-

Opening statements in Sean Combs trial expected Monday

Opening statements in Sean Combs trial expected Monday

-

Indian army reports 'first calm night' after Kashmir truce with Pakistan holds

-

As world heats up, UN cools itself the cool way: with water

As world heats up, UN cools itself the cool way: with water

-

Pacers push Cavs to brink in NBA playoffs, Thunder pull even with Nuggets

-

US, China to publish details of 'substantial' trade talks in Geneva

US, China to publish details of 'substantial' trade talks in Geneva

-

Asian markets rally after positive China-US trade talks

-

Indians buy 14 million ACs a year, and need many more

Indians buy 14 million ACs a year, and need many more

-

Election campaigning kicks off in South Korea

-

UK hosts European ministers for Ukraine talks after ceasefire ultimatum

UK hosts European ministers for Ukraine talks after ceasefire ultimatum

-

Leo XIV gets down to business on first full week as pope

-

White at the double as Whitecaps fight back against LAFC

White at the double as Whitecaps fight back against LAFC

-

Trump hails Air Force One 'gift' after Qatari luxury jet reports

-

'Tool for grifters': AI deepfakes push bogus sexual cures

'Tool for grifters': AI deepfakes push bogus sexual cures

-

US and China to publish details of 'substantial' trade talks in Geneva

-

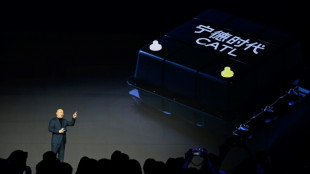

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

-

Kiwi Fox wins PGA Myrtle Beach title in playoff

-

Thunder edge Nuggets to level NBA playoff series

Thunder edge Nuggets to level NBA playoff series

-

Straka holds firm to win PGA Tour's Truist Championship

-

Philippines heads to polls with Marcos-Duterte feud centre stage

Philippines heads to polls with Marcos-Duterte feud centre stage

-

Napoli give Inter Scudetto hope after being held by Genoa

-

US, China hail 'substantial progress' after trade talks in Geneva

US, China hail 'substantial progress' after trade talks in Geneva

-

Blessings but not tips from Pope Leo at Peru diner

-

Alcaraz, Zverev march into Italian Open last 16

Alcaraz, Zverev march into Italian Open last 16

-

US and China hail 'progress' after trade talks end in Geneva

-

Jeeno keeps cool to win LPGA's Americas Open

Jeeno keeps cool to win LPGA's Americas Open

-

Hamas to release hostage as part of direct Gaza talks with US

-

Marvel's 'Thunderbolts*' retains top spot in N.America box office

Marvel's 'Thunderbolts*' retains top spot in N.America box office

-

Parade, protests kick off Eurovision Song Contest week

-

Forest owner Marinakis says Nuno row due to medical staff's error

Forest owner Marinakis says Nuno row due to medical staff's error

-

Hamas officials say group held direct Gaza ceasefire talks with US

-

Zelensky offers to meet Putin in Turkey 'personally'

Zelensky offers to meet Putin in Turkey 'personally'

-

Inter beat Torino and downpour to move level with Napoli

-

'Not nice' to hear Alexander-Arnold booed by Liverpool fans: Robertson

'Not nice' to hear Alexander-Arnold booed by Liverpool fans: Robertson

-

'We'll defend better next season': Barca's Flick after wild Clasico win

-

Trump urges Ukraine to accept talks with Russia

Trump urges Ukraine to accept talks with Russia

-

Amorim warns Man Utd losing 'massive club' feeling after Hammers blow

-

Complaint filed over 'throat-slitting gesture' at Eurovision protests: Israeli broadcaster

Complaint filed over 'throat-slitting gesture' at Eurovision protests: Israeli broadcaster

