-

Defending Rome champion Zverev blames burn out on poor run of form

Defending Rome champion Zverev blames burn out on poor run of form

-

No signs of US recession, Treasury Secretary says

-

Israel pummels Yemen airport in reprisal against Huthis

Israel pummels Yemen airport in reprisal against Huthis

-

Swiatek struggling with 'perfectionism' ahead of Rome

-

Germany's Merz elected chancellor after surprise setback

Germany's Merz elected chancellor after surprise setback

-

Ukraine fires drones on Moscow days before WWII parade

-

EU proposes ending all Russian gas imports by 2027

EU proposes ending all Russian gas imports by 2027

-

UK, India strike trade deal amid US tariff blitz

-

Move over Met Ball. For fashion wow head to the Vatican

Move over Met Ball. For fashion wow head to the Vatican

-

Stocks retreat as traders cautious before Fed rates call

-

EDF complaint blocks Czech-Korean nuclear deal

EDF complaint blocks Czech-Korean nuclear deal

-

Germany's Merz faces new vote for chancellor after surprise loss

-

US trade deficit hit fresh record before new Trump tariffs

US trade deficit hit fresh record before new Trump tariffs

-

US Fed starts rate meeting under cloud of tariff uncertainty

-

Trump's Aberdeen course to host revived Scottish Championship

Trump's Aberdeen course to host revived Scottish Championship

-

Argentina's 1978 World Cup winner Galvan dies

-

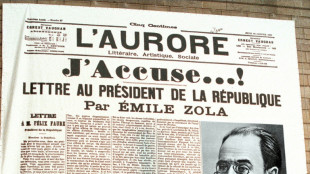

French lawmakers want Dreyfus promoted 130 years after scandal

French lawmakers want Dreyfus promoted 130 years after scandal

-

AFP Gaza photographers shortlisted for Pulitzer Prize

-

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

Cristiano Ronaldo's eldest son called up by Portugal Under-15s

-

Stocks diverge as traders await Fed rates meeting

-

Tesla sales fall again in Germany as drivers steer clear of Musk

Tesla sales fall again in Germany as drivers steer clear of Musk

-

Radiohead's Jonny Greenwood says shows cancelled after 'credible threats'

-

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

Hamas says Gaza truce talks pointless as Israel wages 'hunger war'

-

Aussie cycling star Ewan announces shock retirement

-

Blow for Germany's Merz as he loses first-round vote for chancellor

Blow for Germany's Merz as he loses first-round vote for chancellor

-

EU to lay out plan to cut last Russian gas supplies

-

Food delivery app DoorDash agrees to buy peer Deliveroo

Food delivery app DoorDash agrees to buy peer Deliveroo

-

Zhao's world championship win will take snooker to 'another level': sport's chief

