-

Israel pummels Yemen airport in reprisal against Huthis

Israel pummels Yemen airport in reprisal against Huthis

-

Swiatek struggling with 'perfectionism' ahead of Rome

-

Germany's Merz elected chancellor after surprise setback

Germany's Merz elected chancellor after surprise setback

-

Ukraine fires drones on Moscow days before WWII parade

-

EU proposes ending all Russian gas imports by 2027

EU proposes ending all Russian gas imports by 2027

-

UK, India strike trade deal amid US tariff blitz

-

Move over Met Ball. For fashion wow head to the Vatican

Move over Met Ball. For fashion wow head to the Vatican

-

Stocks retreat as traders cautious before Fed rates call

-

EDF complaint blocks Czech-Korean nuclear deal

EDF complaint blocks Czech-Korean nuclear deal

-

Germany's Merz faces new vote for chancellor after surprise loss

-

US trade deficit hit fresh record before new Trump tariffs

US trade deficit hit fresh record before new Trump tariffs

-

US Fed starts rate meeting under cloud of tariff uncertainty

-

Trump's Aberdeen course to host revived Scottish Championship

Trump's Aberdeen course to host revived Scottish Championship

-

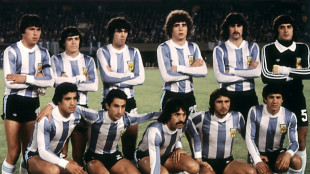

Argentina's 1978 World Cup winner Galvan dies

-

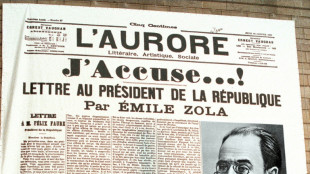

French lawmakers want Dreyfus promoted 130 years after scandal

French lawmakers want Dreyfus promoted 130 years after scandal

-

AFP Gaza photographers shortlisted for Pulitzer Prize

-

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

-

Stocks diverge as traders await Fed rates meeting

-

Tesla sales fall again in Germany as drivers steer clear of Musk

Tesla sales fall again in Germany as drivers steer clear of Musk

-

Radiohead's Jonny Greenwood says shows cancelled after 'credible threats'

-

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

-

Aussie cycling star Ewan announces shock retirement

-

Blow for Germany's Merz as he loses first-round vote for chancellor

Blow for Germany's Merz as he loses first-round vote for chancellor

-

EU to lay out plan to cut last Russian gas supplies

-

Food delivery app DoorDash agrees to buy peer Deliveroo

Food delivery app DoorDash agrees to buy peer Deliveroo

-

Zhao's world championship win will take snooker to 'another level': sport's chief

