-

'Devastated' Prince Harry says no UK return but seeks reconciliation

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

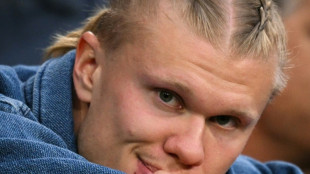

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

-

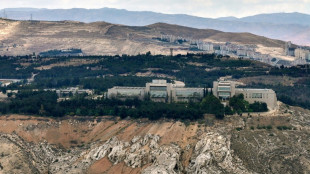

Syria slams Israeli Damascus strike as 'dangerous escalation'

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

US hiring slows less than expected, unemployment unchanged

-

Man Utd must 'take risk' and rotate players as they target European glory: Amorim

-

Vatican chimney installed ahead of papal conclave

Vatican chimney installed ahead of papal conclave

-

Toulouse's Ramos to miss Champions Cup semi with injury

-

Grand Theft Auto VI release postponed to May 2026: publisher

Grand Theft Auto VI release postponed to May 2026: publisher

-

S.African mother found guilty of selling young daughter

-

EU wins post-Brexit fishing row with Britain

EU wins post-Brexit fishing row with Britain

-

Activists say drones attacked aid boat bound for Gaza

Stocks nervous even after Russia sees 'chance' in Ukraine crisis

Stock markets attempted to claw back some of their earlier losses on Monday after Russia suggested there might be a "chance" of reaching an agreement with the West over Ukraine.

But prospects of the US Federal Reserve raising interest rates more aggressively than anticipated prevented markets from recouping even more lost ground.

On Wall Street, stock prices were mixed after intially opening flat, and European markets -- which had tumbled sharply earlier in the session -- came off their lows, but remained firmly in the red.

"Stock markets are getting pummelled... as investors prepare for a potential Russian invasion of Ukraine this week," said OANDA analyst, Craig Erlam.

"Reports since Friday suggest an invasion has gone from being a risk to highly likely and the late sell-off in the US followed by today's plunge reflects that."

Nevertheless, the markets experienced some momentary relief from comments by Russian Foreign Minister Sergei Lavrov, who told President Vladimir Putin that there was a "chance" of reaching an agreement on security with the West.

"The tone changed suddenly... following a headline that Russian Foreign Minister Lavrov said there is a chance for agreement on security issues," said Patrick O'Hare at Briefing.com.

"The fact that the door has not been shut to further talks... is a good thing," O'Hare said.

"Hence, the negativity seen earlier has dissipated some, yet there is still a major cloud of uncertainty hanging over the market."

Lavrov's comments "eased investor nerves over an 'imminent' invasion of Ukraine by Russia, something which Kremlin has continually denied," said ThinkMarkets analyst, Fawad Razaqzada.

Nevertheless, looking beyond the Ukraine crisis, inflation remained very much an "elephant in the room" for financial markets, the analyst cautioned.

"It is all about how central banks are going to address surging inflationary pressures around the world, not least the Federal Reserve."

Comments by a top US Federal Reserve official, suggesting the central bank needed to accelerate the pace of interest rate increases to fight inflation, threatened to dampen some of the nascent optimism.

"Our credibility is on the line here," St. Louis Fed President James Bullard said on CNBC.

After consumer prices saw their biggest jump in 40 years in January, he said the Fed should "front load" rate increases to rise by a full point by July.

- $100 oil? -

The Ukraine crisis is also being closely watched by the oil markets, amid a pick-up in crude demand as economies reopen after the coronavirus pandemic and people return to a more normal life.

Earlier in Asia, Brent had climbed as high as $96.16 and WTI crude to $94.94 per barrel, stoking renewed concern over elevated inflation.

But later in the session, prices had come back down again as investors took profit.

Europe has for months already suffered from soaring natural gas prices, which have fuelled rocketing domestic energy prices and sparked decades-high inflation.

"In the event of a Russia-Ukraine escalation we could be seeing a significant increase in domestic energy prices since much of Europe is heavily reliant on Russian oil and gas supplies," said XTB analyst Walid Koudmani.

- Key figures around 1640 GMT -

New York - Dow: DOWN 0.5 percent at 34,555.29 points

London - FTSE 100: DOWN 1.7 percent at 7,531.59 (close)

Frankfurt - DAX: DOWN 2.0 percent at 15,113.97(close)

Paris - CAC 40: DOWN 2.3 percent at 6,852.20 (close)

EURO STOXX 50: DOWN 2.2 percent at 4,064.45

Tokyo - Nikkei 225: DOWN 2.2 percent at 27,079.59 (close)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 24,556.57 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,428.88 (close)

Brent North Sea crude: UP 0.4 percent at $94.84 per barrel

West Texas Intermediate: UP 0.6 percent at $93.74 per barrel

Euro/dollar: DOWN at $1.1309 from $1.1350 late Friday

Pound/dollar: DOWN at $1.3515 from $1.3564

Euro/pound: DOWN at 83.67 pence from 83.68 pence

Dollar/yen: UP at 115.69 yen from 115.42 yen

burs-spm/kjm

S.Gregor--AMWN