-

Giannis triumphant in NBA return as Spurs win streak ends

Giannis triumphant in NBA return as Spurs win streak ends

-

How company bets on bitcoin can backfire

-

Touadera on path to third presidential term as Central African Republic votes

Touadera on path to third presidential term as Central African Republic votes

-

'Acoustic hazard': Noise complaints spark Vietnam pickleball wars

-

Iraqis cover soil with clay to curb sandstorms

Iraqis cover soil with clay to curb sandstorms

-

Australia's Head backs struggling opening partner Weatherald

-

'Make emitters responsible': Thailand's clean air activists

'Make emitters responsible': Thailand's clean air activists

-

Zelensky looks to close out Ukraine peace deal at Trump meet

-

MCG curator in 'state of shock' after Ashes Test carnage

MCG curator in 'state of shock' after Ashes Test carnage

-

Texans edge Chargers to reach NFL playoffs

-

Osimhen and Mane score as Nigeria win to qualify, Senegal draw

Osimhen and Mane score as Nigeria win to qualify, Senegal draw

-

Osimhen stars as Nigeria survive Tunisia rally to reach second round

-

How Myanmar's junta-run vote works, and why it might not

How Myanmar's junta-run vote works, and why it might not

-

Watkins wants to sicken Arsenal-supporting family

-

Arsenal hold off surging Man City, Villa as Wirtz ends drought

Arsenal hold off surging Man City, Villa as Wirtz ends drought

-

Late penalty miss denies Uganda AFCON win against Tanzania

-

Watkins stretches Villa's winning streak at Chelsea

Watkins stretches Villa's winning streak at Chelsea

-

Zelensky stops in Canada en route to US as Russia pummels Ukraine

-

Arteta salutes injury-hit Arsenal's survival spirit

Arteta salutes injury-hit Arsenal's survival spirit

-

Wirtz scores first Liverpool goal as Anfield remembers Jota

-

Mane rescues AFCON draw for Senegal against DR Congo

Mane rescues AFCON draw for Senegal against DR Congo

-

Arsenal hold off surging Man City, Wirtz breaks Liverpool duck

-

Arsenal ignore injury woes to retain top spot with win over Brighton

Arsenal ignore injury woes to retain top spot with win over Brighton

-

Sealed with a kiss: Guardiola revels in Cherki starring role

-

UK launches paid military gap-year scheme amid recruitment struggles

UK launches paid military gap-year scheme amid recruitment struggles

-

Jota's children join tributes as Liverpool, Wolves pay respects

-

'Tired' Inoue beats Picasso by unanimous decision to end gruelling year

'Tired' Inoue beats Picasso by unanimous decision to end gruelling year

-

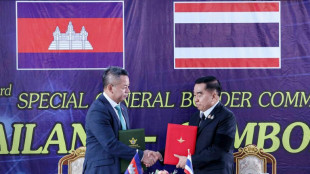

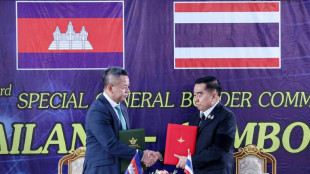

Thailand and Cambodia declare truce after weeks of clashes

-

Netanyahu to meet Trump in US on Monday

Netanyahu to meet Trump in US on Monday

-

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

-

Cherki stars in Man City win at Forest

Cherki stars in Man City win at Forest

-

Schwarz records maiden super-G success, Odermatt fourth

-

Russia pummels Kyiv ahead of Zelensky's US visit

Russia pummels Kyiv ahead of Zelensky's US visit

-

Smith laments lack of runs after first Ashes home Test loss for 15 years

-

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

-

Stokes, Smith agree two-day Tests not a good look after MCG carnage

-

Stokes hails under-fire England's courage in 'really special' Test win

Stokes hails under-fire England's courage in 'really special' Test win

-

What they said as England win 4th Ashes Test - reaction

-

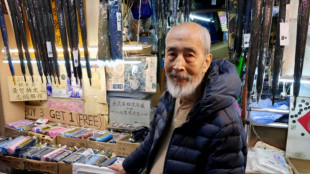

Hong Kongers bid farewell to 'king of umbrellas'

