-

Sesko double not enough as Man Utd stumble at Burnley

Sesko double not enough as Man Utd stumble at Burnley

-

Semenyo stuns Spurs to leave Frank under fire

-

Inter extend Serie A lead at Parma after Napoli slip

Inter extend Serie A lead at Parma after Napoli slip

-

US stocks retreat from records as oil falls further

-

City stumble again in title race as Villa held

City stumble again in title race as Villa held

-

Man City title bid damaged by Brighton draw despite Haaland's 150th goal

-

France's Noel wins World Cup slalom at Madonna di Campiglio

France's Noel wins World Cup slalom at Madonna di Campiglio

-

US immigration officer fatally shoots woman in Minneapolis

-

Barca rout Athletic to reach Spanish Super Cup final

Barca rout Athletic to reach Spanish Super Cup final

-

Trump plots offer to buy Greenland as NATO ally Denmark seethes

-

What are the US charges against Venezuela's Maduro?

What are the US charges against Venezuela's Maduro?

-

Syria govt demands Kurdish fighters leave Aleppo neighbourhoods

-

Napoli scrape draw with lowly Verona as leaders Inter look to capitalise

Napoli scrape draw with lowly Verona as leaders Inter look to capitalise

-

US lays out plan for marketing Venezuelan oil after Maduro ouster

-

'One Battle After Another' leads SAG's Actor Awards noms with seven

'One Battle After Another' leads SAG's Actor Awards noms with seven

-

Saudi strikes Yemen after separatist leader skips talks

-

Rosenior vows to make fast start as Chelsea boss

Rosenior vows to make fast start as Chelsea boss

-

3,000 tourists evacuated as Argentine Patagonia battles wildfires

-

US oil giant Chevron interested in Russian Lukoil's foreign assets: report

US oil giant Chevron interested in Russian Lukoil's foreign assets: report

-

England great Keegan diagnosed with cancer

-

Arraignment postponed for Rob Reiner's son over parents' murder

Arraignment postponed for Rob Reiner's son over parents' murder

-

Yes to red meat, no to sugar: Trump's new health guidelines

-

Trump plots to buy Greenland as NATO ally Denmark seethes

Trump plots to buy Greenland as NATO ally Denmark seethes

-

US seizes Russia-linked oil tanker chased to North Atlantic

-

Venezuela's decisions to be 'dictated' by US, White House says

Venezuela's decisions to be 'dictated' by US, White House says

-

Vinicius will bounce back from 'blank spell': Real Madrid's Bellingham

-

Accused scam boss Chen Zhi arrested in Cambodia, extradited to China: Phnom Penh

Accused scam boss Chen Zhi arrested in Cambodia, extradited to China: Phnom Penh

-

Pakistan cruise past Sri Lanka in T20I opener

-

Mourners pay tribute to Brigitte Bardot at Saint-Tropez funeral

Mourners pay tribute to Brigitte Bardot at Saint-Tropez funeral

-

Oil sinks as US ups pressure on Venezuela over crude supplies

-

Frenchwoman accused of libel over Nazi 'collaborator' family novel

Frenchwoman accused of libel over Nazi 'collaborator' family novel

-

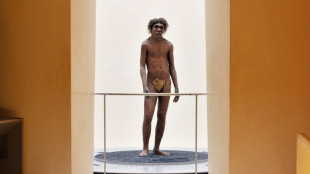

Fossils discovered in Morocco shed light on our African roots

-

Arsenal must win trophies to leave 'legacy' - Arteta

Arsenal must win trophies to leave 'legacy' - Arteta

-

Brazil's Bolsonaro back to hospital after prison fall

-

AI helps pave the way for self-driving cars

AI helps pave the way for self-driving cars

-

Strasbourg offer too good to turn down, says O'Neil

-

US should topple Chechen leader after Maduro, Zelensky says

US should topple Chechen leader after Maduro, Zelensky says

-

Dogsleds, China and independence: Facts on Greenland

-

Atletico back struggling Alvarez ahead of Real Super Cup semi

Atletico back struggling Alvarez ahead of Real Super Cup semi

-

US seizes Russia-flagged oil tanker chased to North Atlantic

-

Arsenal boss Arteta 'sad' to see Amorim sacked by Man Utd

Arsenal boss Arteta 'sad' to see Amorim sacked by Man Utd

-

France halts imports of food with traces of banned pesticides

-

Europe faces transport chaos as cold snap toll rises

Europe faces transport chaos as cold snap toll rises

-

US private sector hiring rebounds in December but misses expectations

-

Giro d'Italia champion Yates announces shock retirement

Giro d'Italia champion Yates announces shock retirement

