-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

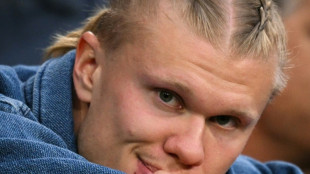

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

-

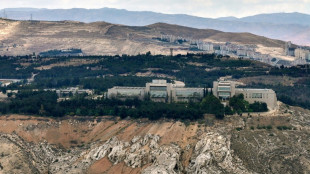

Syria slams Israeli Damascus strike as 'dangerous escalation'

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

US hiring slows less than expected, unemployment unchanged

-

Man Utd must 'take risk' and rotate players as they target European glory: Amorim

-

Vatican chimney installed ahead of papal conclave

Vatican chimney installed ahead of papal conclave

-

Toulouse's Ramos to miss Champions Cup semi with injury

-

Grand Theft Auto VI release postponed to May 2026: publisher

Grand Theft Auto VI release postponed to May 2026: publisher

-

S.African mother found guilty of selling young daughter

-

EU wins post-Brexit fishing row with Britain

EU wins post-Brexit fishing row with Britain

-

Activists say drones attacked aid boat bound for Gaza

-

Israel says struck near Syria presidential palace amid Druze clashes

Israel says struck near Syria presidential palace amid Druze clashes

-

Eurozone inflation holds above expectations in April

-

Orgies, murder and intrigue, the demons of the Holy See

Orgies, murder and intrigue, the demons of the Holy See

-

'Deadly blockade' leaves Gaza aid work on verge of collapse: UN, Red Cross

-

Pakistani Kashmir orders stockpiling of food as India tensions flare

Pakistani Kashmir orders stockpiling of food as India tensions flare

-

Stock markets gain as China mulls US tariff talks

India to sell 5% of insurance giant in huge IPO

India plans to sell a five percent stake in insurance giant LIC in what could potentially be the country's largest initial public offering, according to a regulatory filing Sunday.

Prime Minister Narendra Modi's government is desperate for proceeds from the IPO of the Life Insurance Corporation of India and the sale of other state assets to help fix its tattered public finances.

Founded in 1956 by nationalising and combining 245 insurers, LIC was synonymous with life insurance in post-independence India for decades until the entry of private companies in 2000.

Despite a steady decline in market share, LIC continues to lead the pack with 64 percent of the life insurance market in the country of 1.4 billion people.

With staff of more than 100,000 people, its vast assets under management of 36.7 trillion rupees ($491 billion) equate to nearly 16 percent of India's gross domestic product.

LIC in turn is one of India's biggest institutional investors, with significant stakes in Indian blue-chip stocks like Reliance, TCS, Infosys and ITC.

According to LIC's draft prospectus filed with the market regulator on Sunday, the government plans to sell around 316 million shares in the IPO, which is expected to take place in March.

While the pricing has not yet been set, analysts expect the IPO to dwarf that of payments firm Paytm, which raised $2.5 billion in November in India's largest public share sale to date.

- Courting first-time investors -

The government hopes LIC's IPO will attract legions of first-time investors to the stock market, in a country where less than five percent of people have trading accounts.

It will be a crucial step in Modi's policy to "monetise and modernise" state-run companies and plug an estimated 16-trillion-rupee budget deficit this financial year in the wake of the coronavirus pandemic.

Earlier this month, the government drastically cut its divestment target for the current year from 1.75 trillion rupees to 780 billion rupees.

Of this, the government has raised only 120.3 billion rupees by selling stakes in various state-owned entities this financial year, government data shows.

This puts New Delhi on course to miss its privatisation target for a third straight year despite concluding the long-delayed sale of flag carrier Air India to the Tata Group last month.

The IPO of LIC though will require additional transparency of the insurance behemoth's operations, which has more than 2,000 branches and an army of around one million "LIC agents".

LIC's real estate assets include vast offices at prime locations in different Indian cities, including a distinctively curved Art Deco building in Mumbai's financial district and a 15-storey LIC Building in Chennai that was once India's tallest building.

The firm is also believed to own a large collection of rare and valuable artwork that includes paintings by MF Hussain -- known as the Pablo Picasso of India -- although the value of these holdings has not been made public.

Srinath Sridharan, an independent markets commentator, likened LIC to one of India's "family jewels" and said that a successful IPO by the government could pave the way for others.

"If they can get this right, running a large entity and yet having the ability and agility to take care of minority shareholders' concerns, I think... it will be far easier to divest smaller entities, mid-sized entities," Sridharan told AFP.

Y.Aukaiv--AMWN