-

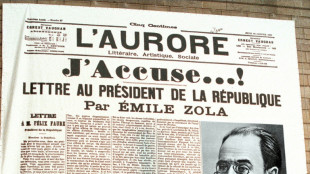

French lawmakers want Dreyfus promoted 130 years after scandal

French lawmakers want Dreyfus promoted 130 years after scandal

-

AFP Gaza photographers shortlisted for Pulitzer Prize

-

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

-

Stocks diverge as traders await Fed rates meeting

-

Tesla sales fall again in Germany as drivers steer clear of Musk

Tesla sales fall again in Germany as drivers steer clear of Musk

-

Radiohead's Jonny Greenwood says shows cancelled after 'credible threats'

-

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

-

Aussie cycling star Ewan announces shock retirement

-

Blow for Germany's Merz as he loses first-round vote for chancellor

Blow for Germany's Merz as he loses first-round vote for chancellor

-

EU to lay out plan to cut last Russian gas supplies

-

Food delivery app DoorDash agrees to buy peer Deliveroo

Food delivery app DoorDash agrees to buy peer Deliveroo

-

Zhao's world championship win will take snooker to 'another level': sport's chief

-

Ukraine fires drones on Moscow days before Red Square parade

Ukraine fires drones on Moscow days before Red Square parade

-

Blow for Merz as he misses majority in first vote for chancellor

-

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

-

Cardinals to move into Vatican on eve of conclave

-

Romania names interim premier as turmoil deepens

Romania names interim premier as turmoil deepens

-

DoorDash agrees £2.9 billion takeover of Deliveroo

-

Dollar recovers some losses, stocks mixed as traders eye tariff deals

Dollar recovers some losses, stocks mixed as traders eye tariff deals

-

Hamas says no point in further Gaza truce talks

-

'Aussiewood' courts Hollywood as Trump film tariffs loom

'Aussiewood' courts Hollywood as Trump film tariffs loom

-

How a privately owned city in Kenya took on corrupt officials

-

Ozempic slimming craze sweeps Kosovo despite side effects

Ozempic slimming craze sweeps Kosovo despite side effects

-

Drone strikes rock Port Sudan in third day of attacks

-

US President Trump and Canada's Carney set for high-stakes meeting

US President Trump and Canada's Carney set for high-stakes meeting

-

Philips turns in a profit but China, tariffs weigh

-

Drones hit Port Sudan airport in third day of attacks

Drones hit Port Sudan airport in third day of attacks

-

Australian mushroom murder suspect rejected help preparing meal: witness

-

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

-

India's woman fighter pilot trailblazer eyes space

-

'Shared dream': China celebrates Zhao's world snooker breakthrough

'Shared dream': China celebrates Zhao's world snooker breakthrough

-

Wait for Vatican white smoke fires up social media

-

Sinner leading the charge in golden era for Italian tennis

Sinner leading the charge in golden era for Italian tennis

-

Donnarumma stands tall on PSG's Champions League run

-

Dollar recovers some losses, stocks gain as traders eye tariff deals

Dollar recovers some losses, stocks gain as traders eye tariff deals

-

US aid cuts push Bangladesh's health sector to the edge

-

Prayers, pride in Philippine papal contender's hometown

Prayers, pride in Philippine papal contender's hometown

-

Germany's Merz to launch new govt in times of Trump turbulence

-

Brunson sparks Knicks in comeback win over Celtics

Brunson sparks Knicks in comeback win over Celtics

-

All roads lead to Rome Open for Sinner after doping ban

-

French Resistance members reunited 80 years after end of WWII

French Resistance members reunited 80 years after end of WWII

-

Arsenal must 'stick together' in PSG showdown: Odegaard

-

New Zealand PM proposes banning under-16s from social media

New Zealand PM proposes banning under-16s from social media

-

United States Antimony Corporation Announces Webcast set for Thursday, May 8, 2025, at 4:15 PM Eastern Time on Record First Quarter 2025 Financial and Operating Results

-

Xifaxan(R) (rifaximin) Treatment Following Overt Hepatic Encephalopathy (OHE) Hospitalization Associated with Reduced Risk of 30-Day OHE Rehospitalization

Xifaxan(R) (rifaximin) Treatment Following Overt Hepatic Encephalopathy (OHE) Hospitalization Associated with Reduced Risk of 30-Day OHE Rehospitalization

-

Scepter Holdings, Inc, to Add Marketing Executive, Natalie Guzman, to Advisory Board

