-

US appeals WTO ruling in dispute by China over clean energy subsidies

US appeals WTO ruling in dispute by China over clean energy subsidies

-

Guadalajara: World Cup host city rocked by narco violence

-

Briiliant Brook 100 puts England into T20 World Cup semi-finals

Briiliant Brook 100 puts England into T20 World Cup semi-finals

-

Germany's Merz heads to China for talks centred on trade

-

Briiliant Brook 100 puts England into T20 World Cups semi-finals

Briiliant Brook 100 puts England into T20 World Cups semi-finals

-

Warner Bros. 'reviewing' new takeover bid from Paramount

-

US told EU it 'stands' by tariff deal: trade chief

US told EU it 'stands' by tariff deal: trade chief

-

Torrential rains leave 23 dead in Brazil, dozens missing

-

UK govt says will release files on 'rude' ex-prince Andrew

UK govt says will release files on 'rude' ex-prince Andrew

-

Nearly an own gull! CPR performed on bird at Turkey football match

-

How AFP has used data analysis to cover the Ukraine war

How AFP has used data analysis to cover the Ukraine war

-

Paris says US envoy pledges not to 'interfere' in France affairs

-

Iran says students must respect 'red lines' after protests

Iran says students must respect 'red lines' after protests

-

Italian biathlete Giacomel has heart surgery after Olympic withdrawal

-

Gazans salvage ancient books in mosque library damaged by war

Gazans salvage ancient books in mosque library damaged by war

-

Farhan scores 63 as England restrict Pakistan to 164-9

-

Stocks bounce as traders assess AI fallout, tariffs

Stocks bounce as traders assess AI fallout, tariffs

-

Brazil court tries politicians over hit on Black councilwoman

-

Senegal PM vows to double penalty for same-sex relations

Senegal PM vows to double penalty for same-sex relations

-

UK govt backs releasing documents tied to 'rude' ex-prince Andrew

-

Novo Nordisk to slash prices of weightloss drugs in US

Novo Nordisk to slash prices of weightloss drugs in US

-

Welllage says Sri Lanka can rescue T20 World Cup campaign

-

UK's royal protection officers urged to speak up in Epstein probe

UK's royal protection officers urged to speak up in Epstein probe

-

Aid groups petition Israel's top court to halt ban on Gaza, West Bank ops

-

UEFA can make fight against racism more than a slogan: Real Madrid's Arbeloa

UEFA can make fight against racism more than a slogan: Real Madrid's Arbeloa

-

Bali flooding prompts tourist evacuation: official

-

Jones says Borthwick's 'title-decider' comments behind England collapse

Jones says Borthwick's 'title-decider' comments behind England collapse

-

UK fines Reddit nearly $20 mn over children's data failures

-

PSG star Hakimi faces trial for alleged rape

PSG star Hakimi faces trial for alleged rape

-

Netflix, Prime and Disney+ face UK broadcasting regulation

-

Greece set new tourism record in 2025

Greece set new tourism record in 2025

-

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Snoop Dogg 'can't wait' for first Swansea visit

-

Stocks fluctuate as traders assess AI fallout, tariffs

Stocks fluctuate as traders assess AI fallout, tariffs

-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

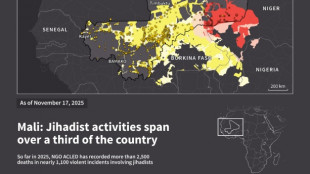

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

Volcon, Inc. Announces Closing of $12.0 Million Underwritten Public Offering

AUSTIN, TX / ACCESS Newswire / February 6, 2025 / Volcon, Inc. (Nasdaq:VLCN) (the "Company"), the first all-electric, off-road powersports company, today announced the closing of its previously announced firm commitment underwritten public offering. Gross proceeds to the Company were approximately $12.0 million, before deducting underwriting fees and other offering expenses payable by the Company. The offering closed on February 6, 2025.

