-

India-Pakistan tensions hit tourism in Kashmiri valley

India-Pakistan tensions hit tourism in Kashmiri valley

-

Bangladesh Islamists rally in show of force

-

Zelensky says won't play Putin's 'games' with short truce

Zelensky says won't play Putin's 'games' with short truce

-

Cardinals meet ahead of papal election

-

Pakistan tests missile weapons system amid India standoff

Pakistan tests missile weapons system amid India standoff

-

France charges 21 prison attack suspects

-

Pakistan military says conducts training launch of missile

Pakistan military says conducts training launch of missile

-

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

GISEC Global 2025: Dubai Mobilises Global Cyber Defence Leaders to Combat AI-Driven Cybercrime and Ransomware

-

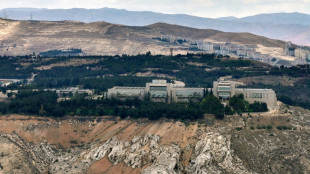

Israel launches new Syria strikes amid Druze tensions

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

Asian markets track global sell-off on inflation, rate fears

Asia extended losses across world markets on Friday after the European Central Bank laid the groundwork to join others in a programme of interest rate hikes, while attention turns to the release of key US inflation data.

After a largely positive start to the week, investors tracked their US and European colleagues in selling up as they contemplate higher borrowing costs and surging prices, which many fear could lead to a recession.

Adding to the unease was news that officials in China had once again locked down millions of people to test them owing to another flare-up in cases, dealing a blow to hopes for an economic reopening.

Still, the move helped push down oil prices -- a key driver of global inflation -- owing to concerns about the impact on demand.

With prices rising at a decades-high pace, central banks have been forced to withdraw the vast financial support measures put in place to combat the impact of the pandemic and helped fuel a rally across markets to record or multi-year highs.

The ECB became the latest to join the tightening campaign, announcing Thursday the end of its bond-buying programme and signalling it will hike rates several times this year.

It also sharply upgraded its inflation forecasts for this year and next while lowering the economic growth outlook.

Focus now turns to the release of US consumer price figures later Friday, with a strong reading likely to give the Federal Reserve more room to be aggressive.

"A robust May... print will probably prompt (policymakers) to hint at a 50 basis point hike for the September meeting," said SPI Asset Management's Stephen Innes.

"The tone will remain hawkish and the tough talk on inflation will continue."

However, he added that "the significant upward revisions to core inflation projections are close to ending. Risk markets could take solace if one or two participants shift to seeing the inflation outlook is more balanced".

Expectations are that the Fed will hike by half a point for at least three more meetings before January.

Other commentators also suggested that traders were looking for signs inflation may be close to its highs.

"The big question is whether inflation has peaked or not," said Matthew Simpson of StoneX Financial.

"Inflation may have softened to a degree in April, but traders really want to see further evidence that inflation is pointing lower to call 'peak inflation' with confidence.

"Besides, one single month of data doesn’t define a trend."

And OANDA's Edward Moya said that the darkening outlook could provide an argument for the Fed to apply the brakes to hiking later in the year.

"Warning signs about the economy are emerging as weekly jobless claims are starting to rise, China's Covid situation will prove troublesome for supply chains over the next couple of quarters, and as inflationary pressures broaden and show no sign of easing.

"It seems reductions in global growth forecasts will become a steady theme over the next few months and that should complicate how much more tightening we see from central banks."

In early trade, Tokyo, Hong Kong, Sydney, Seoul, Singapore, Taipei, Wellington, Manila and Jakarta were all down.

However, data showing Chinese producer price inflation eased last month to its lowest level in a year provided some cheer to mainland traders with Shanghai edging up slightly.

On currency markets the euro continued to struggle against the dollar after the ECB flagged a quarter-point hike, while the yen remained around two-decade lows on the greenback.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.4 percent at 27,848.79 (break)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 21,726.41

Shanghai - Composite: UP 0.3 percent at 3,248.75

Euro/dollar: UP at $1.0626 from $1.0620 late Thursday

Euro/pound: UP at 85.05 pence from 84.98 pence

Dollar/yen: DOWN at 134.03 yen from 134.40 yen

Pound/dollar: DOWN at $1.2493 from $1.2495

Brent North Sea crude: DOWN 0.8 percent at $122.10 per barrel

West Texas Intermediate: DOWN 0.8 percent at $120.60 per barrel

New York - Dow: DOWN 1.9 percent at 32,272.79 (close)

London - FTSE 100: DOWN 1.5 percent at 7,476.21 (close)

A.Malone--AMWN