-

Databahn.ai Introduces 'Data Reef' - An AI Insight Layer Powered by Its Own MCP Server for Smarter Security Data Context

Databahn.ai Introduces 'Data Reef' - An AI Insight Layer Powered by Its Own MCP Server for Smarter Security Data Context

-

CBD Life Sciences Inc. (CBDL) Announces New Manufacturing Deal With A Southwest-Based Company

-

Upexi Increases Solana Treasury to 201,500 Solana Tokens for $30 Million and Begins to Generate Staking Revenue

Upexi Increases Solana Treasury to 201,500 Solana Tokens for $30 Million and Begins to Generate Staking Revenue

-

Eden Radioisotopes and Cross River Infrastructure Partners Sign MOU to Explore Development of a New Generation Medical Radioisotope Reactor in New Brunswick

Stocks mixed as US hits Nvidia chip export to China

Wall Street shares fell but European stocks diverged Wednesday after the US government imposed restrictions on exports of a key Nvidia chip to China, the latest trade war salvo between the world's biggest economies.

After a relatively peaceful couple of days on markets following tariff-related volatility last week, investors were once again on the defensive, sending gold, a safe-haven asset in times of uncertainty, above $3,300 an ounce for the first time.

Wall Street's main indexes were down in late morning deals, with Nvidia shares tanking by more than six percent and the dollar under pressure again.

Nvidia notified regulators late Tuesday that it expects a $5.5 billion hit this quarter owing to a new US licencing requirement on the chip it can legally sell in China.

The company at the heart of helping to power artificial intelligence said it must obtain licences to export its H20 chips to the Asian country because of concerns they would be used in supercomputers there.

"It's another stark reminder that geopolitics and technology remain deeply entangled -- and that markets will continue to dance to Washington's tune, whether they like it or not," said Fawad Razaqzada, market analyst at City Index and Forex.com.

The United States on Monday opened the door to tariffs targeting semiconductors and chip-making equipment, with Trump saying on Sunday an announcement would be made "over the next week".

Trump has also kicked off an investigation that could see tariffs imposed on critical minerals such as rare earths, which are used in a wide range of products including smartphones, wind turbines and electric vehicle motors.

It is the latest front in Trump's erratic trade war, which has seen the US leader impose a universal 10-percent duty, pause higher levies on some countries and temporarily exempt some sectors from duties.

"Markets continue to suffer from the White House's tariff flip-flopping," Razaqzada said.

"The stop-start nature of US trade policy this month has made long-term positioning something of a fool's errand, with volatility dominating the landscape."

In Europe, London's benchmark FTSE 100 stock index closed 0.3 percent higher, as official data showed UK inflation slowed more than expected in March.

Frankfurt also finished 0.3 percent in the green but Paris fell almost 0.1 percent.

Shares in Dutch tech giant ASML, which makes machines that produce semiconductors, fell more than five percent as its net bookings came in below expectations.

ASML's disappointing earnings report "has only added to the sector-wide tech concerns", said David Morrison, analyst at Trade Nation.

The dollar slid once more against main rivals. Yields on 10-year Treasury bills eased but remain high following a selloff last week that raised doubts about the haven stauts of US bonds.

Gold hit a record $3,317.75 an ounce before paring back gains.

Oil prices rose almost two percent after recent sharp falls on fears that the tariffs will dampen global economic growth.

- Key figures at 1540 GMT -

New York - Dow: DOWN 0.1 percent at 40,332.34 points

New York - S&P 500: DOWN 0.7 percent at 5,356.74

New York - Nasdaq: DOWN 1.6 percent at 16,556.19

London - FTSE 100: UP 0.3 percent at 8,275.60 (close)

Paris - CAC 40: DOWN 0.1 percent at 7,329.97 (close)

Frankfurt - DAX: UP 0.3 percent at 21,311.02 (close)

Tokyo - Nikkei 225: DOWN 1.0 percent at 33,920.40 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 21,056.98 (close)

Shanghai - Composite: UP 0.3 percent at 3,276.00 (close)

Euro/dollar: UP at $1.1370 from $1.1291 on Tuesday

Pound/dollar: UP at $1.3235 from $1.3232

Dollar/yen: DOWN at 142.65 yen from 143.18 yen

Euro/pound: UP at 85.90 pence from 85.30 pence

Brent North Sea Crude: UP 1.9 percent at $65.92 per barrel

West Texas Intermediate: UP 1.9 percent at $61.91 per barrel

burs-bcp-lth/rmb

C.Garcia--AMWN