-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

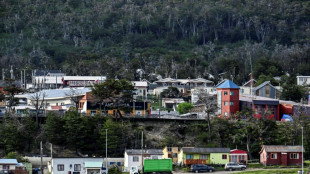

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

Australians vote in election swayed by inflation, Trump

-

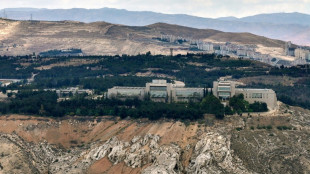

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

-

Man Utd must 'take risk' and rotate players as they target European glory: Amorim

Man Utd must 'take risk' and rotate players as they target European glory: Amorim

-

Vatican chimney installed ahead of papal conclave

-

Toulouse's Ramos to miss Champions Cup semi with injury

Toulouse's Ramos to miss Champions Cup semi with injury

-

Grand Theft Auto VI release postponed to May 2026: publisher

-

S.African mother found guilty of selling young daughter

S.African mother found guilty of selling young daughter

-

EU wins post-Brexit fishing row with Britain

Asian markets track Wall St losses on Ukraine conflict fears

Asian markets fell and oil prices rallied Monday after the United States warned Russia could attack Ukraine within days as diplomatic efforts to prevent a war appeared to fail, while fears over inflation were also keeping traders on edge.

The losses matched a sell-off in New York and Europe on Friday as Western powers prepare for a conflict in eastern Europe after Russian President Vladimir Putin dismissed calls by US counterpart Joe Biden and others to pull back.

Governments have told their citizens to leave Ukraine and US national security adviser Jake Sullivan warned last week that an invasion could begin "any day now" and would likely start with "a significant barrage of missiles and bomb attacks".

German Chancellor Olaf Scholz was preparing to visit Kyiv and Moscow to try to head off the crisis that officials said had reached a "critical" point.

The prospect of a conflict compounded the gloomy mood on trading floors after data Thursday showed US inflation hit a forecast-busting 7.5 percent in January, ramping up pressure on the Federal Reserve to hike interest rates by more than expected.

After sharp losses on Friday on Wall Street, the dip continued in Asia.

Tokyo and Mumbai each shed more than two percent, while Hong Kong, Shanghai, Seoul, Jakarta, Wellington and Taipei were at least one percent down. Singapore and Bangkok were also off, though Sydney and Manila rose.

A "flight to safety for all markets will be the first order" if Russia invades, said Wai Ho Leong, a strategist with Modular Asset Management in Singapore.

"The impact on inflation will go beyond oil and gas," he warned. "For the rest of the world, it is potentially a massive food shock -- as Ukraine is a major exporter of grain -- mainly corn and wheat."

Wheat futures are up about eight percent since the start of the month.

Eli Lee at Bank of Singapore added that the volatility that had characterised markets so far this year would likely continue.

"In the scenario of military action, we could see a spike in oil and gas prices, which would exacerbate the issue of inflation over the near term, and result in a market-wide risk-off move," he wrote in a note.

"This would inject volatility into risk assets and cause a bid for safe havens such as the Japanese yen, the US dollar and gold."

Meanwhile, oil prices jumped more than one percent, closing in on the $100-a-barrel mark last seen in 2014, as investors grow increasingly worried about supplies in the event of a war.

The crisis comes with crude already tight, owing to a pick-up in demand as economies reopen after the coronavirus pandemic and people return to a more normal life.

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: DOWN 2.2 percent at 27,079.59 (close)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 24,555.19

Shanghai - Composite: DOWN 1.0 percent at 3,428.88 (close)

West Texas Intermediate: UP 1.1 percent at $94.10 per barrel

Brent North Sea crude: UP 0.9 percent at $95.27 per barrel

Dollar/yen: DOWN at 115.33 yen from 115.48 yen late Friday

Euro/dollar: DOWN at $1.1339 from $1.1351

Pound/dollar: DOWN at $1.3538 from $1.3564

Euro/pound: UP at 83.77 pence from 83.64 pence

New York - Dow: DOWN 1.4 percent at 34,738.06 (close)

London - FTSE 100: DOWN 0.2 percent at 7,661.02 (close)

-- Bloomberg News contributed to this story --

C.Garcia--AMWN