-

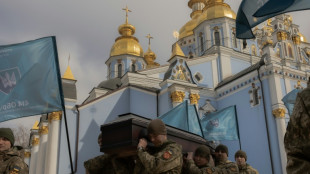

Russia, Ukraine hold first peace talks since 2022

Russia, Ukraine hold first peace talks since 2022

-

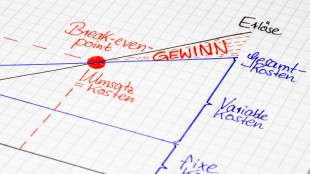

Stock markets calmer as trade rally eases

-

Global acute hunger hits new high, 2025 outlook 'bleak': UN-backed report

Global acute hunger hits new high, 2025 outlook 'bleak': UN-backed report

-

Nantes' Mohamed cites 'origins and faith' for skipping anti-homophobia match

-

Russia, Ukraine hold first talks since 2022

Russia, Ukraine hold first talks since 2022

-

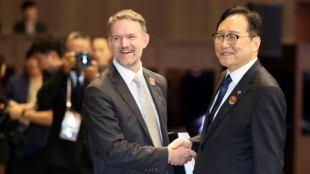

APEC says 'concerned' over challenges to global trade

-

Iran, European powers hold nuclear talks in Turkey

Iran, European powers hold nuclear talks in Turkey

-

More Hollywood stars join protest letter over Gaza 'genocide'

-

France star Dupont invests in American rugby

France star Dupont invests in American rugby

-

India asks IMF to reconsider Pakistan programme over 'terror funding'

-

Russia, Ukraine to meet for first talks since 2022

Russia, Ukraine to meet for first talks since 2022

-

Trump says many in Gaza are 'starving'

-

Umerov: 'Wonder' dealmaker from Crimea leading Ukraine peace talks

Umerov: 'Wonder' dealmaker from Crimea leading Ukraine peace talks

-

Australia's Starc opts out of return to IPL: reports

-

APEC says 'concerned' over challanges to global trade

APEC says 'concerned' over challanges to global trade

-

Coach Chaabani wishes Berkane were not CAF Cup final favourites

-

Eurovision in numbers

Eurovision in numbers

-

Eurovision comes full circle, showing changing times

-

Salman Rushdie attacker faces sentencing

Salman Rushdie attacker faces sentencing

-

Influencer's murder shows dark side of Mexican social media fame

-

Russia and Ukraine to meet in Istanbul, but expectations low

Russia and Ukraine to meet in Istanbul, but expectations low

-

'He's killing us': Cannes dealmakers hate Trump's big Hollywood idea

-

Last Champions League place, relegation to be decided in Ligue 1 finale

Last Champions League place, relegation to be decided in Ligue 1 finale

-

De Bruyne seeks fitting Man City farewell in FA Cup final

-

Crystal Palace go for glory as Man City seek salvation in FA Cup final

Crystal Palace go for glory as Man City seek salvation in FA Cup final

-

Napoli's first match point as Scudetto race reaches climax

-

Dortmund hope to take 'final step' in unlikely top-four rescue act

Dortmund hope to take 'final step' in unlikely top-four rescue act

-

Raisuqe death to 'motivate' Castres in Top 14 season run-in

-

Eurovision favourite KAJ shines spotlight on Finland's Swedish- speaking minority

Eurovision favourite KAJ shines spotlight on Finland's Swedish- speaking minority

-

'Serious problem': Afghan capital losing race against water shortages

-

Jokic, Strawther star as Nuggets down Thunder to tie series

Jokic, Strawther star as Nuggets down Thunder to tie series

-

Buttler to leave extended IPL early for England duty

-

Asian markets stagger into weekend as trade rally runs out of legs

Asian markets stagger into weekend as trade rally runs out of legs

-

US singer Chris Brown charged with assault in Britain

-

YouTube star MrBeast upsets Mexican officials with temple videos

YouTube star MrBeast upsets Mexican officials with temple videos

-

Take-Two earnings boost delayed along with 'GTA VI'

-

Independence hero assassin's calligraphy breaking auction records in Seoul

Independence hero assassin's calligraphy breaking auction records in Seoul

-

Trump caps Gulf tour in Abu Dhabi with dizzying investment pledges

-

Iran, European powers to hold nuclear talks in Turkey

Iran, European powers to hold nuclear talks in Turkey

-

Opposition leader vows 'empty' polling stations for Venezuelan legislative vote

-

Venezuelan Vegas birdies five of last six to grab PGA lead

Venezuelan Vegas birdies five of last six to grab PGA lead

-

Nose cone glitch wipes Australian rocket launch

-

Curry 'excited' by Warriors future despite playoff exit

Curry 'excited' by Warriors future despite playoff exit

-

Bionoid Pharma, Inc. Rebrands as AI Maverick Intel, Inc. to Reflect Strategic Shift Toward AI-Driven Innovation