-

Newcastle win top-five showdown with Chelsea, Arsenal rescue Liverpool draw

-

Departing Alonso says announcement on next move 'not far' away

Departing Alonso says announcement on next move 'not far' away

-

Arsenal hit back to rescue valuable draw at Liverpool

-

Pakistan's Kashmiris return to homes, but keep bunkers stocked

Pakistan's Kashmiris return to homes, but keep bunkers stocked

-

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

-

Washington hails 'substantive progress' after trade talks with China

Washington hails 'substantive progress' after trade talks with China

-

Barca edge Real Madrid in thriller to move to brink of Liga title

-

Albanians vote in election seen as key test of EU path

Albanians vote in election seen as key test of EU path

-

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

-

Dortmund thump Leverkusen to spoil Alonso's home farewell

Dortmund thump Leverkusen to spoil Alonso's home farewell

-

Pedersen sprints back into Giro pink after mountain goat incident

-

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

-

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

Energy spikes, ruble and equities dive on Russia fallout

Oil and gas prices surged Monday but the ruble collapsed and European equities sank after world powers imposed new sanctions on Russia over its invasion of Ukraine.

Russian President Vladimir Putin reacted to the latest tough measures by placing his nuclear forces on a higher alert level.

Brent crude again topped $100 per barrel and Europe's reference Dutch TTF natural gas price surged more than a third to 128 euros per megawatt hour, as traders fretted over Russian energy supplies.

The news, alongside sharp gains for aluminium, nickel and wheat, sparked renewed concern over rampant inflation.

Traders will closely watch a meeting this week of OPEC and other major oil producers led by Russia, where they will discuss output plans.

European stocks sank with London losing 1.2 percent, while Frankfurt and Paris shed 2.3 percent and 3.0 percent respectively following a mixed showing in Asia.

The ruble struck record lows against the euro and dollar after the West banned all transactions with Russia's central bank and ejected some lenders from international payments system SWIFT.

- Eurozone banks take hit -

The weekend news sent shockwaves through European banks amid fears of a sector-wide impact.

In Paris, Societe Generale slumped 10.4 percent, BNP Paribas shed 8.2 percent and Credit Agricole lost 5.5 percent.

In Frankfurt, Deutsche Bank was the heaviest faller with a drop of 8.5 percent.

"European banks with the biggest exposure to Russia... have been hit hardest amid today's market sell-off," said Interactive Investor's Victoria Scholar.

"The SWIFT system in this context mainly matters as it allows Russian energy companies to easily sell oil and gas abroad via the conduit of the global financial system."

The European subsidiary of Russia's state-owned Sberbank is meanwhile facing bankruptcy, the European Central Bank said on Monday, in the wake of the sanctions.

In the British capital, Russia-exposed companies were back in the firing line.

London-listed shares in Russian metal giants Polymetal and Evraz took another battering, collapsing by 52 percent and 27 percent respectively.

British energy giant BP dived almost 6.0 percent in value after deciding to exit Russia.

Gold and the yen, go-to assets in times of uncertainty, rose, while the dollar was up against most other currencies.

Emerging markets units took a hit from the Ukraine turmoil, with the Hungarian forint hitting an all-time euro low.

News that Russia's central bank had hiked interest rates to 20 percent -- the highest since 2003 -- helped pare the ruble's losses only briefly.

- Key figures around 1145 GMT -

Brent North Sea crude: UP 4.9 percent at $102.68 per barrel

West Texas Intermediate: UP 4.6 percent at $95.81 per barrel

London - FTSE 100: DOWN 1.2 percent at 7,400.36 points

Frankfurt - DAX: DOWN 2.3 percent at 14,228.45

Paris - CAC 40: DOWN 3.0 percent at 6,547.06

EURO STOXX 50: DOWN 3.0 percent at 3,852.63

Tokyo - Nikkei 225: UP 0.2 percent at 26,526.82 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 22,713.02 (close)

Shanghai - Composite: UP 0.3 percent at 3,462.31 (close)

New York - Dow: UP 2.5 percent at 34,058.75 (close)

Euro/dollar: DOWN at $1.1199 from $1.1268 late Friday

Pound/dollar: DOWN at $1.3400 from $1.3409

Euro/pound: DOWN at 83.53 pence from 84.03 pence

Dollar/yen: DOWN at 115.54 yen from 115.55 yen

S.F.Warren--AMWN