-

Ukraine fires drones on Moscow days before Red Square parade

Ukraine fires drones on Moscow days before Red Square parade

-

Blow for Merz as he misses majority in first vote for chancellor

-

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

-

Cardinals to move into Vatican on eve of conclave

-

Romania names interim premier as turmoil deepens

Romania names interim premier as turmoil deepens

-

DoorDash agrees £2.9 billion takeover of Deliveroo

-

Dollar recovers some losses, stocks mixed as traders eye tariff deals

Dollar recovers some losses, stocks mixed as traders eye tariff deals

-

Hamas says no point in further Gaza truce talks

-

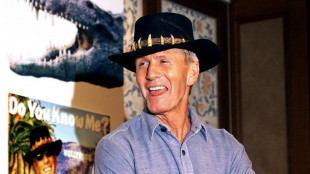

'Aussiewood' courts Hollywood as Trump film tariffs loom

'Aussiewood' courts Hollywood as Trump film tariffs loom

-

How a privately owned city in Kenya took on corrupt officials

-

Ozempic slimming craze sweeps Kosovo despite side effects

Ozempic slimming craze sweeps Kosovo despite side effects

-

Drone strikes rock Port Sudan in third day of attacks

-

US President Trump and Canada's Carney set for high-stakes meeting

US President Trump and Canada's Carney set for high-stakes meeting

-

Philips turns in a profit but China, tariffs weigh

-

Drones hit Port Sudan airport in third day of attacks

Drones hit Port Sudan airport in third day of attacks

-

Australian mushroom murder suspect rejected help preparing meal: witness

-

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

-

India's woman fighter pilot trailblazer eyes space

-

'Shared dream': China celebrates Zhao's world snooker breakthrough

'Shared dream': China celebrates Zhao's world snooker breakthrough

-

Wait for Vatican white smoke fires up social media

-

Sinner leading the charge in golden era for Italian tennis

Sinner leading the charge in golden era for Italian tennis

-

Donnarumma stands tall on PSG's Champions League run

-

Dollar recovers some losses, stocks gain as traders eye tariff deals

Dollar recovers some losses, stocks gain as traders eye tariff deals

-

US aid cuts push Bangladesh's health sector to the edge

Stocks diverge as traders await Fed rates meeting

Stock markets diverged Tuesday as investors awaited a US Federal Reserve interest-rate meeting for signs of the outlook for the tariffs-hit economy.

Oil prices staged a comeback after tanking on news of an output hike by key OPEC+ producers that came despite growing concerns over a slowdown in the global economy, which could hit demand.

In Europe, Frankfurt's stock market shed around one percent after German conservative leader Friedrich Merz failed to win a majority in the first parliament vote for chancellor, in an unexpected setback.

Paris dropped while London was flat in early afternoon deals.

"It's a big week for central bank interest rate decisions," noted AJ Bell investment director Russ Mould.

The US Federal Reserve is expected to hold interest rates steady on Wednesday, even as President Donald Trump pushes for more cuts.

While data last week showed that the US economy contracted in the first quarter, strong jobs and services sector figures suggest there is still some resilience.

"The key focus will be on forward-looking commentary and whether the Fed is getting worried about Trump's tariffs," Mould added.

Elsewhere, the Bank of England is Thursday expected to cut its key rate by a quarter point to 4.25 percent amid concerns of weak growth in Britain.

In Asia Tuesday, stock markets benefited from some renewed optimism that governments are making progress in agreements to temper Trump's levies, which have roiled global markets in recent months.

US Treasury Secretary Scott Bessent told CNBC that the Trump administration had been approached by 17 countries and offered "very good" trade proposals.

He also said there could be "substantial progress in the coming weeks" with China, which has been hit with tariffs of 145 percent.

Hong Kong and Shanghai stock markets closed higher Tuesday as investors returned from a long weekend.

Traders brushed off losses on Wall Street, with the S&P 500 snapping a nine-day winning streak and film studios hit by Trump's warning of new tariffs on all films made outside the United States.

Oil prices rose more than two percent, clawing back Monday's losses that came after Saudi Arabia, Russia and six other members of the OPEC+ cartel agreed to boost output by 411,000 barrels a day in June.

The move came a month after a similar announcement that caused prices to fall.

In company news, US food delivery service DoorDash agreed to buy Deliveroo in a £2.9-billion ($3.9-billion) deal that values the UK group at less than half of its initial public offering price.

Shares in Deliveroo rose around two percent on London's second-tier FTSE 250 index.

Danish wind turbine maker Vestas rose five percent in Copenhagen after it stuck to its annual earnings forecasts despite geopolitical uncertainty and US tariffs.

- Key figures at around 1100 GMT -

London - FTSE 100: FLAT at 8,593.68 points

Paris - CAC 40: DOWN 0.4 percent at 7,695.11

Frankfurt - DAX: DOWN 0.9 percent at 23,139.69

Hong Kong - Hang Seng Index: UP 0.7 percent at 22,662.71 (close)

Shanghai - Composite: UP 1.1 percent at 3,316.11 (close)

Tokyo - Nikkei 225: Closed for holiday

New York - Dow: UP 0.2 percent at 41,218.83 (close)

Euro/dollar: UP at $1.1326 from $1.1319 on Monday

Pound/dollar: UP at $1.3350 from $1.3296

Dollar/yen: DOWN at 143.11 yen from 143.72

Euro/pound: DOWN at 84.84 pence from 85.10

Brent North Sea Crude: UP 2.1 percent at $61.48 per barrel

West Texas Intermediate: UP 2.1 percent at $58.34 per barrel

C.Garcia--AMWN