-

Morales vows no surrender in bid to reclaim Bolivian presidency

Morales vows no surrender in bid to reclaim Bolivian presidency

-

Ukraine, US sign minerals deal, tying Trump to Kyiv

-

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

-

Ukraine, US say minerals deal ready as Kyiv hails sharing

-

Global stocks mostly rise following mixed economic data

Global stocks mostly rise following mixed economic data

-

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

-

Sabalenka eases past Kostyuk into Madrid Open semis

Sabalenka eases past Kostyuk into Madrid Open semis

-

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

-

US economy unexpectedly shrinks, Trump blames Biden

US economy unexpectedly shrinks, Trump blames Biden

-

Barca fight back against Inter in sensational semi-final draw

-

Meta quarterly profit climbs despite big cloud spending

Meta quarterly profit climbs despite big cloud spending

-

US Supreme Court weighs public funding of religious charter school

-

Climate change made fire conditions twice as likely in South Korea blazes: study

Climate change made fire conditions twice as likely in South Korea blazes: study

-

Amorim says not even Europa League glory can save Man Utd's season

-

Syria reports Israeli strikes as clashes with Druze spread

Syria reports Israeli strikes as clashes with Druze spread

-

Ukraine, US say minerals deal ready as suspense lingers

-

Everything is fine: Trump's cabinet shrugs off shrinking economy

Everything is fine: Trump's cabinet shrugs off shrinking economy

-

Chelsea boss Maresca adamant money no guarantee of success

-

Wood warns England cricketers against 'dumb' public comments

Wood warns England cricketers against 'dumb' public comments

-

US economy shrinks, Trump blames Biden

-

Caterpillar so far not hiking prices to offset tariff hit

Caterpillar so far not hiking prices to offset tariff hit

-

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

-

Trump praises Musk as chief disruptor eyes exit

Trump praises Musk as chief disruptor eyes exit

-

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

-

Pope Francis saw clergy's lack of humility as a 'cancer': author

Pope Francis saw clergy's lack of humility as a 'cancer': author

-

Weinstein accuser recounts alleged rape at assault retrial in NY

-

Piastri heads into Miami GP as the man to beat

Piastri heads into Miami GP as the man to beat

-

US economy unexpectedly shrinks in first quarter, Trump blames Biden

-

Maxwell likely to miss rest of IPL with 'fractured finger'

Maxwell likely to miss rest of IPL with 'fractured finger'

-

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

-

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

-

NFL fines Falcons and assistant coach over Sanders prank call

-

British teen Brennan takes stage 1 of Tour de Romandie

British teen Brennan takes stage 1 of Tour de Romandie

-

Swedish reporter gets suspended term over Erdogan insult

-

Renewable energy in the dock in Spain after blackout

Renewable energy in the dock in Spain after blackout

-

South Africa sets up inquiry into slow apartheid justice

-

Stocks retreat as US GDP slumps rattles confidence

Stocks retreat as US GDP slumps rattles confidence

-

Migrants' dreams buried under rubble after deadly strike on Yemen centre

-

Trump blames Biden's record after US economy shrinks

Trump blames Biden's record after US economy shrinks

-

UK scientists fear insect loss as car bug splats fall

-

Mexico avoids recession despite tariff uncertainty

Mexico avoids recession despite tariff uncertainty

-

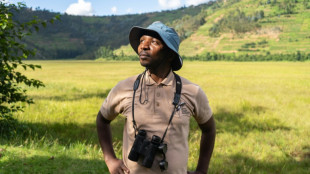

Rwandan awarded for saving grey crowned cranes

-

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

-

Microsoft president urges fast 'resolution' of transatlantic trade tensions

-

Poppies flourish at Tower of London for WWII anniversary

Poppies flourish at Tower of London for WWII anniversary

-

US economy unexpectedly shrinks on import surge before Trump tariffs

-

Stocks drop after US economy contracts amid tariffs turmoil

Stocks drop after US economy contracts amid tariffs turmoil

-

US economy unexpectedly shrinks on import surge ahead of Trump tariffs

-

Dravid says Suryavanshi, 14, needs support from fame

Dravid says Suryavanshi, 14, needs support from fame

-

Arsenal can win 'anywhere' says Merino after Champions League defeat by PSG

Russian central bank slashes rate to rein in ruble

Russia's central bank cut its key interest rate Thursday following an emergency meeting, as authorities seek to rein in the ruble which has surged in value despite the conflict in Ukraine.

The Bank of Russia slashed the rate to 11 percent from 14 percent, saying external conditions for the economy remained "challenging, considerably constraining economic activity."

The policy-setting meeting was originally set to take place on June 10 but the central bank surprised the market by announcing Wednesday that an extraordinary meeting would take place the next day.

"Financial stability risks decreased somewhat, enabling a relaxation of some capital control measures," it said in a statement on Thursday.

The Bank of Russia said it "holds open the prospect of key rate reduction at its upcoming meetings."

Central Bank head Elvira Nabiullina said that Russia managed to stabilise the economy but it was too early to "exhale calmly".

"As the economy adapts, it will be difficult for both companies and citizens," she said after the meeting.

"The first months were a time of tactical decisions: the first shock of the sanctions had to be counteracted," she added.

"As a result, we managed to protect financial stability and prevent an inflationary spiral. But this, of course, does not mean that we can exhale calmly."

The next rate-setting meeting is set to take place on June 10.

After the West slapped Russia with debilitating sanctions over the start of Moscow's military campaign in Ukraine in February, financial authorities introduced strict capital controls to boost the economy.

Since then, the ruble has staged a spectacular rebound and strengthened by around 30 percent against the dollar.

After the decision on Thursday, the ruble weakened

by 7 percent against the dollar.

A strong ruble is not desirable for the Russian government, which fears it can hit budget revenues and exports.

Generally, lower interest rates are unattractive for foreign investment and decrease the value of a country's currency.

- 'Dollar is shrinking' -

The Kremlin said on Wednesday the government was paying "special attention" to the strong ruble but President Vladimir Putin sought to cast the rallying currency as a positive development.

"As we know, the dollar is shrinking, the ruble is strengthening," he said on Wednesday.

But analysts say the strong ruble is a sign of Russia's weakening economy.

"The ruble strength reflects high oil/energy prices, but mostly a collapse in import demand with sanctions. That suggests that growth is going to be massively challenged -- likely deep recession this year," wrote Timothy Ash, an emerging markets strategist at BlueBay Asset Management.

"A strong currency will not help that and will also stall the ruble value of oil export earnings to the budget, boosting the budget deficit," he added.

The government had earlier taken steps to loosen capital controls but the ruble continued to appreciate.

On Monday, Russia's finance ministry announced domestic companies would have to sell 50 percent of their foreign currency export earnings, a reduction from 80 percent earlier.

"High oil and gas revenues are providing policymakers with a lifeline, allowing them to row back emergency economic measures," said William Jackson, chief emerging markets economist at Capital Economics.

A.Mahlangu--AMWN