-

Barca rout Athletic to reach Spanish Super Cup final

Barca rout Athletic to reach Spanish Super Cup final

-

Trump plots offer to buy Greenland as NATO ally Denmark seethes

-

What are the US charges against Venezuela's Maduro?

What are the US charges against Venezuela's Maduro?

-

Syria govt demands Kurdish fighters leave Aleppo neighbourhoods

-

Napoli scrape draw with lowly Verona as leaders Inter look to capitalise

Napoli scrape draw with lowly Verona as leaders Inter look to capitalise

-

US lays out plan for marketing Venezuelan oil after Maduro ouster

-

'One Battle After Another' leads SAG's Actor Awards noms with seven

'One Battle After Another' leads SAG's Actor Awards noms with seven

-

Saudi strikes Yemen after separatist leader skips talks

-

Rosenior vows to make fast start as Chelsea boss

Rosenior vows to make fast start as Chelsea boss

-

3,000 tourists evacuated as Argentine Patagonia battles wildfires

-

US oil giant Chevron interested in Russian Lukoil's foreign assets: report

US oil giant Chevron interested in Russian Lukoil's foreign assets: report

-

England great Keegan diagnosed with cancer

-

Arraignment postponed for Rob Reiner's son over parents' murder

Arraignment postponed for Rob Reiner's son over parents' murder

-

Yes to red meat, no to sugar: Trump's new health guidelines

-

Trump plots to buy Greenland as NATO ally Denmark seethes

Trump plots to buy Greenland as NATO ally Denmark seethes

-

US seizes Russia-linked oil tanker chased to North Atlantic

-

Venezuela's decisions to be 'dictated' by US, White House says

Venezuela's decisions to be 'dictated' by US, White House says

-

Vinicius will bounce back from 'blank spell': Real Madrid's Bellingham

-

Accused scam boss Chen Zhi arrested in Cambodia, extradited to China: Phnom Penh

Accused scam boss Chen Zhi arrested in Cambodia, extradited to China: Phnom Penh

-

Pakistan cruise past Sri Lanka in T20I opener

-

Mourners pay tribute to Brigitte Bardot at Saint-Tropez funeral

Mourners pay tribute to Brigitte Bardot at Saint-Tropez funeral

-

Oil sinks as US ups pressure on Venezuela over crude supplies

-

Frenchwoman accused of libel over Nazi 'collaborator' family novel

Frenchwoman accused of libel over Nazi 'collaborator' family novel

-

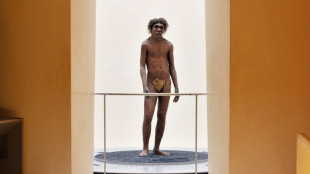

Fossils discovered in Morocco shed light on our African roots

-

Arsenal must win trophies to leave 'legacy' - Arteta

Arsenal must win trophies to leave 'legacy' - Arteta

-

Brazil's Bolsonaro back to hospital after prison fall

-

AI helps pave the way for self-driving cars

AI helps pave the way for self-driving cars

-

Strasbourg offer too good to turn down, says O'Neil

-

US should topple Chechen leader after Maduro, Zelensky says

US should topple Chechen leader after Maduro, Zelensky says

-

Dogsleds, China and independence: Facts on Greenland

-

Atletico back struggling Alvarez ahead of Real Super Cup semi

Atletico back struggling Alvarez ahead of Real Super Cup semi

-

US seizes Russia-flagged oil tanker chased to North Atlantic

-

Arsenal boss Arteta 'sad' to see Amorim sacked by Man Utd

Arsenal boss Arteta 'sad' to see Amorim sacked by Man Utd

-

France halts imports of food with traces of banned pesticides

-

Europe faces transport chaos as cold snap toll rises

Europe faces transport chaos as cold snap toll rises

-

US private sector hiring rebounds in December but misses expectations

-

Giro d'Italia champion Yates announces shock retirement

Giro d'Italia champion Yates announces shock retirement

-

US attempts to seize Russia-flagged oil tanker in Atlantic

-

Warner Bros rejects updated Paramount takeover bid, backs Netflix deal

Warner Bros rejects updated Paramount takeover bid, backs Netflix deal

-

Brigitte Bardot buried in Saint-Tropez as cause of death revealed

-

'I don't': AI wedding vows fall foul of Dutch law

'I don't': AI wedding vows fall foul of Dutch law

-

German emissions cuts slow, North Sea has warmest year on record

-

France's Lucu a doubt for Six Nations opener

France's Lucu a doubt for Six Nations opener

-

Could Trump's desire for Greenland blow up NATO?

