-

Scientists reveal what drives homosexual behaviour in primates

Scientists reveal what drives homosexual behaviour in primates

-

Venezuela releases more political prisoners as pressure builds

-

15,000 NY nurses stage largest-ever strike over conditions

15,000 NY nurses stage largest-ever strike over conditions

-

Rosenior plots long Chelsea stay as Arsenal loom

-

Zuckerberg names banker, ex-Trump advisor as Meta president

Zuckerberg names banker, ex-Trump advisor as Meta president

-

Reza Pahlavi: Iran's ex-crown prince dreaming of homecoming

-

Venezuela releases more political prisoners

Venezuela releases more political prisoners

-

Kenya's NY marathon champ Albert Korir gets drug suspension

-

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

-

Russian captain in fiery North Sea crash faces UK trial

-

Carrick is frontrunner for interim Man Utd job: reports

Carrick is frontrunner for interim Man Utd job: reports

-

Iran government stages mass rallies as alarm grows over protest toll

-

Variawa leads South African charge over Dakar dunes

Variawa leads South African charge over Dakar dunes

-

Swiss inferno bar owner detained for three months

-

Heathrow airport sees record high annual passenger numbers

Heathrow airport sees record high annual passenger numbers

-

Georgia jails ex-PM for five years amid ruling party oustings

-

Kyiv buries medic killed in Russian drone strike

Kyiv buries medic killed in Russian drone strike

-

Israel revokes French researcher's travel permit

-

India and Germany seek to boost defence industry ties

India and Germany seek to boost defence industry ties

-

French coach and football pundit Rolland Courbis dies at 72

-

UK regulator opens probe into X over sexualised AI imagery

UK regulator opens probe into X over sexualised AI imagery

-

AFCON organisers investigate incidents after Algeria-Nigeria clash

-

US Fed chief warns of 'intimidation' after criminal subpoenas

US Fed chief warns of 'intimidation' after criminal subpoenas

-

Iran says 'prepared for war' as alarm grows over protest toll

-

India and Germany eye defence industry boost to ties

India and Germany eye defence industry boost to ties

-

'I know the pain': ex-refugee takes over as UNHCR chief

-

US prosecutors open criminal probe into Federal Reserve

US prosecutors open criminal probe into Federal Reserve

-

Rohingya 'targeted for destruction' by Myanmar, ICJ hears

-

'Genius' chimpanzee Ai dies in Japan at 49

'Genius' chimpanzee Ai dies in Japan at 49

-

Trump says US will take Greenland 'one way or the other'

-

Myanmar pro-military party claims Suu Kyi's seat in junta-run poll

Myanmar pro-military party claims Suu Kyi's seat in junta-run poll

-

Fed chair Powell says targeted by federal probe

-

Trailblazing Milos Raonic retires from tennis

Trailblazing Milos Raonic retires from tennis

-

Australia recalls parliament early to pass hate speech, gun laws

-

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

-

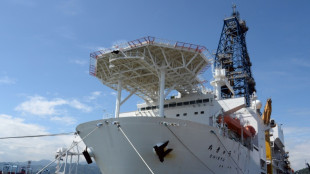

Japan aims to dig deep-sea rare earths to reduce China dependence

-

Top UN court to hear Rohingya genocide case against Myanmar

Top UN court to hear Rohingya genocide case against Myanmar

-

US sends more agents to Minneapolis despite furor over woman's killing

-

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

-

Bangladesh's powerful Islamists prepare for elections

-

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

-

Ukraine's Kostyuk defends 'conscious choice' to speak out about war

-

Trump says working well with Venezuela's new leaders, open to meeting

Trump says working well with Venezuela's new leaders, open to meeting

-

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

-

Hong Kong court hears sentencing arguments for Jimmy Lai

Hong Kong court hears sentencing arguments for Jimmy Lai

-

Powell says Federal Reserve subpoenaed by US Justice Department

-

Chalamet, 'One Battle' among winners at Golden Globes

Chalamet, 'One Battle' among winners at Golden Globes

-

Turning point? Canada's tumultuous relationship with China

-

Eagles stunned by depleted 49ers, Allen leads Bills fightback

Eagles stunned by depleted 49ers, Allen leads Bills fightback

-

Globes red carpet: chic black, naked dresses and a bit of politics

Taxpayers Are Misusing Payment Plans - Clear Start Tax Warns Why "Set It and Forget It" Can Lead to Default

Many IRS installment agreements fail not because of missed payments, but because taxpayers overlook ongoing compliance rules that can quietly trigger default and renewed collections.

IRVINE, CALIFORNIA / ACCESS Newswire / January 12, 2026 / As more taxpayers turn to IRS payment plans to manage back tax balances, tax resolution professionals are warning that a common misunderstanding is putting thousands at risk of default. Clear Start Tax, a national tax relief firm, says many people assume that once a payment plan is approved, their tax problems are effectively paused - a belief that can lead to serious consequences.

According to Clear Start Tax, IRS installment agreements require more than making monthly payments. Taxpayers must remain fully compliant with future filing and payment obligations, including filing returns on time and paying new taxes in full. Failure to do so can cause the IRS to terminate the agreement, often without much warning.

"Payment plans are not a 'set it and forget it' solution," said a Clear Start Tax spokesperson. "We regularly see taxpayers who are making every monthly payment, yet still default because they missed a filing deadline or underpaid current-year taxes."

When a payment plan defaults, the IRS can quickly resume collection activity, including levies, wage garnishments, and liens. In some cases, penalties and interest continue to grow during the agreement, increasing the overall balance even while payments are being made.

Clear Start Tax notes that self-employed individuals and taxpayers with variable income are especially vulnerable. Estimated tax payments, unexpected income changes, or simple administrative oversights can all trigger a default.

"Many people don't realize that a single missed return or unpaid balance from a new tax year can undo years of progress," the spokesperson added. "The IRS views compliance as ongoing, not conditional."

Tax professionals emphasize that payment plans can be an effective tool when used correctly, but they require active management. Regular reviews, proper withholding or estimated payments, and timely filings are critical to keeping agreements in good standing.

With IRS collection activity increasing, Clear Start Tax urges taxpayers currently on installment agreements to reassess their compliance status before problems escalate.

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

About Clear Start Tax

Clear Start Tax is a national tax resolution firm that helps individuals and businesses navigate IRS collection issues, including back taxes, penalties, and payment arrangements. The firm specializes in educating taxpayers on IRS procedures and guiding them through available relief options to achieve long-term financial stability.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

P.Costa--AMWN