-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

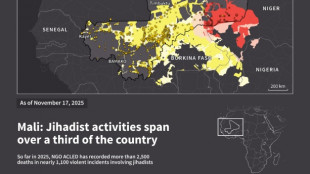

Jihadist threat puts eastern Senegal on edge

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Simulab Launches TraumaMan(R) System Ultrasound Module for Realistic Trauma Training

-

Bytek Joins the Google Cloud Ready - BigQuery Program

Bytek Joins the Google Cloud Ready - BigQuery Program

-

Formation Metals Intersects 0.95 g/t Au over 61.1 Metres, including 1.68 g/t Au over 26.5 Metres at the Advanced N2 Gold Project; Bulk-Tonnage Gold Target Identified with 8 Kilometres of Strike to Explore

-

Bolt Metals Announces Closing of Fully Subscribed Private Placement

Bolt Metals Announces Closing of Fully Subscribed Private Placement

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 24

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

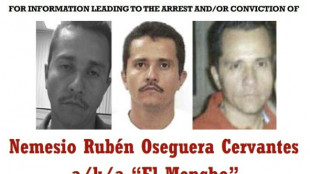

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

Rising student debt to worsen money woes of young Britons

Rhiannon Muise graduated from Edge Hill University in northwest England last year with a mountain of student debt, which is growing even larger due to surging inflation.

The 21-year-old dance and drama graduate said it will take a "lifetime" for her to pay back the £45,000 ($55,000) she owes for tuition fees and living expenses, particularly if she stays within her chosen field where salaries can be low.

Muise's plight echoes that of students across Britain, who are already struggling with a cost-of-living crisis.

Britons heading to university next year face major changes that critics argue will worsen the financial pain.

- Exhausting -

The pressure is "exhausting, especially for someone in their 20s who has just started thinking about their career", Muise told AFP.

Her current job as Edge Hill student engagement officer pays below the threshold that activates repayments.

UK graduates shoulder more debt than any other developed country, according to House of Commons Library data.

About 1.5 million students borrow nearly £20 billion in loans every year in England alone.

And on average, graduates of 2020 have amassed £45,000 in debt.

Zeno, a 25-year-old student in London who gave only his first name, said he owes just short of £75,000 for his loans.

Unless he "wins the lottery", he accepts he will probably be paying the money back from his salary for the next 30 years.

- Tuition fees -

University used to be free in the UK, with means-tested grants for the poorest students to cover living costs.

But after the sector was opened up in the 1990s, numbers surged and, despite protests from student bodies, tuition fees have been gradually introduced in the last decade to help universities meet costs.

With education a devolved matter for the governments in Scotland, Wales and Northern Ireland, different tuition fee arrangements are in place across the UK.

Accommodation and living costs are extra.

In England, undergraduate tuition fees are capped at £9,250 a year for UK and Irish students -- up from £3,375 in 2011 when the government cut most ongoing direct public funding.

The cap in Wales is £9,000 and £4,030 in Northern Ireland.

Scottish students studying in Scotland pay £1,820 but those from the rest of the UK attending universities north of the border with England pay £9,250.

- Inflation worry -

The picture is further complicated by rocketing inflation because the student loan interest rate is linked to the retail price index (RPI).

Loan interest is calculated by adding up to 3.0 percentage points to the RPI rate.

Inflation however soared to 30-year highs this year, particularly on rocketing energy costs and fallout from the Ukraine conflict.

Graduates could therefore pay an interest rate of 12 percent from September -- or more if prices rise even higher.

The UK government plays a large part in student financing, providing loans that only demand repayment when a graduate earns above a threshold of £27,295 per year.

What borrowers repay depends on how much they earn. Unlike private lenders, they have up to 30 years to repay. The debt is cancelled after this time.

"This system is more progressive than in the United States, with generous write-offs for lower-paid graduates," said Nick Hillman, director of the Higher Education Policy Institute in Oxford.

Current and recent students faced huge upheaval during courses due to coronavirus restrictions, with the pandemic also hitting job opportunities.

A combination of high debt repayments, high cost of living and wages that have failed to keep pace with inflation, add yet more stress.

- Conundrum -

Student finance poses a major conundrum for the public purse because the UK forecasts outstanding loans will top £560 billion by 2050.

From next year, Britain will lower the repayment threshold for new borrowers to £25,000 and lengthen the repayment time from 30 to 40 years.

This will however increase costs for low-earners, while benefiting richer graduates who can pay back more quickly.

The UK government forecasts however that half of new students will repay their loans in full under the new plan.

Student debt has long been a concern in the United States, where the Federal Reserve estimates that it amounts to a staggering $1.76 trillion.

US students on average have outstanding debt of close to $41,000, according to think-tank Education Data Initiative.

President Joe Biden this year extended a moratorium on student loan repayment and interest -- and is holding talks over partial debt write-offs.

F.Dubois--AMWN