-

Ukraine fires drones on Moscow days before Red Square parade

Ukraine fires drones on Moscow days before Red Square parade

-

Blow for Merz as he misses majority in first vote for chancellor

-

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

Putin gears up for 'grandest' Victory Day amid Ukraine conflict

-

Cardinals to move into Vatican on eve of conclave

-

Romania names interim premier as turmoil deepens

Romania names interim premier as turmoil deepens

-

DoorDash agrees £2.9 billion takeover of Deliveroo

-

Dollar recovers some losses, stocks mixed as traders eye tariff deals

Dollar recovers some losses, stocks mixed as traders eye tariff deals

-

Hamas says no point in further Gaza truce talks

-

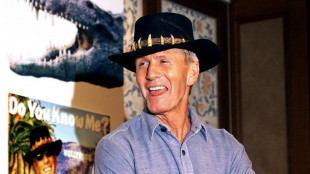

'Aussiewood' courts Hollywood as Trump film tariffs loom

'Aussiewood' courts Hollywood as Trump film tariffs loom

-

How a privately owned city in Kenya took on corrupt officials

-

Ozempic slimming craze sweeps Kosovo despite side effects

Ozempic slimming craze sweeps Kosovo despite side effects

-

Drone strikes rock Port Sudan in third day of attacks

-

US President Trump and Canada's Carney set for high-stakes meeting

US President Trump and Canada's Carney set for high-stakes meeting

-

Philips turns in a profit but China, tariffs weigh

-

Drones hit Port Sudan airport in third day of attacks

Drones hit Port Sudan airport in third day of attacks

-

Australian mushroom murder suspect rejected help preparing meal: witness

-

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

Jokic-inspired Nuggets stun Thunder, Knicks down Celtics

-

India's woman fighter pilot trailblazer eyes space

-

'Shared dream': China celebrates Zhao's world snooker breakthrough

'Shared dream': China celebrates Zhao's world snooker breakthrough

-

Wait for Vatican white smoke fires up social media

-

Sinner leading the charge in golden era for Italian tennis

Sinner leading the charge in golden era for Italian tennis

-

Donnarumma stands tall on PSG's Champions League run

| RBGPF | 4.89% | 66.24 | $ | |

| CMSC | 0.14% | 22.05 | $ | |

| RYCEF | 0.29% | 10.45 | $ | |

| SCS | -0.71% | 9.9 | $ | |

| NGG | 0.77% | 72.398 | $ | |

| RELX | -0.08% | 54.995 | $ | |

| BTI | 1.05% | 44.215 | $ | |

| AZN | -1.24% | 71.21 | $ | |

| GSK | -0.05% | 38.83 | $ | |

| RIO | 0.35% | 59.78 | $ | |

| BCC | -7.09% | 86.35 | $ | |

| CMSD | -0.13% | 22.23 | $ | |

| BCE | 1.84% | 21.79 | $ | |

| VOD | 0.88% | 9.685 | $ | |

| JRI | -0.12% | 13.035 | $ | |

| BP | -2.4% | 28.495 | $ |

Stocks waver as ECB cuts rate, Trump slams Fed chief

Stock markets wavered Thursday as the European Central Bank cut interest rates and Donald Trump slammed Federal Reserve chief Jerome Powell, who warned that the US president's tariffs would likely fuel inflation.

Wall Street's tech-heavy Nasdaq index and the broad-based S&P 500 opened higher, a day after Powell's comments contributed to another market slump.

The Dow, however, extended its losses in early deals.

Powell warned on Wednesday that Trump's sweeping tariffs were "highly likely to generate at least a temporary rise in inflation".

He said it could put the US central bank in the unenviable position of having to choose between tackling inflation and unemployment.

Trump hit back Thursday, slamming Powell for not lowering interest rates as the ECB has done and saying his "termination cannot come fast enough".

"All-in-all, the trade news and Powell's comments provided a tough backdrop for market," said a Deutsche Bank analyst note.

The ECB, meanwhile, cut rates for the sixth consecutive time as it warned that "the outlook for growth has deteriorated owing to rising trade tensions".

ECB President Christine Lagarde, however, said the tariffs' impact on inflation would only get "clearer over time".

Trump imposed 10-percent tariffs on all imports this month, though he suspended higher duties on dozens of nations for 90 days.

He has also placed 25-percent levies on steel, aluminium and cars.

Investors found solace in Trump declaring "Big Progress!" in tariff negotiations with Japan.

Tokyo's envoy Ryosei Akazawa said: "I understand that the US wants to make a deal within the 90 days. For our part, we want to do it as soon as possible."

Tokyo led Asian stocks higher.

With Japanese companies the biggest investors into the United States, Tokyo's negotiations are of particular interest to markets.

While Japan's Prime Minister Shigeru Ishiba warned that the talks "won't be easy", he said the president had "expressed his desire to give the negotiations... the highest priority".

Elsewhere, safe-haven investment gold hit a fresh record above $3,357.78 an ounce before paring back gains, while the dollar and oil prices firmed.

Hopes that Trump's blistering tariffs could be pared back have helped temper some of the disquiet on markets after a rout at the start of the month fuelled by talk of a global recession and an upending of historic trading norms.

"But don't get carried away -- the market remains jittery," said Fawad Razaqzada, market analyst at City Index and Forex.com

- Key figures at 1335 GMT -

New York - Dow: DOWN 1.3 percent at 39,167.49 points

New York - S&P 500: UP 0.2 percent at 5,288.21

New York - Nasdaq: UP 0.1 percent at 16,322.87

London - FTSE 100: DOWN 0.5 percent at 8,235.68

Paris - CAC 40: DOWN 0.7 percent at 7,277.29

Frankfurt - DAX: DOWN 0.6 percent at 21,174.48

Tokyo - Nikkei 225: UP 1.4 percent at 34,377.60 (close)

Hong Kong - Hang Seng Index: UP 1.6 percent at 21,395.14 (close)

Shanghai - Composite: UP 0.1 percent at 3,280.34 (close)

Euro/dollar: DOWN at $1.1358 from $1.1395 on Wednesday

Pound/dollar: UP $1.3251 at $1.3235

Dollar/yen: UP at 142.18 yen from 142.12 yen

Euro/pound: DOWN at 85.71 pence from 86.06 pence

Brent North Sea Crude: UP 1.1 percent at $66.57 per barrel

West Texas Intermediate: UP 1.2 percent at $62.57 per barrel

A.Malone--AMWN