dome (SHIELD) Multiple Award IDIQ Contract Vehicle

-

Prospect Ridge Updates Diamond Drill Program at 100% Owned Camelot Copper-Gold Project in B.C.'S Cariboo Mining District

Prospect Ridge Updates Diamond Drill Program at 100% Owned Camelot Copper-Gold Project in B.C.'S Cariboo Mining District

-

The Alkaline Water Company Receives SEC Qualification of Tier 1 Regulation A Offering of Up to $10 Million

-

Public Can Help Rid Oceans of Mines in New Freelancer Global Challenge

Public Can Help Rid Oceans of Mines in New Freelancer Global Challenge

-

Shareholders Update Report

Switching Payroll Providers Won't Fix Past IRS Errors - Clear Start Tax Warns Business Owners About Lingering Liability

Tax professionals say changing payroll services may stop future mistakes, but it does not erase unpaid taxes or filing errors already on record with the IRS.

IRVINE, CA / ACCESS Newswire / December 22, 2025 / Business owners facing payroll tax issues often assume that switching payroll providers will resolve ongoing problems with the IRS. However, tax resolution specialists caution that while a new provider may help prevent future errors, it does not eliminate past payroll tax liabilities or correct filings that have already been submitted.

According to Clear Start Tax, payroll taxes are ultimately the responsibility of the employer, not the payroll company. When mistakes occur - such as underpaid withholding, late deposits, or missed filings - the IRS continues to hold the business accountable, even if those errors were caused by a previous provider.

"Changing payroll companies is a smart operational move, but it's not a reset button," said a spokesperson for Clear Start Tax. "The IRS looks at the employer as responsible for everything that's already been reported or missed."

Clear Start Tax notes that unresolved payroll tax issues can linger for years, often surfacing unexpectedly through IRS notices, penalty assessments, or enforcement actions. In some cases, business owners are surprised to learn that balances continued to grow long after the payroll provider relationship ended.

"Payroll tax problems don't disappear just because the system changes," the spokesperson said. "If the IRS sees missing deposits or incorrect filings, it will pursue the business until those issues are addressed."

Tax professionals say early intervention is critical. Ignoring notices or assuming a new provider has corrected past errors can lead to escalating penalties, interest, and potential collection activity.

"Business owners should treat payroll tax notices as urgent," the Clear Start Tax spokesperson added. "Addressing past issues head-on is often far less costly than waiting for enforcement to intensify."

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

About Clear Start Tax

Clear Start Tax is a national tax resolution firm that assists businesses and individuals with IRS matters, including payroll tax issues, back taxes, and compliance challenges. The firm provides education-focused guidance and tailored solutions designed to help taxpayers resolve problems and move forward with confidence.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

F.Pedersen--AMWN