-

US attempts to seize Russia-flagged oil tanker in Atlantic

-

Warner Bros rejects updated Paramount takeover bid, backs Netflix deal

Warner Bros rejects updated Paramount takeover bid, backs Netflix deal

-

Brigitte Bardot buried in Saint-Tropez as cause of death revealed

-

'I don't': AI wedding vows fall foul of Dutch law

'I don't': AI wedding vows fall foul of Dutch law

-

German emissions cuts slow, North Sea has warmest year on record

Equities extend record run, oil eases

Global stock markets advanced on Tuesday to fresh record highs while oil prices eased as investors tracked developments surrounding crude-rich Venezuela as well as the outlook for the global economy.

Brushing off geopolitical concerns triggered by the surprise US raid Saturday on Caracas that saw Venezuelan president Nicolas Maduro and his wife taken to New York, some major stock markets have begun the new year with all-time highs, having already smashed records in 2025.

Seoul rose more than one percent Tuesday to top 4,500 points for the first time, helped by another strong rally in chip giant SK hynix.

That came after the Dow ended at a record high Monday on Wall Street, boosted by a rally of technology titans Amazon and Meta.

London's benchmark FTSE 100 index reached a new high Tuesday above 10,000 points, with investors expecting more cuts to British interest rates to bolster growth in 2026.

"Yesterday it was the Dow Jones and Dax at record highs, and today the FTSE 100 has joined the party, barely a week after its last record high," said IG trading platform analyst Chris Beauchamp.

He said investors don't appear to be fazed by tensions within the Western alliance following the US raid or about high stock valuations.

"Global equities are likely to keep looking through the geopolitical shock unless it threatens the broader supply chain or tightens financial conditions, because geopolitics has become a persistent feature rather than a surprise," said Charu Chanana, chief investment strategist at Saxo Markets.

"Equities can continue grinding higher if earnings expectations, liquidity, and rate expectations remain supportive, especially in tech," she added.

Shares in Nvidia rose more than one percent at the start of trading after the world's most valuable company unveiled its latest AI platform the previous evening, although they later gave up much of those gains.

Wall Street's main stock indices continued to push higher, with the Dow falling just short of setting a fresh all-time high.

Traders are awaiting key US jobs data due Friday for clues on the outlook for interest rates.

The Federal Reserve is expected to keep cutting American borrowing costs this year, but how many times remains unclear.

Oil prices pulled lower after having spent much of Tuesday higher.

Oil prices have experienced choppy trading since Saturday's US raid.

While Venezuela sits on about a fifth of the world's oil reserves, observers pointed out that a quick ramp-up of output would be hamstrung by several issues including its creaking infrastructure, low prices and political uncertainty.

"With the country pumping less than one percent of the world's oil after years of underinvestment, any major near-term disruption looks more bark than bite," Matt Britzman, senior equity analyst at Hargreaves Lansdown, said Tuesday.

- Key figures at around 1630 GMT -

Brent North Sea Crude: DOWN 0.3 percent at $61.56 per barrel

West Texas Intermediate: DOWN 0.5 percent at $58.04 per barrel

New York - Dow: UP 0.5 percent at 49,212.28 points

New York - S&P 500: UP 0.2 percent at 6,915.88

New York - Nasdaq Composite: UP 0.1 percent at 23,424.98

London - FTSE 100: UP 1.2 percent at 10,122.73 (close)

Paris - CAC 40: UP 0.3 percent at 8,237.43 (close)

Frankfurt - DAX: UP less than 0.1 percent at 24,892.20 (close)

Tokyo - Nikkei 225: UP 1.3 percent at 52,518.08 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 26,710.45 (close)

Shanghai - Composite: UP 1.5 percent at 4,083.67 (close)

Euro/dollar: DOWN at $1.1688 from $1.1714 on Monday

Pound/dollar: DOWN at $1.3498 from $1.3525

Dollar/yen: UP at 156.71 yen from 156.31 yen

Euro/pound: UP at 86.59 pence from 86.57 pence

burs-rl/cw

Y.Kobayashi--AMWN