-

Spurs sign England midfielder Gallagher from Atletico Madrid

Spurs sign England midfielder Gallagher from Atletico Madrid

-

Russian captain tried to avoid North Sea crash: court

-

Battle over Chinese-owned chipmaker Nexperia rages in Dutch court

Battle over Chinese-owned chipmaker Nexperia rages in Dutch court

-

Transatlantic ties 'disintegrating': German vice chancellor

-

Five problems facing Ukraine's new defence chief

Five problems facing Ukraine's new defence chief

-

Italian influencer Ferragni acquitted in Christmas cake fraud trial

-

Ryanair hits out at 'stupid' Belgium over aviation taxes

Ryanair hits out at 'stupid' Belgium over aviation taxes

-

Burkina Faso sack coach Traore after AFCON exit

-

African manufacturers welcome US trade deal, call to finalise it

African manufacturers welcome US trade deal, call to finalise it

-

What happens when fire ignites in space? 'A ball of flame'

-

Death of author's baby son puts Nigerian healthcare in spotlight

Death of author's baby son puts Nigerian healthcare in spotlight

-

France bans 10 British anti-migrant activists

-

2025 was third hottest year on record: climate monitors

2025 was third hottest year on record: climate monitors

-

Hydrogen planes 'more for the 22nd century': France's Safran

-

Julio Iglesias, the Spanish crooner who won global audience

Julio Iglesias, the Spanish crooner who won global audience

-

'We can't make ends meet': civil servants protest in Ankara

-

UK prosecutors appeal Kneecap rapper terror charge dismissal

UK prosecutors appeal Kneecap rapper terror charge dismissal

-

UK police chief blames AI for error in evidence over Maccabi fan ban

-

Oil prices extend gains on Iran unrest

Oil prices extend gains on Iran unrest

-

France bans 10 UK far-right activists over anti-migrant actions

-

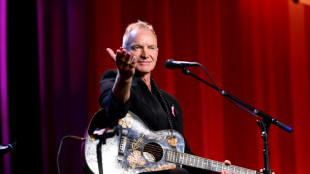

Every cent you take: Sting, ex-Police band mates in royalty battle

Every cent you take: Sting, ex-Police band mates in royalty battle

-

Thailand crane collapses onto train, killing 32

-

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

-

Italian influencer Ferragni awaits verdict in Christmas cake fraud trial

-

Louvre and other French museums fare hikes for non-European visitors

Louvre and other French museums fare hikes for non-European visitors

-

Japan's Takaichi to dissolve parliament for snap election

-

Dutch court hears battle over Nexperia

Dutch court hears battle over Nexperia

-

World-first ice archive to guard secrets of melting glaciers

-

Ted Huffman, the New Yorker aiming to update top French opera festival

Ted Huffman, the New Yorker aiming to update top French opera festival

-

Ofner celebrates early then loses in Australian Open qualifying

-

Singer Julio Iglesias accused of 'human trafficking' by former staff

Singer Julio Iglesias accused of 'human trafficking' by former staff

-

Luxury retailer Saks Global files for bankruptcy

-

Asian markets mostly up with politics bump for Tokyo

Asian markets mostly up with politics bump for Tokyo

-

China's trade surplus hit record $1.2 trillion in 2025

-

Trail goes cold in UK abandoned babies mystery

Trail goes cold in UK abandoned babies mystery

-

Japan's Takaichi set to call February snap election: media

-

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

-

From bricklayer to record-breaker: Brentford's Thiago eyes World Cup berth

-

Keys overcomes serve demons to win latest Australian Open warm-up

Keys overcomes serve demons to win latest Australian Open warm-up

-

As world burns, India's Amitav Ghosh writes for the future

-

Actor Kiefer Sutherland arrested for assaulting ride-share driver

Actor Kiefer Sutherland arrested for assaulting ride-share driver

-

Gilgeous-Alexander shines as Thunder halt Spurs losing streak

-

West Bank Bedouin community driven out by Israeli settler violence

West Bank Bedouin community driven out by Israeli settler violence

-

Asian markets mixed, Tokyo up on election speculation

-

US official says Venezuela freeing Americans in 'important step'

US official says Venezuela freeing Americans in 'important step'

-

2025 was third hottest year on record: EU, US experts

-

Japan, South Korea leaders drum up viral moment with K-pop jam

Japan, South Korea leaders drum up viral moment with K-pop jam

-

LA28 organizers promise 'affordable' Olympics tickets

-

Danish foreign minister heads to White House for high-stakes Greenland talks

Danish foreign minister heads to White House for high-stakes Greenland talks

-

US allows Nvidia to send advanced AI chips to China with restrictions

Pacific Avenue Capital Partners to Acquire U.S. Power Chain Hoist and Chain Business from Columbus McKinnon