Hong Kongers bid farewell to 'king of umbrellas'

-

England snap 15-year losing streak to win chaotic 4th Ashes Test

-

Thailand and Cambodia agree to 'immediate' ceasefire

Thailand and Cambodia agree to 'immediate' ceasefire

-

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

-

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

-

Somalia, African nations denounce Israeli recognition of Somaliland

-

England need 175 to win chaotic 4th Ashes Test

England need 175 to win chaotic 4th Ashes Test

-

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

-

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

-

Six Australia wickets fall as England fight back in 4th Ashes Test

-

New to The Street Show #710 Airs Tonight at 6:30 PM EST on Bloomberg Television

New to The Street Show #710 Airs Tonight at 6:30 PM EST on Bloomberg Television

-

Dental Implant Financing and Insurance Options in Georgetown, TX

How company bets on bitcoin can backfire

The year-end plunge in cryptocurrencies has rattled companies that had bet heavily on bitcoin, sending share prices tumbling and reviving fears of a bubble.

Below AFP explains what happens to these bitcoin-buying firms when prices drop.

- Why accumulate bitcoin? -

Bitcoin surged this year, reaching a record above $126,000 in October.

Companies began buying and holding bitcoin to diversify their cash reserves, protect against inflation or attract investors chasing high returns.

Some were already linked to the cryptocurrency, such as exchanges or "mining" firms that use powerful computers to earn bitcoins as rewards.

Others from unrelated industries also started buying in, boosting demand and driving its price even higher.

- Why is buying risky? -

Many companies borrowed money to buy bitcoin, betting that its price would keep rising.

Some relied on convertible bonds, which offer lower interest rates while giving lenders the option to be repaid in shares instead of cash.

But problems can emerge if a company's share price falls -- for example, if a drop in the bitcoin price makes its business model less appealing.

Investors may then demand cash repayment, leaving the company scrambling for liquidity.

- What happens when bitcoin drops? -

Trouble surfaced after the summer when bitcoin began falling, eventually dropping below $90,000 in November, undermining confidence in companies heavily exposed to it.

"The market quickly started to ask: 'Are these companies going to run into trouble? Could they go bankrupt?'" said Eric Benoist, a tech and data expert at Natixis bank.

Carol Alexander, a finance professor at the University of Sussex, told AFP that regulatory uncertainty, cyberattacks and fraud risks are also deepening investor mistrust.

- What happened to Strategy ? -

Software company Strategy is the largest corporate holder of bitcoin, owning more than 671,000 coins, or about three percent of all the bitcoin that will ever exist.

Over six months, however, its share price more than halved, and its market value briefly dropped below the total value of its bitcoin holdings.

Pressure stemmed largely from its heavy use of convertible bonds, exposing it to the risk of repaying large amounts of debt in cash.

To reassure investors, Strategy issued new shares to create a $1.44 billion reserve to fund dividend and interest rate payments.

Semiconductor firm Sequans took a different route, selling 970 bitcoins to pay down part of its convertible debt.

Strategy and Sequans did not respond to AFP requests for comment.

- Could problems spread? -

If struggling companies sell large amounts of bitcoin, prices could fall further, worsening losses.

"The contagion risk in crypto markets is pretty considerable," Alexander said.

She added, however, that the impact would likely be confined to the crypto sector, with no major risk to traditional markets.

"Bitcoin is inherently volatile in both directions, and we view that volatility as the cost of long-term upside," Dylan LeClair, head of bitcoin strategy at Japan's Metaplanet, told AFP.

Originally a hotel company, Metaplanet now holds around $2.7 billion worth of bitcoin.

- What's the sector's future? -

According to Benoist, companies will need to generate income from their bitcoin holdings -- such as through financial products -- rather than relying solely on rising prices.

"Not all of them will survive," but "the model will continue to exist," he said.

New initiatives are emerging such as French entrepreneur Eric Larcheveque's crypto treasury firm, The Bitcoin Society.

He told AFP that falling prices are "a good opportunity because it allows you to buy more bitcoin cheaply."

D.Kaufman--AMWN