-

Snipp Interactive Reports Financial Results for Q4 And Fiscal 2024, Announces Conference Call on May 20, 2025, And Management Changes

Snipp Interactive Reports Financial Results for Q4 And Fiscal 2024, Announces Conference Call on May 20, 2025, And Management Changes

-

EIA Evaluation Process for the Penco Module Advances to Next Phase

-

Abrams Towing Wins 2025 Consumer Choice Award for Towing Services in Toronto Central

Abrams Towing Wins 2025 Consumer Choice Award for Towing Services in Toronto Central

-

Pestend Pest Control Wins 2025 Consumer Choice Award for Pest Control in Toronto Central

-

ATA Creativity Global Reports Q1 2025 Financial Results

ATA Creativity Global Reports Q1 2025 Financial Results

-

NanoViricides, Inc. Has Filed its Quarterly Report: Broad-Spectrum Antiviral NV-387 To Combat MPox Pandemic in Africa - Phase II Clinical Trial Update, Also Readying to Combat Measles Outbreaks, and to Tackle Bird Flu

Global stocks drop ahead of Trump auto tariff announcement

Global stock markets mostly slipped Wednesday as investors readied for an announcement on auto tariffs from US President Donald Trump.

In New York, all three major indices closed lower, while the CBOE Volatility Index -- Wall Street's so-called "fear gauge" -- jumped seven percent, reflecting market jitters.

"It's the continuation of worries regarding the tariffs and the impact on the economy," Peter Cardillo from Spartan Capital Securities told AFP.

In Europe, Paris and Frankfurt closed down while London edged up as data showed an unexpected slowdown to UK annual inflation.

- Incoming auto tariffs -

With the White House's so-called "Liberation Day" on April 2 fast approaching, investors are bracing for a wave of sweeping levies on imports amid warnings of crippled global trade, a fresh spike in inflation, and even a possible recession.

Trump has alternated between tough talk about imposing tariffs across the board to suggesting he may allow some carve-outs to spare US consumers the full brunt of their impact on prices.

The result has been a drop in economic sentiment as consumers expect higher prices.

"All the tariff talk uncertainty has led to a sharp drop in confidence," said Trade Nation analyst David Morrison.

On Wednesday, White House Press Secretary Karoline Leavitt said that Trump would unveil new tariffs on the auto industry at 4:00 pm local time in Washington (2000 GMT), setting off a sell-off in the stocks of several firms, including General Motors and Tesla.

Trump's tariff plans have hit consumer sentiment hard, with the Conference Board reporting Tuesday that its closely-watched gauge of consumer confidence dived to its lowest level since 2021 as concerns grow about higher prices.

"Recent survey data has painted a gloomy outlook for the US economy," Morrison said. "But this pessimism has yet to show up in hard data, such as unemployment, while corporate earnings continue to beat expectations."

- Defense stocks rise -

While most European markets fell, defense stocks bucked the trend, as one country after another has pledged to boost military spending, with Spain and Sweden being the latest to do so Wednesday.

France's Thales, Germany's Rheinmetall and Italy's Leonardo all rose.

London's stock market closed up on the news that Britain's annual consumer inflation slowed to 2.8 percent in February from 3.0 percent a month earlier.

The market held onto its gains even after the British government's financial watchdog halved the country's growth forecast for 2025, while raising it for the next three years.

Trump's talk of tariff exemptions had earlier helped some Asian markets edge higher after recent slumps.

Copper futures traded on New York's Comex exchange touched a record high after Trump said he could impose duties on imports of the commodity within weeks, leading some investors to shift supply to the United States to avoid any eventual levies.

- Key figures around 2020 GMT -

New York - Dow: DOWN 0.3 percent at 42,454.79 points (close)

New York - S&P 500: DOWN 1.1 percent at 5,712.20 (close)

New York - Nasdaq Composite: DOWN 2.0 percent at 17,899.02 (close)

London - FTSE 100: UP 0.3 percent at 8,689.59 (close)

Paris - CAC 40: DOWN 1.0 percent at 8,030.68 (close)

Frankfurt - DAX: DOWN 1.2 percent at 22,839.03 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 38,027.29 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 23,483.32 (close)

Shanghai - Composite: DOWN less than 0.1 percent at 3,368.70 (close)

Euro/dollar: DOWN at 1.0757 from $1.0790 on Tuesday

Pound/dollar: DOWN at $1.2891 from $1.2943

Dollar/yen: UP at 150.54 yen from 149.90 yen

Euro/pound: UP at 83.41 pence from 83.37 pence

Brent North Sea Crude: UP 1.1 percent at $73.79 per barrel

West Texas Intermediate: UP 0.9 percent at $69.65 per barrel

dan-ajb-ni-da/jgc

F.Bennett--AMWN