LOS ANGELES, CA / ACCESS Newswire / January 14, 2026 / Pacific Avenue Capital Partners ("Pacific Avenue"), a Los Angeles-headquartered private equity firm focused on complex corporate carve-outs and other operationally intensive situations in the middle market, today announced that an affiliate has entered into an agreement to acquire Columbus McKinnon Corporation's ("Columbus McKinnon", NASDAQ:CMCO) U.S. based power chain hoist and chain business (the "Company"), including its international sales support functions.

The Company is a leading designer and manufacturer of electric, air, battery-powered, and manual chain hoists, trolleys, and related aftermarket parts and components. The transaction includes Columbus McKinnon's complete portfolio of U.S. based power chain hoist and chain products, as well as its related aftermarket parts and components. This includes a portfolio of highly regarded brands including Lodestar® and Lodestar ET™, Budgit®, Chester®, Coffing® (including the JLC and EC lines), Cyclone®, CM Puller®, Powerstar®, Prostar®, Valustar®, Shopstar®, ShopAir™, and the innovative BatteryStar®, with strong positions across industrial, construction, defense, and entertainment end markets. The power chain hoist and chain product platforms primarily serve customers through a broad distributor network across North America, as well as internationally.

The business operates a primary manufacturing and engineering facility in Damascus, Virginia and a vertically integrated chain manufacturing facility in Lexington, Tennessee. The Company also operates a leased training and production facility in Rock Lititz, Pennsylvania for its Lodestar® brand and entertainment customers. The Company's products are widely recognized for reliability, safety, and performance in mission-critical lifting applications.

As it transitions to a standalone business, the Company will operate with a renewed strategic and operational focus, prioritizing its employees and customers in the power chain hoist and chain market. With support from Pacific Avenue, the Company plans to increase investment in product innovation, supply chain resilience, and customer service.

"We are pleased to partner with Columbus McKinnon on this transaction," said Chris Sznewajs, Founder and Managing Partner of Pacific Avenue Capital Partners. "We aim to be the buyer of choice for corporate sellers, with the ability to complete complex carve-outs on an accelerated timetable and with minimal disruption. This business represents a collection of iconic brands with deep customer relationships, a large installed base, and a global customer set across critical end markets. We are proud to support Columbus McKinnon in executing a timely divestiture and look forward to investing behind product innovation, operational excellence, and customer service as the Company grows as a standalone enterprise."

"This product portfolio has a long heritage of reliably serving our loyal customers." said Spencer Darr, Chief Revenue Officer of Columbus McKinnon. "We believe Pacific Avenue's carve-out expertise and operational focus make them a strong partner for the business and our customers as we move forward as a standalone operation. We look forward to growing this business with the support of Pacific Avenue."

KeyBanc Capital Markets served as Pacific Avenue's M&A advisor and O'Melveny & Myers LLP as legal advisor.

The transaction is expected to close in the first quarter of 2026, subject to customary closing conditions, including receipt of required regulatory approvals.

About Pacific Avenue Capital Partners

Pacific Avenue Capital Partners is a global private equity firm, headquartered in Los Angeles with offices in Paris, France. The firm is focused on corporate divestitures and other complex situations in the middle market. Pacific Avenue has extensive M&A and operations experience, allowing the firm to navigate complex transactions and unlock value through operational improvement, capital investment, and accelerated growth. Pacific Avenue takes a collaborative approach in partnering with strong management teams to drive lasting and strategic change while assisting businesses in reaching their full potential. Pacific Avenue has approximately $3.8 billion of Assets Under Management (AUM) as of September 30, 2025. The members of the Pacific Avenue team have closed over 120 transactions, including over 50 corporate divestitures, across a multitude of industries throughout their combined careers. For more information, please visit https://pacificavenuecapital.com/.

About Columbus McKinnon

Columbus McKinnon Corporation (NASDAQ:CMCO) is a leading designer, manufacturer, and marketer of intelligent motion solutions for material handling. Through a portfolio of well-known brands, Columbus McKinnon helps customers improve efficiency, safety, and performance in demanding industrial and commercial applications worldwide. For more information, visit www.columbusmckinnon.com.

Contact Information

Chris Baddon

Managing Director

[email protected]

SOURCE: Pacific Avenue Capital Partners

View the original press release on ACCESS Newswire

A.Mahlangu--AMWN