-

Reigning champion Al-Rajhi abandons Dakar Rally

Reigning champion Al-Rajhi abandons Dakar Rally

-

UN accuses Israel of West Bank 'apartheid'

-

US, Ukraine teams tackle 'most difficult issues' in Russia war talks: Zelensky

US, Ukraine teams tackle 'most difficult issues' in Russia war talks: Zelensky

-

Trump says Venezuela to hand over oil stocks worth billions

-

Slot says Liverpool can still do 'special things' ahead of Arsenal clash

Slot says Liverpool can still do 'special things' ahead of Arsenal clash

-

Brigitte Bardot to be buried in Saint-Tropez as cause of death revealed

Kensington's KHPI ETF Surpasses $250 Million in Assets

Milestone Highlights Advisor Demand for Risk-Aware Income Strategies

AUSTIN, TEXAS / ACCESS Newswire / January 6, 2026 / Kensington Asset Management, LLC ("Kensington") announced that the Kensington Hedged Premium Income ETF (Ticker:KHPI) has surpassed $250 million in Assets Under Management (AUM) as of 12/18/2025. The milestone represents a meaningful level of scale for the actively managed ETF following its launch in September 2024 and reflects continued advisor adoption across platforms.

KHPI was designed to address demand for income-oriented strategies with an explicit focus on risk management. The fund seeks to generate income through a disciplined option overlay while maintaining an approach intended to help manage downside risk during periods of market volatility. Since launch, KHPI has expanded across national Broker-Dealer platforms, model portfolios, and Turnkey Asset Management Platforms ("TAMPs").

"KHPI's growth reflects strong alignment between the fund's design and the needs we hear from advisors," said Brian Weisenberger, Chief Market Strategist of Kensington Asset Management. "Advisors are incorporating the strategy into portfolios where income consistency and risk awareness are important considerations."

"Reaching $250 million in assets represents a meaningful level of scale in the ETF market, where many strategies face challenges building sustainable adoption," said Mano Fanopoulos, Managing Partner of Kensington Asset Management. "KHPI's role as a differentiated income solution with embedded hedging has become increasingly relevant as markets remain unpredictable."

The milestone underscores Kensington's continued focus on developing risk-aware, outcome-oriented investment strategies and supporting financial professionals with tools designed for evolving market conditions.

About Kensington Asset Management: Kensington Asset Management, advisor to the Kensington Hedged Premium Income ETF (KHPI) specializes in active systematic strategies, built to navigate market volatility by providing innovative pathways to upside participation with a downside hedge.

About Liquid Strategies: Liquid Strategies, sub-advisor to the Kensington Hedged Premium Income ETF (KHPI) focuses on managing dynamic investment strategies designed to help investors achieve their investment goals with innovative investment solutions. In addition to KHPI, the Sub-Advisor manages a series of Strategies and Exchange Traded Funds ("ETFs") under the name Overlay Shares.

For more information about KHPI, please visit Kensington Hedged Premium Income ETF.

Investors should consider the investment objectives, risks, charges and expenses of the Kensington Hedged Premium Income ETF (KHPI) before investing. The Fund's prospectus and summary prospectus contain this and other information about the Fund may be obtained by calling 1(866) 303-8623 / visiting www.kensingtonassetmanagement.com, which should be read carefully. There is no guarantee the Fund will achieve its investment objectives. Please read carefully. There is no guarantee any investment strategy will generate a profit or prevent a loss.

The Kensington Hedged Premium Income ETF ("KHPI"), prospectus available here. Investing in the Funds involves risk, including loss of principal. Risks specific to the KHPI are detailed in the prospectus.

Future distributions are not guaranteed, and distributions may include option income, dividends, and possibly some return of capital.

Past performance does not guarantee future results. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end please call (866) 303-8623 or visit our website, available here.

Options Risk: An option gives the holder the right, but not the obligation, to buy (call) or sell (put) an asset at a specified price. Options are speculative. The Fund may lose the premium paid if the underlying asset's price doesn't move favorably. Writing put options risks declines in the asset's value, while writing call options may require delivering the asset below market price. Uncovered call options carry the risk of unlimited loss.

Advisory services offered through Kensington Asset Management, LLC.

Quasar Distributors, LLC, Distributor, Member FINRA/SIPC not affiliated with Kensington Asset Management, LLC or Liquid Strategies, LLC.

KAML-854541-2025-12-16

SOURCE: Kensington Asset Management, LLC

View the original press release on ACCESS Newswire

H.E.Young--AMWN