-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

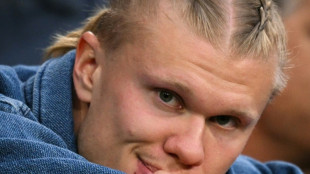

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

-

Syria slams Israeli Damascus strike as 'dangerous escalation'

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

US hiring slows less than expected, unemployment unchanged

-

Man Utd must 'take risk' and rotate players as they target European glory: Amorim

-

Vatican chimney installed ahead of papal conclave

Vatican chimney installed ahead of papal conclave

-

Toulouse's Ramos to miss Champions Cup semi with injury

-

Grand Theft Auto VI release postponed to May 2026: publisher

Grand Theft Auto VI release postponed to May 2026: publisher

-

S.African mother found guilty of selling young daughter

-

EU wins post-Brexit fishing row with Britain

EU wins post-Brexit fishing row with Britain

-

Activists say drones attacked aid boat bound for Gaza

-

Israel says struck near Syria presidential palace amid Druze clashes

Israel says struck near Syria presidential palace amid Druze clashes

-

Eurozone inflation holds above expectations in April

-

Orgies, murder and intrigue, the demons of the Holy See

Orgies, murder and intrigue, the demons of the Holy See

-

'Deadly blockade' leaves Gaza aid work on verge of collapse: UN, Red Cross

-

Pakistani Kashmir orders stockpiling of food as India tensions flare

Pakistani Kashmir orders stockpiling of food as India tensions flare

-

Stock markets gain as China mulls US tariff talks

| CMSC | 0.38% | 22.115 | $ | |

| CMSD | 0.38% | 22.345 | $ | |

| JRI | 0.19% | 13.035 | $ | |

| BCC | 3.72% | 96.295 | $ | |

| BCE | -0.68% | 21.295 | $ | |

| NGG | 0.07% | 71.7 | $ | |

| RIO | 2.05% | 59.775 | $ | |

| RBGPF | 6.26% | 67.21 | $ | |

| SCS | 3.05% | 10.18 | $ | |

| BTI | -0.29% | 43.175 | $ | |

| GSK | 0.17% | 38.815 | $ | |

| AZN | 2.68% | 72.455 | $ | |

| RYCEF | 1.26% | 10.35 | $ | |

| BP | 0.73% | 28.085 | $ | |

| VOD | -0.88% | 9.645 | $ | |

| RELX | 1.65% | 54.99 | $ |

Why is India's largest insurer being listed?

India is embarking on the blockbuster listing of the country's largest insurer as part of a wider privatisation drive to bolster public coffers drained by the coronavirus pandemic and fund new infrastructure.

While the pricing has not yet been set, analysts expect the IPO of the Life Insurance Corporation of India (LIC) to be India's largest to date, potentially earning the government more than $10 billion.

After the listing, which is expected in March, LIC will be one of India's biggest publicly listed companies alongside giants such as Reliance and TCS.

- How big is the firm? -

LIC was created in 1956 and was synonymous with life insurance in post-independence India until private firms were allowed entry in 2000.

The company holds a two-thirds share in the domestic life insurance market. It manages assets of 36.7 trillion rupees ($491 billion), which equates to nearly 16 percent of India's gross domestic product.

It has more than 100,000 employees and one million insurance agents.

LIC's real estate assets include big offices at prime locations in various Indian cities, including a 15-storey building in the southern city of Chennai and a distinctively curved head office in the heart of Mumbai's financial district.

The firm is also believed to own a large collection of rare and valuable artwork that includes paintings by MF Hussain -- known as the Pablo Picasso of India -- although the value of these holdings has not been made public.

- Why is the IPO taking place? -

Asia's third-largest economy was already grappling with a prolonged slowdown even before the start of the coronavirus pandemic. India has recorded its worst recession since independence due to the Covid-19 crisis.

Efforts to contain the spread of the virus, such as through stringent lockdowns, created a significant budget deficit and pushed millions into joblessness and poverty.

The IPO of LIC will give a boost to the government's efforts to raise much-needed cash through privatisations, which are running badly behind schedule.

The government has raised just 120.3 billion rupees by selling stakes in various state-owned entities this financial year, well short of its target of 780 billion rupees.

Srinath Sridharan, an independent markets commentator, likened LIC to one of the Indian government's "family jewels".

- Is it an attractive investment? -

LIC is a household name in India and has a strong grip on the life insurance market in the vast South Asian nation despite the entrance of private players.

The company is offering its millions of policyholders the opportunity to invest in the IPO at a discount, promoting the offer through television advertisements and full-page newspaper ads.

Analysts expect retail investors, including many first-timers, to show strong appetite for snaring a stake in the venerable company.

But there are numerous uncertainties for investors. These include question marks over whether investment decisions can be made by LIC management without interference from the government.

It is also unclear if LIC will be able to retain its market share, with increased competition for younger consumers from more tech-savvy new entrants to the market.

S.Gregor--AMWN