The offering consisted of 6,000,000 Common Units (or Pre-Funded Units), each consisting of (i) one (1) share of Common Stock or Pre-Funded Warrant and (ii) one (1) Registered Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $2.00. The public offering price per Common Unit was $2.00 (or $1.99999 for each Pre-Funded Unit, which is equal to the public offering price per Common Unit sold in the offering minus an exercise price of $0.00001 per Pre-Funded Warrant). The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until exercised in full. For each Pre-Funded Unit sold in the offering, the number of Common Units in the offering was decreased on a one-for-one basis. The initial exercise price of each Common Warrant is $2.00 per share of Common Stock. The Common Warrants are exercisable immediately and expire 60 months after the initial issuance date.

Aggregate gross proceeds to the Company were $12.0 million. The Company expects to use the net proceeds from the offering, together with its existing cash, for general corporate purposes and working capital. As previously disclosed, the Company announced the sale of 1,831,558 shares of Common Stock pursuant to its At-The-Market Issuance Sales Agreement with Aegis for gross proceeds of approximately $9.47 million. Following the closing of the Offering and assuming the exercise of all Pre-Funded Warrants, the Company has 8,572,429 shares of Common Stock outstanding.

Aegis Capital Corp. acted as the sole book-running manager for the offering. ArentFox Schiff LLP acted as counsel to the Company. Kaufman & Canoles, P.C. acted as counsel to Aegis Capital Corp.

The offering was made pursuant to an effective shelf registration statement on Form S-3 (No. 333-269644) previously filed with the U.S. Securities and Exchange Commission (SEC) and declared effective by the SEC on March 21, 2023. A final prospectus supplement and accompanying prospectus describing the terms of the proposed offering was filed with the SEC and is available on the SEC's website located at www.sec.gov. Electronic copies of the final prospectus supplement and the accompanying prospectus may be obtained by contacting Aegis Capital Corp., Attention: Syndicate Department, 1345 Avenue of the Americas, 27th floor, New York, NY 10105, by email at [email protected], or by telephone at +1 (212) 813-1010.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Volcon, Inc.

Based in the Austin, Texas area, Volcon was founded as the first all-electric power sports company producing high-quality and sustainable electric vehicles for the outdoor community. Volcon electric vehicles are the future of off-roading, not only because of their environmental benefits but also because of their near-silent operation, which allows for a more immersive outdoor experience.

Volcon's vehicle roadmap includes both motorcycles and UTVs. Its first product, the innovative Grunt, began shipping to customers in late 2021 and combines a fat-tired physique with high-torque electric power and a near-silent drive train. The Volcon Grunt EVO, an evolution of the original Grunt with a belt drive, an improved suspension, and seat, began shipping to customers in October 2023. The Brat is Volcon's first foray into the wildly popular eBike market for both on-road and off-road riding and is currently being delivered to dealers across North America. In 2024, Volcon entered the rapidly expanding LUV and UTV market and shipped its first production MN1 unit in October 2024. The new MN1 and HF1 products empower the driver to explore the outdoors in a new and unique way that gas-powered units cannot. They offer the same thrilling performance of a standard LUV / UTV without the noise (or pollution), allowing the driver to explore the outdoors with all their senses.

Forward-Looking Statements

Some of the statements in this release are forward-looking statements, which involve risks and uncertainties. Forward-looking statements in this press release include, without limitation, when the Pre-Funded Warrants will be exercised. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. The Company has attempted to identify forward-looking statements by terminology including "believes," "estimates," "anticipates," "expects," "plans," "projects," "intends," "potential," "may," "could," "might," "will," "should," "approximately" or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors. Any forward-looking statements contained in this release speak only as of its date. The Company undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events. More detailed information about the risks and uncertainties affecting the Company is contained under the heading "Risk Factors" in the Company's Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, which are available on the SEC's website, www.sec.gov.

Volcon Contacts

For Media: [email protected]

For Dealers: [email protected]

For Investors: [email protected]

For Marketing: [email protected]

For more information on Volcon or to learn more about its complete motorcycle and side-by-side line-up, visit: www.volcon.com

SOURCE: Volcon ePowersports, Inc.

View the original press release on ACCESS Newswire

A.Rodriguezv--AMWN