-

India-Pakistan tensions hit tourism in Kashmiri valley

India-Pakistan tensions hit tourism in Kashmiri valley

-

Bangladesh Islamists rally in show of force

-

Zelensky says won't play Putin's 'games' with short truce

Zelensky says won't play Putin's 'games' with short truce

-

Cardinals meet ahead of papal election

-

Pakistan tests missile weapons system amid India standoff

Pakistan tests missile weapons system amid India standoff

-

France charges 21 prison attack suspects

-

Pakistan military says conducts training launch of missile

Pakistan military says conducts training launch of missile

-

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

GISEC Global 2025: Dubai Mobilises Global Cyber Defence Leaders to Combat AI-Driven Cybercrime and Ransomware

-

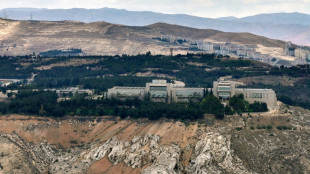

Israel launches new Syria strikes amid Druze tensions

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

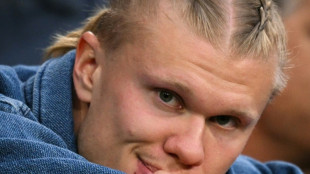

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

Toxic cocktail darkens outlook for British pound

A toxic cocktail of sluggish growth and high inflation, plus Brexit and fallout from the coronavirus pandemic, is set to weigh on the pound in the coming months, economists warned.

Since the start of the year, sterling has fallen by more than seven percent against the dollar, which is benefiting from rises in US interest rates.

The pound has also fallen by 1.7 percent against the euro since the beginning of 2022.

This comes despite the Bank of England having raised UK borrowing costs four times this year to fight inflation.

By contrast, the European Central Bank is waiting until July to raise its key interest rates for the first time in more than a decade.

BoE rate rises have "been insufficient to offset the headwinds weighing on the pound", said Rabobank analyst Jane Foley.

"Concerns about growth have been central to the poor performance of the pound," she said.

Fears of recession in the UK and elsewhere are gaining momentum as soaring inflation -- fuelled by rocketing energy prices -- hits investment and consumer spending.

Oil and gas demand has surged as economies emerge from pandemic lockdowns, while supplies have been hit by the invasion of Ukraine by major producer Russia.

Britain's annual inflation rate stands at nine percent, a 40-year high, while the Bank of England is forecasting the UK economy to contract at the end of the year.

The Bank of England's next rate decision is due June 16 when it is expected to take its main borrowing cost above one percent.

"Hiking rates against a sharply slowing economy is never a good look for any currency," said Bank of America currency strategist, Kamal Sharma.

- Brexit cost -

The pound has dropped to around $1.25 compared with $1.40 before the 2016 vote in favour of Brexit, or Britain's departure from the European Union.

After the UK entered its first pandemic lockdown in March 2020, sterling sank to $1.14, the lowest level since 1985.

And the pound took a knock this week after embattled British Prime Minister Boris Johnson faced a vote of no confidence from his own Conservative MPs.

Although Johnson survived, 41 percent of those who voted failed to back him as their leader.

Another big factor affecting the pound is that the BoE "remains wholly unwilling to discuss" the full consequences of Brexit on the UK economy, according to Sharma.

This could partly be due to the fact that it is difficult to pin down the exact financial fallout, with Britain's departure from the European Union formalised only during the economic shock caused by the Covid-19 pandemic.

Meanwhile, political paralysis in Northern Ireland, a direct consequence of Brexit, poses further problems for the pound, according to economists.

"The added risk is that there is another Brexit bust-up, perhaps over the Northern Ireland Protocol," Capital Economics analyst Paul Dales told AFP.

"The latter could result in the pound weakening below $1.22."

The protocol was agreed upon as part of Britain's Brexit divorce deal with Brussels, recognising Northern Ireland's status as a fragile, post-conflict territory that shares the UK's new land border with the EU.

But Britain is readying new legislation to rewrite its Brexit commitments to fix trade distortions in the province.

Sharma expressed concern "that the increasing politicisation of UK policy undermines the pound".

Whatever the financial cost of Brexit, "underpinning the market's concerns about growth was the recent IMF (International Monetary Fund) projection that the UK is set to have the slowest pace of growth in the G7" group of rich nations next year, said Foley.

Other global financial bodies, such as the Paris-based Organisation for Economic Co-operation and Development (OECD), have also slashed their growth outlooks for Britain, as well as for other major economies.

L.Mason--AMWN