-

Rockets down Warriors to stay alive in NBA playoffs

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

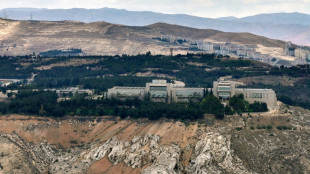

Israel launches new Syria strikes amid Druze tensions

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

Rangers hire two-time NHL champion Sullivan as coach

-

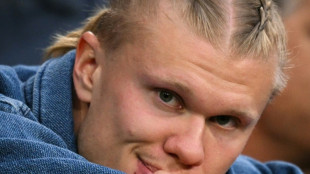

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

Asian markets mixed as autos suffer more tariff-fuelled losses

Asian markets were mixed Friday as traders brace for next week's expected wave of US tariffs, while auto firms extended their painful losses following President Donald Trump's announcement of steep levies on vehicle imports.

The mood on trading floors has soured in recent weeks as the White House presses ahead with its hardball policy approach that has hit friend and foe alike and fuelled recession fears.

The president's pledge to impose 25 percent levies on all autos coming into the United States overshadowed earlier indications that planned reciprocal measures due on Trump's so-called "Liberation Day" on April 2.

Governments around the world have hit out at the announcement, with Canadian Prime Minister Mark Carney saying the "old relationship" of deep economic, security and military ties with Washington "is over".

But warnings of retaliation have stoked worries of a long-running global trade war and a reignition of inflation that could force central banks to rethink plans to cut interest rates.

Uncertainty over Trump's plans and long-term intentions has led to uncertainty among investors, sparking a rush out of risk assets into safe havens such as gold, which hit a new record high of $3,066.56 Friday.

Analysts said that while there is hope negotiations with Washington could see the duties tempered, investors were likely choosing to play a wait-and-see game.

After another down day on Wall Street, equity markets in Asia were mixed Friday, with auto firms again taking the brunt.

Tokyo sank more than two percent as Toyota -- the world's biggest carmaker -- Honda, Nissan and Mazda tumbled between 1.5 and 3.9 percent.

Also deep in the red was Nippon Steel after it said it would invest as much as $7 billion to upgrade US Steel if its huge takeover goes ahead. It had initially flagged a $2.7 billion investment.

Seoul was off more than one percent as Hyundai gave up 3.1 percent.

Tariff worries also saw Shanghai, Taipei and Manila fall.

However, Hong Kong advanced thanks to a rally in Chinese tech firms, while Sydney, Singapore and Wellington were also in the green.

Investors will be keeping a close eye on the release later in the day of US personal consumption expenditures data -- the Federal Reserve's preferred gauge of inflation -- hoping for an idea about the impact of Trump's policies.

The figures come after data this week showed consumer confidence was at its lowest level since 2021 -- during the pandemic -- owing to growing concerns over higher prices.

News that the US economy expanded at a slightly faster pace than estimated in the final three months last year did little to stir excitement.

On currency markets the yen strengthened against the dollar after a report showing inflation in Tokyo -- a barometer of Japan as a whole -- rose more than expected in March, boosting bets on another central bank rate hike.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 2.1 percent at 37,011.66 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 23,661.60

Shanghai - Composite: DOWN 0.3 percent at 3,365.23

Euro/dollar: DOWN at $1.0794 from $1.0796 on Thursday

Pound/dollar: UP at $1.2949 from $1.2947

Dollar/yen: DOWN at 150.78 yen from 151.04 yen

Euro/pound: DOWN at 83.36 pence from 83.38 pence

West Texas Intermediate: FLAT at $69.90 per barrel

Brent North Sea Crude: FLAT at $74.00 per barrel

New York - Dow: DOWN 0.4 percent at 42,299.70 (close)

London - FTSE 100: DOWN 0.3 percent at 8,666.12 (close)

F.Bennett--AMWN