-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

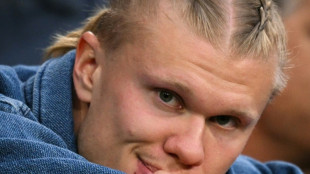

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

-

Syria slams Israeli Damascus strike as 'dangerous escalation'

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

US hiring slows less than expected, unemployment unchanged

-

Man Utd must 'take risk' and rotate players as they target European glory: Amorim

-

Vatican chimney installed ahead of papal conclave

Vatican chimney installed ahead of papal conclave

-

Toulouse's Ramos to miss Champions Cup semi with injury

-

Grand Theft Auto VI release postponed to May 2026: publisher

Grand Theft Auto VI release postponed to May 2026: publisher

-

S.African mother found guilty of selling young daughter

-

EU wins post-Brexit fishing row with Britain

EU wins post-Brexit fishing row with Britain

-

Activists say drones attacked aid boat bound for Gaza

-

Israel says struck near Syria presidential palace amid Druze clashes

Israel says struck near Syria presidential palace amid Druze clashes

-

Eurozone inflation holds above expectations in April

-

Orgies, murder and intrigue, the demons of the Holy See

Orgies, murder and intrigue, the demons of the Holy See

-

'Deadly blockade' leaves Gaza aid work on verge of collapse: UN, Red Cross

-

Pakistani Kashmir orders stockpiling of food as India tensions flare

Pakistani Kashmir orders stockpiling of food as India tensions flare

-

Stock markets gain as China mulls US tariff talks

| CMSC | 0.38% | 22.115 | $ | |

| CMSD | 0.38% | 22.345 | $ | |

| JRI | 0.19% | 13.035 | $ | |

| BCC | 3.72% | 96.295 | $ | |

| BCE | -0.68% | 21.295 | $ | |

| NGG | 0.07% | 71.7 | $ | |

| RIO | 2.05% | 59.775 | $ | |

| RBGPF | 6.26% | 67.21 | $ | |

| SCS | 3.05% | 10.18 | $ | |

| BTI | -0.29% | 43.175 | $ | |

| GSK | 0.17% | 38.815 | $ | |

| AZN | 2.68% | 72.455 | $ | |

| RYCEF | 1.26% | 10.35 | $ | |

| BP | 0.73% | 28.085 | $ | |

| VOD | -0.88% | 9.645 | $ | |

| RELX | 1.65% | 54.99 | $ |

Global stocks sink on US inflation surge

World stock markets fell Friday on fears the Federal Reserve will move more aggressively to tighten monetary policy to tame decades-high inflation.

London equities also slid as investors set aside rebounding 2021 economic growth to focus on shrinking December activity in the wake of the Omicron Covid variant.

The UK economy grew by a record 7.5 percent last year to rebound from the pandemic crash, but shrank by a modest 0.2 percent in the final month, official data showed.

In the eurozone, Frankfurt and Paris stocks banked lower, mirroring Asia after overnight Wall Street losses.

The euro retreated versus the dollar, while oil prices rose after the International Energy Agency lifted its world oil demand forecast.

- US inflation shock -

"It's been quite a week for the markets with a shock from US inflation growing faster than expected," said investment director Russ Mould at stockbroker AJ Bell.

"Now we've got confirmation that Omicron tripped up the UK economy in December, albeit by a smaller amount than forecast."

Wall Street equities tumbled on Thursday as markets bet that the latest inflation data would spark swift action from the Fed.

The 7.5-percent jump in US consumer prices last month was the fastest in 40 years and reinforced fears that the central bank is falling behind the curve in keeping it under control.

Sentiment was also hit by remarks from Fed official James Bullard, who said he wanted to see interest rates lifted one percentage point by the start of July.

The St Louis Fed boss said he was in favour of a 50 basis point lift next month -- double the usual rise and the first since 2000 -- and two more after that.

"I'd like to see 100 basis points in the bag by July 1," Bullard, who has a vote on policy this year, told Bloomberg News. "I was already more hawkish but I have pulled up dramatically what I think the committee should do."

He added: "I do not think it is shock and awe.

"I think it is a sensible response to a surprise inflationary shock that we got during 2021 that we did not expect."

Bullard also said he was open to a very rare announcement of rate hikes between meetings, which further rattled traders who fretted about a move before March, while calling for the quick reduction of the bank's bond holdings that have helped keep rates subdued.

US Treasuries -- a guide to future borrowing costs -- have risen above two percent and analysts are predicting up to seven Fed rate hikes this year.

Separately on Friday, the IEA ramped up its 2022 demand outlook to 100.6 million barrels of crude oil per day, an increase of 3.2 million, as governments further ease Covid restrictions.

- Key figures around 1120 GMT -

London - FTSE 100: DOWN 0.8 percent at 7,612.98 points

Frankfurt - DAX: DOWN 0.7 percent at 15,386.18

Paris - CAC 40: DOWN 1.2 percent at 7,017.45

EURO STOXX 50: DOWN 1.1 percent at 4,149.77

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 24,906.66 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,462.95 (close)

Tokyo - Nikkei 225: Closed for a holiday

New York - Dow: DOWN 1.5 percent at 35,241.59 (close)

Euro/dollar: DOWN at $1.1384 from $1.1428 late Thursday

Pound/dollar: DOWN at $1.3548 from $1.3557

Euro/pound: DOWN at 84.03 pence from 84.29 pence

Dollar/yen: UP at 116.05 yen from 116.01 yen

Brent North Sea crude: UP 0.4 percent at $91.73 per barrel

West Texas Intermediate: UP 0.4 percent at $90.26 per barrel

O.Norris--AMWN