-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

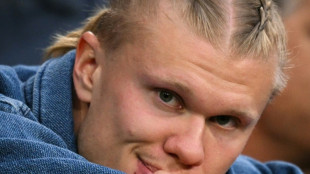

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

Australians vote in election swayed by inflation, Trump

-

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

Markets hit as inflation fears ramp up, eyes on ECB

Most equity markets fell Thursday as a rally in oil ramped up inflation fears, with top officials warning of more pain to come, while focus turns to a meeting of the European Central Bank.

Buyers on Wall Street were in retreat again after data showed US crude and gasoline stockpiles sank, just as the summer driving season begins and a leading OPEC member warned demand would surge further as China moves to reopen.

Adding to the gloom was the OECD's sharp downward revision of its global growth outlook and doubling of its inflation forecast.

The glum mood was only slightly offset by ongoing optimism that Beijing's tech crackdown was close to an end.

Both main crude contracts edged down but held most gains after jumping more than two percent Wednesday to three-month highs after figures showed the biggest US storage depot had seen a big fall in reserves last week, suggesting elevated prices were not deterring people from driving.

Meanwhile, White House Press Secretary Karine Jean-Pierre said officials expect Friday's keenly awaited consumer price index will be "elevated".

The comment lifted expectations that the Federal Reserve will stick to its hawkish path and hike interest rates by half a point for at least three more meetings this year as it tries to bring down inflation from four-decade highs.

Analysts said investors were unlikely to get any reprieve until crude -- a key driver of inflation since Russia's invasion of Ukraine -- was brought under control.

"A pullback in crude would be crucial for any prolonged risk rally, given implications for inflation expectations," said SPI Asset Management's Stephen Innes.

"And for the central bank fraternity intent on frontloading rates, chapter two of the current playbook reads that aggressive tightening risks a material decline in housing, consumer confidence, and consumption that will eventually drive their respective economies into recession and send stocks tumbling.

"So until we reach peak inflation, which will trigger a less hawkish Fed and lower recession odds, it could be a gloomy summer for global stock pickers."

He added that prices were expected to rise further for now as China emerges from months of lockdown, a sentiment that United Arab Emirates Energy Minister Suhail Al-Mazrouei agreed with.

"With the pace of consumption we have, we are nowhere near the peak because China is not back yet," he told a conference Wednesday. "China will come with more consumption."

And OANDA's Jeffrey Halley said difficulties monitoring Iran's nuclear compliance meant a nuclear deal with Iran -- and the release of its crude onto world markets -- was "as far away as ever".

Eyes are now on the European Central Bank's policy meeting later in the day and the release of US inflation data Friday, where it is expected to begin winding down its massive bond-buying programme and signal a rate hike is in the pipeline.

In Asian trade, Hong Kong dropped, even as tech firms continued to benefit from hopes that China's crackdown was almost over, while Shanghai, Sydney, Seoul, Singapore, Taipei, Manila and Wellington were also in the red.

Traders were nervous about news that officials in Shanghai will lock down a district of 2.7 million people Saturday to conduct mass coronavirus testing, highlighting the problems they have in running an economy while chasing their zero-Covid strategy.

There was little reaction to news that China's exports surged last month.

Tokyo, however, was marginally up as the yen sat at two-decade lows owing to widening monetary policies of the United States and Japan, which shows no signs of lifting rates. Mumbai, Jakarta and Bangkok also edged up.

London, Paris and Frankfurt were all down in the morning.

Investors were jarred by a report from the Organisation for Economic Co-operation and Development, which said it had cut its 2022 growth outlook to three percent -- from 4.5 percent predicted in December -- owing to the Ukraine war.

It also doubled its inflation estimate to 8.5 percent, a 34-year high.

"The world is set to pay a hefty price for Russia's war against Ukraine," wrote the OECD's chief economist and deputy secretary-general Laurence Boone.

And Anna Han, at Wells Fargo Securities, told Bloomberg Television: "Our view is that the chance of recession by the end of 2023 is 40 percent or so."

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: FLAT at 28,246.53 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 21,869.05 (close)

Shanghai - Composite: DOWN 0.8 percent at 3,238.95 (close)

London - FTSE 100: DOWN 0.8 percent at 7,535.01

Brent North Sea crude: DOWN 0.4 percent at $123.05 per barrel

West Texas Intermediate: DOWN 0.5 percent at $121.52 per barrel

Dollar/yen: DOWN at 133.59 yen from 134.29 yen late Wednesday

Euro/dollar: DOWN at $1.0711 from $1.0720

Pound/dollar: DOWN at $1.2505 from $1.2535

Euro/pound: UP at 85.65 pence from 85.54 pence

New York - Dow: DOWN 0.8 percent to 32,910.90 (close)

D.Kaufman--AMWN